Kodak 2002 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

74

2000

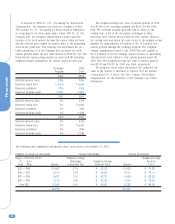

During the second quarter of 2000, the Company acquired the

remaining ownership interest in PictureVision, Inc. for cash and

assumed liabilities with a total transaction value of approximately

$90 million. In relation to this acquisition, the Company’s second

quarter, 2000 results included $10 million in charges for acquired

in-process R&D and approximately $15 million for other

acquisition-related charges. The Company used independent

professional appraisal consultants to assess and allocate values to

the in-process R&D.

During 2000, the Company also completed additional

acquisitions with an aggregate purchase price of approximately

$79 million in cash, none of which were individually material to the

Company’s financial position, results of operations or cash flows.

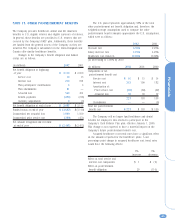

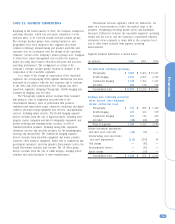

NOTE 21: DISCONTINUED OPERATIONS

In March 2001, the Company acquired Citipix from Groupe Hauts

Monts along with two related subsidiaries involved in mapping

services. Citipix was involved in the aerial photography of large

cities in the United States, scanning of this imagery and hosting

the imagery on the Internet for government, commercial and

private sectors. The acquired companies were formed into Kodak

Global Imaging, Inc. (KGII), a wholly owned subsidiary, which was

reported in the commercial and government products and services

business in the Commercial Imaging segment. Due to a

combination of factors, including the collapse of the

telecommunications market, limitations on flying imposed by the

events of September 11th, delays and losses of key contracts and

the global economic downturn, KGII did not achieve the financial

results expected by management during both 2001 and 2002. In

November 2002, the Company approved a plan to dispose of the

operations of KGII. The disposal plan consisted of the shutdown of

the Citipix business in December 2002 and the sale of the

remaining mapping business and imagery assets of the Citipix

business.

The Company incurred charges of approximately $44 million

in the fourth quarter of 2002 in relation to the disposal of KGII.

The Company recognized an impairment loss of approximately $25

million resulting from the write-down of the carrying value of

goodwill, intangibles and fixed assets to fair value. A loss of

approximately $9 million was recognized on the sale of the

mapping business and imagery assets of Citipix in December

2002. The Company also recognized a charge of approximately

$10 million to accrue various costs associated with the shutdown

of KGII, such as severance costs related to the termination of

150 employees, lease cancellation costs, and claims owed under

the original purchase agreement to the former owners of the

mapping business. In addition to these disposal costs, the

Company incurred losses from operations for the years ended

December 31, 2002 and 2001 amounting to $13 million and $7

million, respectively. The KGII operational losses and loss from

the disposal of KGII were recorded in loss from discontinued

operations in the Consolidated Statement of Earnings for the

years ended December 31, 2002 and 2001.

During the fourth quarter of 2002, the Company recognized

income of $19 million related to the favorable outcome of

litigation associated with the 1994 sale of Sterling Winthrop Inc.

The gain recognized on the favorable settlement was recorded in

loss from discontinued operations in the Consolidated Statement

of Earnings for the year ended December 31, 2002. In January

2003, the Company received the cash related to this settlement.

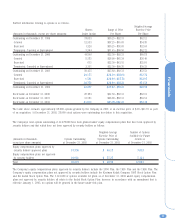

At December 31, 2002 and 2001, total assets related to the

discontinued operations of KGII and Sterling Winthrop Inc.

amounted to $28 million and $39 million, respectively, and were

reported in the Company’s Consolidated Statement of Financial

Position. Of the total assets related to discontinued operations at

December 31, 2002 and 2001, receivables, net amounted to $27

million and $3 million, goodwill, net was $0 and $16 million, and

other long-term assets was $0 and $17 million. The remaining

asset amounts were immaterial. At December 31, 2002 and 2001,

total liabilities related to discontinued operations of $12 million

and $4 million, respectively, were included in the Company’s

Consolidated Statement of Financial Position. These liabilities

were primarily related to the accrual of various costs associated

with the KGII shutdown as noted above.

Net sales resulting from discontinued operations for the

years ended December 31, 2002 and 2001 amounted to $6 million

and $5 million, respectively. The loss from discontinued

operations before income tax benefits for the years ended

December 31, 2002 and 2001 of $38 million and $7 million,

respectively, was taxed at an effective tax rate of 38% and 31%,

respectively, resulting in the loss from discontinued operations,

net of income tax benefits, in the Consolidated Statement of

Earnings of $23 million and $5 million, respectively.