Kodak 2002 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

20

The decrease in worldwide net sales was primarily

attributable to a decrease in optics revenues of 39% and a

decrease in revenues due to the divestment of the Eastman

Software business in 2000. These decreases were partially offset

by a 10% increase in the sale of sensors.

In December 2001, the Company and SANYO announced the

formation of a business venture, SK Display Corporation, to

manufacture and sell active matrix organic light emitting diode

(OLED) displays for consumer devices. Kodak holds a 34%

ownership interest in this venture. For 2001, there were no sales

relating to this business. In the future, the Company will derive

revenue through royalty income and sales of raw materials and

finished displays.

Loss from continuing operations before interest, other

(charges) income, and income taxes increased $49 million from a

loss of $11 million in 2000 to a loss of $60 million in 2001. The

increase in the loss was attributable to increased costs incurred

for the continued development of the OLED technology, the

establishment of the SK Display business venture and costs

incurred to grow the existing optics and sensor businesses.

The Company’s results as noted above include certain one-

time items, such as charges associated with focused cost

reductions and other special charges. These one-time items,

which are described below, should be considered to better

understand the Company’s results of operations that were

generated from normal operational activities.

2002

The Company’s results from continuing operations for the year

included the following:

Charges of $114 million ($80 million after tax) related to

focused cost reductions implemented in the third and fourth

quarters. See further discussion in the Restructuring Costs and

Other section of Management’s Discussion and Analysis of

Financial Condition and Results of Operations (MD&A) and Note

14, “Restructuring Costs and Other.”

Charges of $50 million ($34 million after tax) related to

venture investment impairments and other asset write-offs

incurred in the second, third and fourth quarters. See MD&A and

Note 6, “Investments” for further discussion of venture investment

impairments.

Income tax benefits of $121 million, including a $45 million

tax benefit related to the closure of the PictureVision subsidiary

in the second quarter, a $46 million benefit from the loss realized

on the liquidation of a Japanese photofinishing operations

subsidiary in the third quarter, an $8 million benefit from a

fourth quarter property donation, and a $22 million adjustment to

reduce the Company’s income tax provision due to a decrease in

the estimated effective tax rate for the full year.

Excluding the above items, net earnings from continuing

operations were $787 million, or $2.70 per basic and diluted

share.

SUMMARY

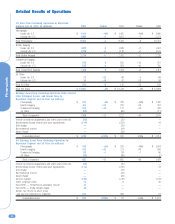

(in millions, except per share data) 2002 Change 2001 Change 2000

Net sales from continuing operations $ 12,835 –3% $13,229 –5% $13,994

Earnings from continuing operations before

interest, other (charges) income,

and income taxes 1,220 +247 352 –84 2,214

Earnings from continuing operations 793 +879 81 –94 1,407

Loss from discontinued operations (23) –360 (5) —

Net earnings 770 +913 76 –95 1,407

Basic earnings (loss) per share

Continuing operations 2.72 +871 .28 –94 4.62

Discontinued operations (.08) –300 (.02) —

Total 2.64 +915 .26 –94 4.62

Diluted earnings (loss) per share

Continuing operations 2.72 +871 .28 –94 4.59

Discontinued operations (.08) –300 (.02) —

Total 2.64 +915 .26 –94 4.59