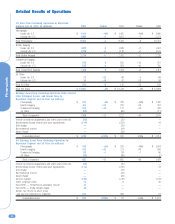

Kodak 2002 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

17

2% decline in price/mix and 5% decline due to negative

exchange.

During 2001, the Company continued the efforts to shift

consumers to the differentiated, higher value MAX and Advantix

film product lines. For 2001, sales of the MAX and Advantix

product lines as a percentage of total consumer roll film revenue

increased from a level of 62% in the fourth quarter of 2000 to

68% by the fourth quarter of 2001.

The U.S. film industry volume was down slightly in 2001

relative to 2000; however, the Company maintained full-year U.S.

consumer film market share for the fourth consecutive year.

During 2001, the Company reached its highest worldwide

consumer film market share position in the past nine years. The

Company’s traditional film business is developing in new markets,

and management believes the business is strong. However, digital

substitution is occurring and the Company continues its

development and application of digital technology in such areas as

wholesale and retail photofinishing. Digital substitution is

occurring more quickly in Japan and more slowly in the U.S.,

Europe and China.

Net worldwide sales of consumer color paper decreased 11%

in 2001 as compared with 2000, reflecting a 4% decline in both

volume and price/mix and a 3% decline due to exchange. The

downward trend in color paper sales existed throughout 2001 and

is due to industry declines resulting from digital substitution,

market trends toward on-site processing where there is a

decreasing trend in double prints, and a reduction in mail-order

processing where Kodak has a strong share position. Effective

January 1, 2001, the Company and Mitsubishi Paper Mills Ltd.

formed the business venture, Diamic Ltd., a consolidated sales

subsidiary, which is expected to improve the Company’s color

paper market share in Japan.

Net worldwide photofinishing sales, including Qualex in the

U.S. and CIS outside the U.S., decreased 16% in 2001 as

compared with 2000. This downward trend, which existed

throughout 2001, is the result of a significant reduction in the

placement of on-site photofinishing equipment due to the

saturation of the U.S. market and the market’s anticipation of the

availability of new digital minilabs. During the fourth quarter of

2001, the Company purchased two wholesale, overnight

photofinishing businesses in Europe. The Company acquired

Spector Photo Group’s wholesale photofinishing and distribution

activities in France, Germany and Austria, and ColourCare

Limited’s wholesale processing and printing operations in the U.K.

The Company believes that these acquisitions will facilitate its

strategy to enhance retail photofinishing activities, provide access

to a broader base of customers, create new service efficiencies

and provide consumers with technologically advanced digital

imaging services.

The Company continued its strong focus on the consumer

imaging digital products and services, which include the picture

maker kiosks and related media and consumer digital services

revenue from picture CD, “You’ve Got Pictures” and Retail.com.

Combined revenues from the placement of picture maker kiosks

and the related media decreased 2% in 2001 as compared with

2000, reflecting a decline in the volume of new kiosk placements

partially offset by a 15% increase in kiosk media volume. This

trend in increased media usage reflects the Company’s focus on

creating new sales channels and increasing the media burn per

kiosk. Revenue from consumer digital services increased 15% in

2001 as compared with 2000.

The Company experienced an increase in digital penetration

in its Qualex wholesale labs. The principal products that

contributed to this increase were Picture CD and Retail.com. The

average digital penetration rate for the number of rolls processed

increased each quarter during 2001 up to a rate of 6.7% in the

fourth quarter, reflecting a 49% increase over the fourth quarter

of 2000. In certain major retail accounts, the digital penetration

reached levels of up to 15%.

During the second quarter of 2001, the Company purchased

Ofoto, Inc. The Company believes that Ofoto will solidify the

Company’s leading position in online imaging products and

services. Since the acquisition, Ofoto has demonstrated strong

order growth, with the average order size increasing by 31% in

2001 as compared with the 2000 level. In addition, the Ofoto

customer base reflected growth of approximately 12% per month

throughout 2001.

Net worldwide sales of the Company’s consumer digital

cameras decreased 3% in 2001 as compared with 2000,

reflecting volume growth of 35% offset by declining prices and a

2% decrease due to negative exchange. The significant volume

growth over the 2000 levels was driven by strong market

acceptance of the new EasyShare consumer digital camera

system, competitive pricing initiatives, and a shift in the go-to-

market strategy to mass-market distribution channels. These

factors have moved the Company into the number two consumer

market share position in the U.S., up from the number three

position as of the end of 2000. Net worldwide sales of

professional digital cameras decreased 12% in 2001 as compared

with 2000, primarily attributable to a 20% decline in volume.

Net worldwide sales of inkjet photo paper increased 55% in

2001 as compared with 2000, reflecting volume growth of 42%

and increased prices. The inkjet photo paper demonstrated

double-digit growth year-over-year throughout 2001, reflecting the

Company’s increased promotional activity at key retail accounts,

improved merchandising and broader channel distribution of the

entire line of inkjet paper within the product group. Net

worldwide sales of professional thermal paper remained flat,

reflecting an 8% increase in volume offset by declines

attributable to price and negative exchange impact of 7% and

1%, respectively.

Net worldwide sales of professional film products, which

include color negative, color reversal and commercial black-and-

white film, decreased 13% in 2001 as compared with 2000. The

downward trend in the sale of professional film products existed

throughout 2001 and is the result of ongoing digital capture

substitution and continued economic weakness in a number of

markets worldwide. Net worldwide sales of sensitized professional