Kodak 2002 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

46

For equipment sales, the recognition criteria are generally

met when the equipment is delivered and installed at the

customer site. In instances in which the agreement with the

customer contains a customer acceptance clause, revenue is

deferred until customer acceptance is obtained, provided the

customer acceptance clause is considered to be substantive. For

certain agreements, the Company does not consider these

customer acceptance clauses to be substantive because the

Company can and does replicate the customer acceptance test

environment and performs the agreed upon product testing prior

to shipment. In these instances, revenue is recognized upon

installation of the equipment.

The sale of equipment combined with services, including

maintenance, and/or other elements, including products and

software, represent multiple element arrangements. The Company

allocates revenue to the various elements based on verifiable

objective evidence of fair value (if software is not included or is

incidental to the transaction) or Kodak-specific objective evidence

of fair value if software is included and is other than incidental

to the sales transaction as a whole. Revenue allocated to an

individual element is recognized when all other revenue

recognition criteria are met for that element.

Revenue from the sale of integrated solutions, which includes

transactions that require significant production, modification or

customization of software, is recognized in accordance with

contract accounting. Under contract accounting, revenue should

be recognized utilizing either the percentage-of-completion or

completed-contract method. The Company currently utilizes the

completed-contract method for all solution sales as sufficient

history does not currently exist to allow the Company to

accurately estimate total costs to complete these transactions.

Revenue from other long-term contracts, primarily government

contracts, is generally recognized using the percentage-of-

completion method.

The Company may offer customer financing to assist

customers in their acquisition of Kodak’s products, primarily in

the area of on-site photofinishing equipment. At the time a

financing transaction is consummated, which qualifies as a sales-

type lease, the Company records the total lease receivable net of

unearned income and the estimated residual value of the

equipment. Unearned income is recognized as finance income

using the interest method over the term of the lease. Leases not

qualifying as sales-type leases are accounted for as operating

leases. The underlying equipment is depreciated on a straight-line

basis over the assets’ estimated useful life.

The Company’s sales of tangible products are the only class

of revenues that exceeds 10% of total consolidated net sales. All

other sales classes are individually less than 10%, and therefore,

have been combined with the sales of tangible products on the

same line in accordance with Regulation S-X.

Warranty Costs The Company has warranty obligations in

connection with the sale of its equipment. The original warranty

period for equipment products is generally one year. The costs

incurred to provide for these warranty obligations are estimated

and recorded as an accrued liability at the time of sale. The

Company estimates its warranty cost at the point of sale for a

given product based on historical failure rates and related costs to

repair. The change in the Company’s accrued warranty obligations

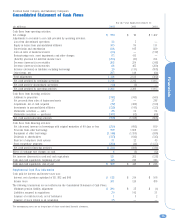

from December 31, 2001 to December 31, 2002 was as follows:

(in millions)

Accrued warranty obligations

at December 31, 2001 $ 50

Actual warranty experience during 2002 (47)

2002 warranty provisions 48

Adjustments for changes in estimates (8)

Accrued warranty obligations at December 31, 2002 $43

The Company also offers extended warranty arrangements to

its customers, which are generally one year but may range from

three months to three years after the original warranty period.

The Company provides both repair services and routine

maintenance services under these arrangements. The Company

has not separated the extended warranty revenues and costs from

the routine maintenance service revenues and costs, as it is not

practicable to do so. Costs incurred under these extended

warranty arrangements for the year ended December 31, 2002

amounted to $179 million. The change in the Company's deferred

revenue balance in relation to these extended warranty

arrangements was as follows:

(in millions)

Deferred revenue at December 31, 2001 $ 91

New extended warranty arrangements in 2002 330

Recognition of extended warranty arrangement

revenue in 2002 (318)

Deferred revenue at December 31, 2002 $103

Research and Development Costs Research and

development costs, which include costs in connection with new

product development, fundamental and exploratory research,

process improvement, product use technology and product

accreditation are charged to operations in the period in which

they are incurred.

Advertising Advertising costs are expensed as incurred and

included in selling, general and administrative expenses.

Advertising expenses amounted to $632 million, $634 million and

$701 million in 2002, 2001 and 2000, respectively.

Shipping and Handling Costs Amounts charged to customers

and costs incurred by the Company related to shipping and

handling are included in net sales and cost of goods sold,

respectively, in accordance with Emerging Issues Task Force

(EITF) Issue No. 00-10, “Accounting for Shipping and Handling

Fees and Costs.”