LensCrafters 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

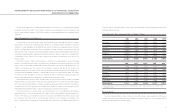

ANALYSIS OF FINANCIAL CONDITION

As of December 31, 2003, Luxottica Group’s consolidated net financial position (defined as financial debt less

cash balances) was (1,470.4) million, compared with (1,254.3) million as of December 31, 2002. This increase in

the Company’s financial position was attributable mainly to the acquisition of OPSM Group Ltd and, to a lesser extent,

the purchase of treasury shares and the acquisition of the Versace and Prada licenses, partially offset by the cash

generated from operations during 2003.

Set forth below is certain information regarding the Company’s net financial position as of December 31, 2002,

and 2003:

(Millions of Euro) December 31,

2002 2003

Cash 151.4 299.9

Bank overdrafts (371.7) (516.9)

Current portion of long-term debt (178.3) (390.9)

Long-term debt (855.7) (862.5)

Net Financial Position (1,254.3) (1470.4)

Net financial position is not a financial measure in accordance with U.S. GAAP and is presented for informational

purposes only. Luxottica Group believes that this measure is useful to investors as a measure of credit availability,

leverage capacity and liquidity. The term net financial position is not, and should not be considered as, a substitute for

the Company’s total long-term debt, total liabilities or any other financial measures presented in accordance with U.S.

GAAP. Luxottica Group’s net financial position may differ from similarly titled financial measures used by other

companies.

During 2003, Luxottica Group has relied primarily upon internally generated funds, trade credit and bank

borrowings to finance its operations and expansion.

In June 1999, Luxottica Group received the proceeds of a 350 million Eurobond offering by a wholly-owned

subsidiary of Luxottica Group. These funds were used to repay indebtedness under a prior credit agreement.

Luxottica Group S.p.A. had guaranteed the subsidiary’s obligations under the Eurobonds, which were repaid in full in

June 2002. To refinance the Eurobonds, in June 2002 Luxottica U.S. Holdings Corp. (“U.S. Holdings”), a U.S.

subsidiary, entered into a US$ 350 million credit facility with a group of four Italian banks led by UniCredito Italiano

S.p.A. The new credit facility was guaranteed by Luxottica Group and matures in June 2005. The term loan portion of

the credit facility provided US$ 200 million of borrowing and required equal quarterly principal installments beginning

36

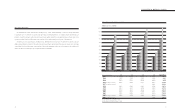

(Millions of Euro) Retail Division Income from Operations

FY 2002 FY 2003 % change

U.S. GAAP results 319.4 269.9 (15.6)

% of net sales 14.5% 13.5%

OPSM results in (1) 8.4

with OPSM in both years 327.8 269.9 (17.7)

% of net sales 14.2% 13.5%

w/o 53rd week in (2) (9.6)

Consistent basis (1) 327.8 260.3 (20.6)

% of net sales 14.2% 13.2%

Consistent basis in U.S. Dollars (3) 309.8 294.2 (5.0)

(1) This effect differs from the one relevant to consolidated income from operations (6.1 million) because is gross of inter-segment elimination

(2) US$ 10.9 million converted in Euro at FY 2003 average exchange rate of 1.00 = US$ 1.1307. Differently from previous reconciliations on net sales,

Luxottica Group is not calculating for income from operations the exchange rate effect.

(3) Translated at the FY 2002 average exchange rate of 1.00 = US$ 0.9450 and at the FY 2003 average exchange rate of 1.00 = US$ 1.1307,

respectively. This translation is provided for comparison purpose only, as most of the Company’s retail business is in U.S. Dollars, and does not purport

to be indicative of operating results at constant exchange rates, because a small portion of retail business is generated in other currencies.

Interest and Other Expenses - Consolidated net interest and other expenses for the year were 42.0 million,

compared with 62.1 million for 2002. This decrease was attributable to lower consolidated interest expenses for

2003 due to lower interest rates.

Net Income - Consolidated net income before taxes and minority interest for the year declined 27.7 percent to

389.8 million, from 539.4 million for 2002. As a percentage of consolidated net sales, consolidated net income

before taxes for 2003 declined to 13.8 percent, from 17.0 percent for 2002. Consolidated minority interest was

(5.1) million for 2003, compared with (4.7) million for 2002. Luxottica Group’s effective tax rate for 2003 was

30.1 percent, compared with 30.2 percent for 2002. Consolidated net income for 2003 declined 28.1 percent to

267.3 million, from 372.1 million for 2002. Consolidated net income for 2003, as a percentage of consolidated

net sales, declined year-over-year to 9.5 percent, from 11.7 percent for 2002.

Earnings per ordinary share or American Depositary Share (EPADS) for 2003 were 0.60, decreasing from EPADS

of 0.82 for 2002. Diluted earnings per share or ADS for 2003 were 0.59, decreasing from 0.82 for 2002. In

U.S. Dollars, EPADS for 2003 were US$ 0.67, compared with EPADS of US$ 0.78 for 2002. Diluted EPADS for 2003

were US$ 0.67, compared with US$ 0.77 for 2002. In 2003, the average Euro/U.S. Dollar exchange rate was 1.00

= US$ 1.1307, compared with 1.00 = US$ 0.9450 for 2002.