Kodak 2002 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

16

a decrease of $110 million, or 4%. The decrease was primarily

attributable to sales declines in Argentina, Brazil, China, and

Taiwan of 13%, 12%, 4%, and 12%, respectively, which were

primarily a result of economic weakness being experienced by

these countries. These sales declines were partially offset by an

increase in sales in Russia of 22%, which was primarily a result

of the success in camera seeding programs. The emerging market

portfolio accounted for approximately 18% and 35% of the

Company’s worldwide and non-U.S. sales, respectively, in both

2001 and 2000.

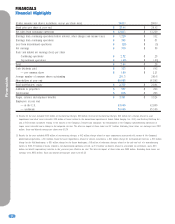

Gross profit was $4,568 million in 2001 as compared with

$5,619 million in 2000, representing a decrease of $1,051

million, or 19%. The gross profit margin declined 5.7 percentage

points from 40.2% in 2000 to 34.5% in 2001. The decline in

margin was driven primarily by lower prices across many of the

Company’s traditional and digital product groups within the

Photography segment, a significant decline in the margin in the

Health Imaging segment, which was caused by declining prices

and mix, and the negative impact of exchange. The decrease in

margin was also attributable to an increase in restructuring costs

incurred in 2001 as compared with 2000, which negatively

impacted gross profit margins by approximately 0.9 percentage

point.

SG&A expenses increased $111 million, or 4%, from $2,514

million in 2000 to $2,625 million in 2001. SG&A expenses

increased as a percentage of sales from 18.0% in 2000 to 19.8%

in 2001. The increase in SG&A expenses is primarily attributable

to charges of $73 million that the Company recorded in 2001

relating to Kmart’s bankruptcy, environmental issues and the

write-off of certain strategic investments that were impaired,

which amounted to $12 million.

R&D expenses remained flat, decreasing $5 million from

$784 million in 2000 to $779 million in 2001. R&D expenses

increased slightly as a percentage of sales from 5.6% in 2000 to

5.9% in 2001.

Earnings from continuing operations before interest, other

(charges) income, and income taxes decreased $1,862 million, or

84%, from $2,214 million in 2000 to $352 million in 2001. The

decrease in earnings from operations is partially attributable to

charges taken in 2001 totaling $891 million primarily relating to

restructuring and asset impairments, significant customer

bankruptcies and environmental issues. The remaining decrease in

earnings from operations is attributable to the decrease in sales

and gross profit margin percentage for the reasons described

above.

Interest expense for 2001 was $219 million as compared

with $178 million for 2000, representing an increase of $41

million, or 23%. The increase in interest expense is primarily

attributable to higher average borrowings in 2001 as compared

with 2000. Other charges for the current year were $18 million

as compared with other income of $96 million for the prior year.

The decrease in other (charges) income is primarily attributable

to increased losses from the Company’s NexPress and Phogenix

joint ventures in 2001 as compared with 2000 as these business

ventures are in the early stages of bringing their offerings to

market, and lower gains recognized from the sale of stock

investments in 2001 as compared with 2000.

The Company’s effective tax rate decreased from 34% for the

year ended December 31, 2000 to 30% for the year ended

December 31, 2001. The decline in the Company’s 2001 effective

tax rate as compared with the 2000 effective tax rate is primarily

attributable to an increase in creditable foreign taxes and an $11

million tax benefit related to favorable tax settlements reached in

the third quarter of 2001, which were partially offset by

restructuring costs recorded in the second, third and fourth

quarters of 2001, which provided reduced tax benefits to the

Company.

Net earnings from continuing operations for 2001 were $81

million, or $.28 per basic and diluted share, as compared with

net earnings from continuing operations for 2000 of $1,407

million, or $4.62 per basic share and $4.59 per diluted share,

representing a decrease of $1,326 million, or 94%. The decrease

in net earnings from continuing operations is primarily

attributable to the reasons outlined above.

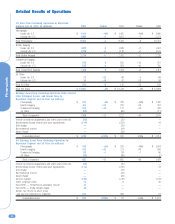

Photography Net worldwide sales for the Photography segment

were $9,403 million for 2001 as compared with $10,231 million

for 2000, representing a decrease of $828 million, or 8% as

reported, or 5% excluding the negative net impact of exchange.

The decrease in Photography sales was driven by declines in

consumer, entertainment origination and professional film

products, consumer and professional color paper, photofinishing

revenues and consumer and professional digital cameras.

Photography net sales in the U.S. were $4,482 million for

2001 as compared with $4,960 million for 2000, representing a

decrease of $478 million, or 10%. Photography net sales outside

the U.S. were $4,921 million for 2001 as compared with $5,271

million for 2000, representing a decrease of $350 million, or 7%

as reported, or 2% excluding the negative impact of exchange.

Net worldwide sales of consumer film products, which

include 35mm film, Advantix film and one-time-use cameras,

decreased 7% in 2001 relative to 2000, reflecting a 3% decline

in both volume and exchange, and a 1% decline in price/mix. The

composition of consumer film products in 2001 as compared with

2000 reflects a 2% decrease in volumes for Advantix film, a 7%

increase in volume of one-time-use cameras and a 4% decline in

volume of traditional film product lines. Sales of the Company’s

consumer film products within the U.S. decreased, reflecting a

5% decline in volume in 2001 as compared with 2000. Sales of

consumer film products outside the U.S. decreased 9% in 2001

as compared with 2000, reflecting a 2% decrease in volume, a