Kodak 2002 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

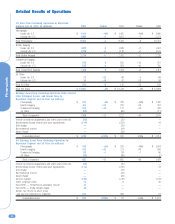

Financials

19

volume of new digital capture equipment and systems placements,

compounded by short-term start-up reliability issues with the new

equipment.

SG&A expenses for the Health Imaging segment increased

$16 million, or 4%, from $351 million in 2000 to $367 million in

2001. As a percentage of sales, SG&A increased from 15.8% in

2000 to 16.2% in 2001.

R&D expenses for the Health Imaging segment increased $14

million, or 10%, from $138 million in 2000 to $152 million in

2001. As a percentage of sales, R&D increased from 6.2% in

2000 to 6.7% in 2001.

Earnings from continuing operations before interest, other

(charges) income, and income taxes decreased $195 million, or

38%, from $518 million in 2000 to $323 million in 2001, which

is attributable to the decrease in the gross profit percentage in

2001 as compared with 2000, as described above.

Commercial Imaging Net worldwide sales for the Commercial

Imaging segment were $1,454 million for 2001 as compared with

$1,417 million for 2000, representing an increase of $37 million,

or 3% as reported, or 5% excluding the negative net impact of

exchange.

Net sales in the U.S. were $820 million for 2001 as

compared with $715 million for 2000, representing an increase of

$105 million, or 15%. Net sales outside the U.S. were $634

million for 2001 as compared with $702 million for 2000,

representing a decrease of $68 million, or 10% as reported, or

5% excluding the negative impact of exchange.

Net worldwide sales of document imaging equipment,

products and services increased 8% in 2001 as compared with

2000. The increase in sales was primarily attributable to an

increase in service revenue due to the acquisition of the Bell and

Howell Imaging business in the first quarter of 2001. With the

acquisition of the Bell and Howell Imaging business, the Company

continues to secure new exclusive third-party maintenance

agreements. The increase in revenue was also due to strong

demand for the Company’s iNnovation series scanners, specifically

the new i800 series high-volume document scanner.

Net worldwide sales of the Company’s commercial and

government products and services increased 16% in 2001 as

compared with 2000. The increase in sales was principally due to

an increase in revenues from government products and services

under its government contracts.

Net worldwide sales for wide-format inkjet products were a

contributor to the net increase in Commercial Imaging sales as

these revenues increased 9% in 2001 as compared with 2000,

reflecting year-over-year sales increases throughout 2001. The

Company continues to focus on initiatives to grow this business

as reflected in the acquisition of ENCAD, Inc. in January of 2002.

Given ENCAD’s strong distribution position in this industry, the

acquisition of ENCAD is expected to provide the Company with an

additional channel to the inkjet printer market.

Net worldwide sales of graphic arts products to KPG

decreased 15% in 2001 as compared with 2000. The largest

contributor to this decline in sales was graphics film, which

experienced a 20% decrease, reflecting a 19% decrease in

volume and small declines attributable to price/mix and exchange.

The decrease in sales to KPG is attributable to continued

technology substitution and economic weakness. During 2001,

KPG continued to implement the operational improvements it

began in 2000, which returned the joint venture to profitability in

the first quarter and throughout 2001. In the fourth quarter of

2001, KPG completed its acquisition of Imation’s color proofing

and software business. The Company believes that Imation’s

portfolio of products will complement and expand KPG’s offerings

in the marketplace, which should drive sell-through of Kodak’s

graphics products. The Company is the exclusive provider of

graphic arts products to KPG. Net earnings from continuing

operations include positive earnings from the Company’s equity in

the income of KPG.

Net worldwide sales of products to NexPress decreased in

2001 as compared with 2000, reflecting a 15% decrease in

volume and declines in price/mix. In September 2001, the joint

venture achieved its key milestone in launching the NexPress

2100 printer product at the Print ‘01 trade show. There is strong

customer demand for the new printer, which the Company

believes should drive increased sell-through of Kodak’s products

through the joint venture.

Gross profit for the Commercial Imaging segment was $451

million for 2001 compared with $473 million for 2000,

representing a decrease of $22 million, or 5%. The gross profit

margin for the Commercial Imaging segment was 31.0% in 2001

as compared with 33.4% in 2000. The 2.4 percentage point

decrease in gross margin was primarily attributable to lower

selling prices in a number of product groups within the segment.

SG&A expenses for the Commercial Imaging segment

increased $32 million, or 18%, from $176 million in 2000, to

$208 million in 2001. As a percentage of sales, SG&A increased

from 12.4% in 2000 to 14.3% in 2001.

R&D costs for the Commercial Imaging segment decreased $3

million, or 5%, from $61 million in 2000 to $58 million in 2001.

As a percentage of sales, R&D decreased from 4.3% in 2000 to

4.0% in 2001.

Earnings from continuing operations before interest, other

(charges) income, and income taxes decreased $61 million, or

26%, from $233 million in 2000 to $172 million in 2001, which

was attributable to the decrease in the gross profit percentage

and an increase in SG&A expenses in 2001 as compared with

2000, as described above.

All Other Net worldwide sales of businesses comprising All

Other were $110 million for 2001 as compared with $126 million

for 2000, representing a decrease of $16 million, or 13% as

reported, with no impact from exchange. Net sales in the U.S.

were flat at $68 million for both 2001 and 2000, while net sales

outside the U.S. were $42 million for 2001 as compared with $58

million for 2000, representing a decrease of $16 million, or 28%

as reported, or 30% excluding the net impact of exchange.