Kodak 2002 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

66

and development positions. The geographic composition of the

employees terminated included approximately 1,110 in the United

States and Canada and 1,590 throughout the rest of the world.

The charge for the long-lived asset impairments includes the

write-off of $61 million relating to sensitizing manufacturing

equipment, lab equipment and leasehold improvements, and other

assets that were scrapped or abandoned immediately and

accelerated depreciation of $33 million relating to sensitizing

manufacturing equipment, lab equipment and leasehold

improvements, and other assets that were to be used until their

abandonment within the first three months of 2002. The total

amount for long-lived asset impairments also includes a charge of

$43 million for the write-off of goodwill relating to the Company’s

PictureVision subsidiary, the realization of which was determined

to be impaired as a result of the Company’s acquisition of Ofoto

in the second quarter of 2001.

In the fourth quarter of 2001, the Company reversed $20

million of the $134 million in severance charges as certain

termination actions, primarily those in EAMER and Japan, will be

completed at a total cost less than originally estimated. This is

the result of a lower actual severance cost per employee as

compared with the original amounts estimated and 275 fewer

employees being terminated, including approximately 150 service

and photofinishing, 100 administrative and 25 R&D.

In the third quarter of 2002, the Company reversed $14

million of the original $134 million in severance charges due

primarily to higher rates of attrition than originally expected,

lower utilization of training and outplacement services by

terminated employees than originally expected and termination

actions being completed at an actual cost per employee that was

lower than originally estimated. As a result, approximately 225

fewer employees were terminated, including 100 service and

photofinishing, 100 administrative and 25 R&D. Also in the third

quarter of 2002, the Company reversed $3 million of exit costs as

a result of negotiating lower contract termination payments in

connection with business or product line exits.

Actions associated with the Second and Third Quarter, 2001

Restructuring Plan have been completed. A total of 2,200

personnel were terminated under the Second and Third Quarter,

2001 Restructuring Plan. A portion of the severance had not been

paid as of December 31, 2002 since, in many instances, the

terminated employees could elect or were required to receive

their severance payments over an extended period of time. Most

of the remaining exit costs are expected to be paid during 2003.

However, certain exit costs, such as long-term lease payments,

will be paid after 2003.

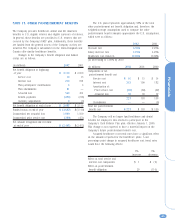

NOTE 15: OTHER ASSET IMPAIRMENTS

In 2001, the Company recorded a $77 million charge associated

with the bankruptcy of the Wolf Camera Inc. consumer retail

business. This amount is reflected in restructuring costs (credits)

and other in the accompanying Consolidated Statement of

Earnings.

Also in 2001, the Company recorded a $42 million charge

representing the write-off of certain lease residuals, receivables

and capital assets resulting primarily from technology changes in

the transition from optical to digital photofinishing equipment

within the Company’s onsite photofinishing operations. The

charges for the lease residuals and capital assets totaling $19

million were recorded in cost of goods sold in the accompanying

Consolidated Statement of Earnings. The remaining $23 million

was recorded in restructuring costs (credits) and other in the

accompanying Consolidated Statement of Earnings.

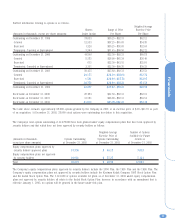

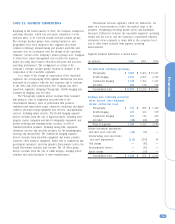

NOTE 16: RETIREMENT PLANS

Substantially all U.S. employees are covered by a noncontributory

plan, the Kodak Retirement Income Plan (KRIP), which is funded

by Company contributions to an irrevocable trust fund. The

funding policy for KRIP is to contribute amounts sufficient to meet

minimum funding requirements as determined by employee benefit

and tax laws plus additional amounts the Company determines to

be appropriate. Generally, benefits are based on a formula

recognizing length of service and final average earnings. Assets in

the fund are held for the sole benefit of participating employees

and retirees. The assets of the trust fund are comprised of

corporate equity and debt securities, U.S. government securities,

partnership and joint venture investments, interests in pooled

funds, and various types of interest rate, foreign currency and

equity market financial instruments. At December 31, 2001,

Kodak common stock represented approximately 3.4% of trust

assets. In December 2002, in connection with Wilshire Associates’

recommendation that KRIP eliminate its investments in specialty

sector U.S. equities, the Company purchased the 7.4 million

shares of Kodak common stock held by KRIP for $260 million.

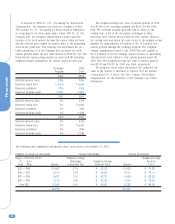

On March 25, 1999, the Company amended this plan to

include a separate cash balance formula for all U.S. employees

hired after February 1999. All U.S. employees hired prior to that

date were granted the option to choose the KRIP plan or the

Cash Balance Plus plan. Written elections were made by

employees in 1999, and were effective January 1, 2000. The Cash

Balance Plus plan credits employees’ accounts with an amount

equal to 4% of their pay, plus interest based on the 30-year

treasury bond rate. In addition, for employees participating in this

plan and the Company’s defined contribution plan, the Savings

and Investment Plan (SIP), the Company will match SIP

contributions for an amount up to 3% of pay, for employee

contributions of up to 5% of pay. Company contributions to SIP

were $14 million, $15 million and $11 million for 2002, 2001

and 2000, respectively. As a result of employee elections to the

Cash Balance Plus plan, the reductions in future pension expense

will be almost entirely offset by the cost of matching employee

contributions to SIP. The impact of the Cash Balance Plus plan is

shown as a plan amendment.