Kodak 2002 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

62

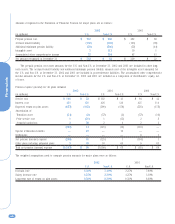

Deferred tax assets (liabilities) are reported in the following

components within the Consolidated Statement of Financial

Position:

(in millions) 2002 2001

Deferred income taxes (current) $ 512 $ 521

Other long-term assets 421 201

Accrued income taxes (83) (29)

Other long-term liabilities (52) (81)

Net deferred tax assets $ 798 $ 612

The valuation allowance as of December 31, 2002 of $72

million is primarily attributable to both foreign tax credits and

certain net operating loss carryforwards outside the U.S. The

valuation allowance as of December 31, 2001 was primarily

attributable to certain net operating loss carryforwards outside

the U.S. The Company estimates that approximately $99 million of

unused foreign tax credits will be available after the filing of the

2002 U.S. consolidated income tax return, with various expiration

dates through 2007. However, based on projections of future

taxable income, the Company would be able to utilize the credits

only if it were to forgo other tax benefits. Accordingly, a valuation

allowance of $56 million was recorded in 2002 as management

believes it is more likely than not that the Company will be

unable to realize these other tax benefits.

During 2002, the Company reduced the valuation allowance

that had been provided for as of December 31, 2001 by $40

million. The $40 million decrease includes $34 million relating to

net operating loss carryforwards in non-U.S. jurisdictions that

expired in 2002. The balance of the reduction of $6 million

relates to net operating loss carryforwards for certain of its

subsidiaries in Japan for which management now believes that it

is more likely than not that the Company will generate sufficient

taxable income to realize these benefits. Most of the remaining

net operating loss carryforwards subject to a valuation allowance

are subject to a five-year expiration period.

The Company is currently utilizing net operating loss

carryforwards to offset taxable income from its operations in

China that have become profitable. The Company has been

granted a tax holiday in China that becomes effective once the

net operating loss carryforwards have been fully utilized. When

the tax holiday becomes effective, the Company’s tax rate in

China will be zero percent for the first two years. For the

following three years, the Company’s tax rate will be 50% of the

normal tax rate for the jurisdiction in which Kodak operates,

which is currently 15%. Thereafter, the Company’s tax rate will

be 15%.

Retained earnings of subsidiary companies outside the U.S.

were approximately $1,817 million and $1,491 million at

December 31, 2002 and 2001, respectively. Deferred taxes have

not been provided on such undistributed earnings, as it is the

Company’s policy to permanently reinvest its retained earnings,

and it is not practicable to determine the deferred tax liability on

such undistributed earnings in the event they were to be

remitted. However, the Company periodically repatriates a portion

of these earnings to the extent that it can do so tax-free.

NOTE 14: RESTRUCTURING COSTS AND OTHER

Fourth Quarter, 2002 Restructuring Plan

During the fourth quarter of 2002, the Company announced a

number of focused cost reductions designed to apply

manufacturing assets more effectively in order to provide

competitive products to the global market. Specifically, the

operations in Rochester, New York that assemble one-time-use

cameras and the operations in Mexico that perform sensitizing for

graphic arts and x-ray films will be relocated to other Kodak

locations. In addition, as a result of declining photofinishing

volumes, the Company will close certain central photofinishing

labs in the U.S. and EAMER. The Company will also reduce

research and development and selling, general and administrative

positions on a worldwide basis and exit certain non-strategic

businesses. The total restructuring charges recorded in the fourth

quarter of 2002 for these actions were $116 million.

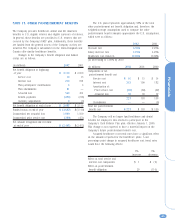

The following table summarizes the activity with respect to

the restructuring and asset impairment charges recorded during

the fourth quarter of 2002 for continuing operations and the

remaining balance in the related restructuring reserves at

December 31, 2002:

Long-lived Exit

Number of Severance Inventory Asset Costs

(dollars in millions) Employees Reserve Write-downs Impairments Reserve Total

4th Quarter, 2002 charges 1,150 $ 55 $ 7 $ 37 $ 17 $ 116

4th Quarter, 2002 utilization (250) (2) (7) (37) — (46)

Balance at 12/31/02 900 $ 53 $ — $ — $ 17 $ 70