Kodak 2002 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

79

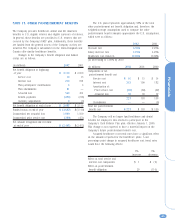

(1) Includes $143 million of restructuring charges; $29 million reversal of restructuring charges; $50 million for a charge related to asset impairments and other asset

write-offs; and a $121 million tax benefit relating to the closure of the Company's PictureVision subsidiary, the consolidation of the Company's photofinishing

operations in Japan, asset write-offs and a change in the corporate tax rate. These items improved net earnings by $7 million.

(2) Includes $678 million of restructuring charges; $42 million for a charge related to asset impairments associated with certain of the Company’s photofinishing

operations; $15 million for asset impairments related to venture investments; $41 million for a charge for environmental reserves; $77 million for the Wolf

bankruptcy; a $20 million charge for the Kmart bankruptcy; $18 million of relocation charges related to the sale and exit of a manufacturing facility; an $11 million

tax benefit related to a favorable tax settlement; and a $20 million tax benefit representing a decline in the year-over-year effective tax rate. These items reduced

net earnings by $594 million.

(3) Includes accelerated depreciation and relocation charges related to the sale and exit of a manufacturing facility of $50 million, which reduced net earnings by $33

million.

(4) Includes $350 million of restructuring charges, and an additional $11 million of charges related to this restructuring program; $103 million of charges associated

with business exits; a gain of $95 million on the sale of The Image Bank; and a gain of $25 million on the sale of the Motion Analysis Systems Division. These items

reduced net earnings by $227 million.

(5) Includes $35 million of litigation charges; $132 million of Office Imaging charges; $45 million primarily for a write-off of in-process R&D associated with the Imation

acquisition; a gain of $87 million on the sale of NanoSystems; and a gain of $66 million on the sale of part of the Company’s investment in Gretag. These items

reduced net earnings by $39 million.

(6) Refer to Note 21, “Discontinued Operations” for a discussion regarding loss from discontinued operations.

(7) Includes a $42 million charge for the write-off of in-process R&D associated with the Imation acquisition.

(8) Excludes short-term borrowings and current portion of long-term debt.