Kodak 2002 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

76

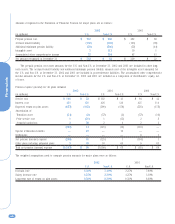

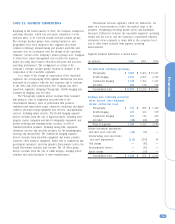

(in millions) 2002 2001 2000

Net earnings from continuing operations

Photography $ 550 $ 535 $ 1,034

Health Imaging 313 221 356

Commercial Imaging 83 84 90

All Other (23) (38) (2)

Total of segments 923 802 1,478

Venture investment impairments

and other asset write-offs (50) (15) —

Restructuring costs and credits

and asset impairments (114) (720) 44

Wolf charge —(77) —

Environmental reserve —(41) —

Kmart charge —(20) —

Interest expense (173) (219) (178)

Other corporate items 14 8 26

Tax benefit - PictureVision

subsidiary closure 45 ——

Tax benefit - Kodak Imagex Japan 46 ——

Income tax effects on above items and

taxes not allocated to segments

102 363 37

Consolidated total $ 793 $ 81 $ 1,407

Operating net assets

Photography $ 5,394 $ 6,288 $ 7,100

Health Imaging 1,123 1,426 1,491

Commercial Imaging 918 1,085 1,045

All Other (138) (219) (92)

Total of segments 7,297 8,580 9,544

LIFO inventory reserve (392) (444) (449)

Cash and marketable securities 577 451 251

Dividends payable —— (128)

Net deferred income tax

(liabilities) and assets 297 97 (4)

Noncurrent other

postretirement liabilities (2,147) (2,180) (2,209)

Other corporate net assets (249) (410) (205)

Consolidated net assets (1) $ 5,383 $ 6,094 $ 6,800

(1) Consolidated net assets are derived from the Consolidated Statement of

Financial Position, as follows:

Total assets $ 13,369 $ 13,362 $ 14,212

Total liabilities 10,592 10,468 10,784

Less: Short-term borrowings and

current portion of long-term debt (1,442) (1,534) (2,206)

Less: Long-term debt, net of

current portion (1,164) (1,666) (1,166)

Non-interest-bearing liabilities 7,986 7,268 7,412

Consolidated net assets $ 5,383 $ 6,094 $ 6,800

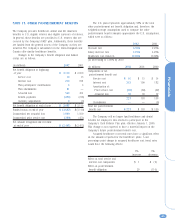

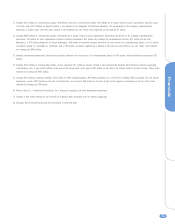

(in millions) 2002 2001 2000

Depreciation expense from

continuing operations

Photography $ 634 $ 599 $ 557

Health Imaging 107 96 92

Commercial Imaging 74 69 80

All Other 3 1 9

Consolidated total $ 818 $ 765 $ 738

Goodwill amortization expense

from continuing operations

Photography $ — $ 110 $ 120

Health Imaging —28 27

Commercial Imaging —15 3

All Other —— 1

Consolidated total $ — $ 153 $ 151

Capital additions from

continuing operations

Photography $ 408 $ 555 $ 721

Health Imaging 81 128 120

Commercial Imaging 83 56 98

All Other 5 4 6

Consolidated total $ 577 $ 743 $ 945

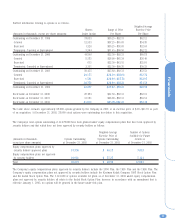

Net sales to external

customers attributed to(2):

The United States $ 6,008 $ 6,419 $ 6,800

Europe, Middle East

and Africa 3,363 3,275 3,464

Asia Pacific 2,242 2,215 2,349

Canada and Latin America 1,222 1,320 1,381

Consolidated total $ 12,835 $ 13,229 $ 13,994

(2) Sales are reported in the geographic area in which they originate.

Property, plant and equipment,

net located in:

The United States $ 3,501 $ 3,738 $ 3,913

Europe, Middle East

and Africa 769 672 647

Asia Pacific 943 977 1,056

Canada and Latin America 207 272 303

Consolidated total $ 5,420 $ 5,659 $ 5,919

Consolidated total

Consolidated net assets (1)

Consolidated net assets