Kodak 2002 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

60

The Company’s financial instrument counterparties are high-

quality investment or commercial banks with significant

experience with such instruments. The Company manages

exposure to counterparty credit risk by requiring specific

minimum credit standards and diversification of counterparties.

The Company has procedures to monitor the credit exposure

amounts. The maximum credit exposure at December 31, 2002

was not significant to the Company.

SFAS No. 133 TRANSITION ADJUSTMENT

On January 1, 2000, the Company adopted SFAS No. 133,

“Accounting for Derivative Instruments and Hedging Activities.”

This statement requires that an entity recognize all derivatives as

either assets or liabilities and measure those instruments at fair

value. If certain conditions are met, a derivative may be

designated as a hedge. The accounting for changes in the fair

value of a derivative depends on the intended use of the

derivative and the resulting designation.

The forward contracts used to hedge existing foreign currency

denominated assets and liabilities, especially those of the

International Treasury Center, are marked to market through

earnings at the same time that the exposed assets and liabilities are

remeasured through earnings (both in other charges) and are not

given hedge accounting treatment. When the Company early-adopted

SFAS No. 133 on January 1, 2000, it recorded a loss of $1 million

in earnings to adjust the pre-SFAS No. 133 book value of the

forward contracts to their market value of $4 million (liability).

Additionally, upon adoption of SFAS No. 133, the existing

forward contracts used to hedge forecasted silver purchases were

designated as cash flow hedges and the Company recorded a gain of

$3 million (pre-tax) in accumulated other comprehensive (loss)

income to adjust the pre-SFAS No. 133 book value of the forward

contracts to their market value of $3 million (asset). These transition

adjustments were not displayed in separate captions as cumulative

effects of a change in accounting principle due to their immateriality.

The Company has a 50 percent ownership interest in KPG, a

joint venture accounted for under the equity method. The

Company’s proportionate share of KPG’s other comprehensive

income is therefore included in its presentation of other

comprehensive income displayed in the Consolidated Statement of

Shareholders’ Equity.

KPG has entered into foreign currency forward contracts that

are designated as cash flow hedges of exchange rate risk related

to forecasted foreign currency denominated intercompany sales,

primarily those denominated in euros and Japanese yen. At

December 31, 2002, KPG had open forward contracts with

maturity dates ranging from January 2003 to December 2003. At

December 31, 2002, Kodak’s share of the fair value of all open

foreign currency forward contracts hedging foreign currency

denominated intercompany sales was an unrealized loss of $5

million (pre-tax), recorded in accumulated other comprehensive

(loss) income. If this amount were to be realized, all of it would

be reclassified into KPG’s cost of goods sold during the next twelve

months. Additionally, realized losses of less than $1 million (pre-

tax), related to closed foreign currency contracts hedging foreign

currency denominated intercompany sales, have been deferred in

accumulated other comprehensive (loss) income. These losses will

be reclassified into KPG’s cost of goods sold as the inventory

transferred in connection with the intercompany sales is sold to

third parties, all within the next twelve months. During 2002, a

pre-tax gain of $4 million (Kodak’s share) was reclassified from

accumulated other comprehensive (loss) income to KPG’s cost of

goods sold. Hedge ineffectiveness was insignificant.

KPG has entered into aluminum forward contracts that are

designated as cash flow hedges of price risk related to forecasted

aluminum purchases. The fair value of open contracts at

December 31, 2002, and the losses reclassified into KPG’s cost of

goods sold during 2002, were negligible. Hedge ineffectiveness

was insignificant.

KPG has an interest rate swap agreement, maturing in August

2003, designated as a cash flow hedge of floating-rate interest

payments. At December 31, 2002, Kodak’s share of its fair value

was a $1 million loss (pre-tax), recorded in accumulated other

comprehensive (loss) income, and reducing Kodak’s investment in

KPG. If realized, all of this amount would be reclassified into

KPG’s interest expense during the next twelve months. During

2002, a pre-tax loss of $2 million (Kodak’s share) was reclassified

from accumulated other comprehensive (loss) income to KPG’s

interest expense. Hedge ineffectiveness was insignificant.

KPG has an interest rate swap agreement, maturing in May

2005, designated as a cash flow hedge of variable rental

payments. At December 31, 2002, Kodak’s share of its fair value

was a $1 million loss (pre-tax), recorded in accumulated other

comprehensive (loss) income, and reducing Kodak’s investment in

KPG. If realized, half of this amount would be reclassified into

KPG’s rental expense during the next twelve months. During

2002, a pre-tax loss of $1 million (Kodak’s share) was

reclassified from accumulated other comprehensive (loss) income

to KPG’s rental expense. There was no hedge ineffectiveness.

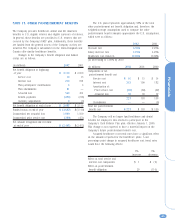

NOTE 12: OTHER (CHARGES) INCOME

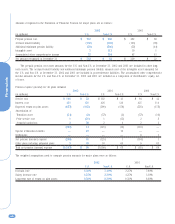

(in millions) 2002 2001 2000

Investment income $20 $15 $36

Loss on foreign exchange

transactions (19) (9) (13)

Equity in losses of unconsolidated

affiliates (106) (79) (110)

Gain on sales of investments —18 127

Gain on sales of capital assets 24 351

Loss on sales of subsidiaries —— (9)

Interest on past-due receivables 610 14

Minority interest (17) 11 (11)

Non-strategic venture investment

impairments (18) (3) —

Other 916 11

Total $(101) $ (18) $ 96