Kodak 2002 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

73

NOTE 20: ACQUISITIONS, JOINT VENTURES

AND BUSINESS VENTURES

2002

On January 24, 2002, the Company completed the acquisition of

100% of the voting common stock of ENCAD, Inc., (ENCAD) for a

total purchase price of approximately $25 million. The purchase

price was paid almost entirely in Kodak common stock. The

purchase price in excess of the fair value of the net assets

acquired of approximately $6 million has been allocated to

goodwill. On December 17, 2002, it was announced that ENCAD

will become part of the newly formed components group along

with the document scanner and microfilm businesses. The

formation of the components group will build a stronger

equipment and consumables business within the Commercial

Imaging segment by consolidating those product lines that utilize

a two tier, indirect sales and distribution channel. Earnings from

continuing operations for 2002 include the results of ENCAD from

the date of acquisition.

On September 11, 2002, the Company initiated an offer to

acquire all of the outstanding minority equity interests in Kodak

India Ltd., (Kodak India) a majority owned subsidiary of the

Company. The voluntary offer to the minority equity interest

holders of Kodak India was for the acquisition of approximately

2.8 million shares representing the full 25.24% minority

ownership in the subsidiary. In the fourth quarter of 2002, the

Company purchased the 2.1 million shares that had been

tendered to date for approximately $16 million in cash. Due to

the timing of this acquisition, the purchase price allocation was

not complete as of December 31, 2002. Accordingly, the purchase

price in excess of the fair value of the net assets acquired of

approximately $8 million has been recorded in other long-term

assets. The purchase price allocation will be completed in the

first quarter of 2003 at which time the excess purchase price

will be allocated to goodwill and other identifiable intangible

assets. In December 2002, the Company made an offer to

purchase the remaining 6.04% outstanding minority interest in

Kodak India for approximately $4.9 million. Kodak India operated

in each of the Company’s reportable segments and is engaged in

the manufacture, trading and marketing of cameras, films, photo

chemicals and other imaging products.

On December 31, 2002, an unaffiliated investor in one of

Kodak’s China subsidiaries exercised its rights under a put option

arrangement, which required Kodak to repurchase a 10%

outstanding minority equity interest in this subsidiary for

approximately $44 million in cash. Due to the timing of this

acquisition, the purchase price allocation was not complete as of

December 31, 2002. Accordingly, the purchase price in excess of

the fair value of the net assets acquired of approximately $18

million has been recorded in other long-term assets. The

purchase price allocation will be completed in the first quarter of

2003 at which time the excess purchase price will be allocated to

goodwill and other identifiable intangible assets.

During 2002, the Company completed a number of additional

acquisitions with an aggregate purchase price of approximately

$14 million, which were individually immaterial to the Company’s

financial position, results of operations or cash flows.

2001

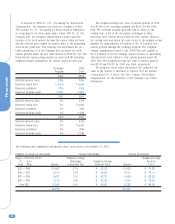

On December 4, 2001, the Company and SANYO Electric Co., Ltd.

announced the formation of a global business venture, the SK

Display Corporation, to manufacture organic light emitting diode

(OLED) displays for consumer devices such as cameras, personal

data assistants (PDAs), and portable entertainment machines.

Kodak has a 34% interest in the business venture and will

contribute approximately $16 million in cash in 2003 and is

committed to contribute $100 million in loan guarantees.

However, the Company was not required to make these loan

guarantees as of December 31, 2002. SANYO holds a 66%

interest in the business venture and is committed to contribute

approximately $36 million in cash and $195 million in loan

guarantees.

On June 4, 2001, the Company completed its acquisition of

Ofoto, Inc. The purchase price of this stock acquisition was

approximately $58 million in cash. The acquisition was accounted

for as a purchase with $10 million allocated to tangible net

assets, $37 million allocated to goodwill and $11 million allocated

to other intangible assets. The acquisition of Ofoto will accelerate

Kodak’s growth in the online photography market and help drive

more rapid adoption of digital and online services. Ofoto offers

digital processing of digital images and traditional film, top-quality

prints, private online image storage, sharing, editing and creative

tools, frames, cards and other merchandise.

On February 7, 2001, the Company completed its acquisition

of substantially all of the imaging services operations of Bell &

Howell Company. The purchase price of this stock and asset

acquisition was $141 million in cash, including acquisition and

other costs of $6 million. The acquisition was accounted for as a

purchase with $15 million allocated to tangible net assets, $70

million allocated to goodwill, and $56 million allocated to other

intangible assets, primarily customer contracts. The acquired

units provide customers worldwide with maintenance for

document imaging components, micrographic-related equipment,

supplies, parts and service.

During 2001, the Company also completed additional

acquisitions with an aggregate purchase price of approximately

$122 million in cash and stock, none of which were individually

material to the Company’s financial position, results of operations

or cash flows.