Kodak 2002 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy Statement

98

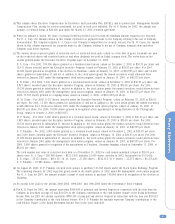

OPTION/SAR GRANTS IN LAST FISCAL YEAR

Individual Grants

Number of Percentage

Securities of Total

Underlying Options/SARs

Options/ Granted to Exercise or Grant Date

SARs Employees Base Price Expiration Present

Name Granted in Fiscal Year Per Share Date Value(c)

D. A. Carp 175,000(a) .00868 $36.66 11/21/12 $1,438,500

R. H. Brust 42,000(a) .00208 36.66 11/21/12 345,240

M. M. Coyne 36,000(a) .00179 36.66 11/21/12 295,920

M. P. Morley 35,000(a) .00174 36.66 11/21/12 287,700

D. P. Palumbo 36,400(a) .00181 36.66 11/21/12 299,208

133,043(b) .00660 31.30 5/18/07-11/15/11 796,928

(a) These options were granted in November 2002 under the management stock option program. Termination of employment, for other

than death or a permitted reason, prior to the first anniversary of the grant date results in forfeiture of the options. Thereafter,

termination of employment prior to vesting results in forfeiture of the options unless the termination is due to retirement, death,

disability or an approved reason. Vesting accelerates upon death. One third of the options vest on each of the first three

anniversaries of the date of grant.

(b) These options were granted to D. P. Palumbo on August 26, 2002, under the Stock Option Exchange Program; they expire

on the following dates: 733 on May 18, 2007; 2,500 on February 11, 2008; 69 on March 12, 2008; 4,700 on April 1, 2008;

390 on March 11, 2009; 8,251 on March 31, 2009; 13,333 on February 29, 2010; 66,667 on October 1, 2010, and 36,400 on

November 15, 2011.

(c) The present value of these options was determined using the Black-Scholes model of option valuation in a manner consistent with

the requirements of Statement of Financial Accounting Standards No. 123, “Accounting for Stock-Based Compensation.” For the

options granted in November 2002 under the management stock option program, the following weighted-average assumptions were

used: risk-free interest rate – 3.8%, expected option life – 7 years, expected volatility – 34%, and expected dividend yield –

5.76%. For the options granted under the Stock Option Exchange Program, the following weighted-average assumptions were used:

risk-free interest rate – 2.9%, expected option life – 4 years, expected volatility – 37%, and expected dividend yield – 5.76%.

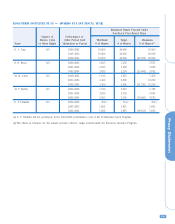

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND

FISCAL YEAR-END OPTION/SAR VALUES

Number of

Securities Underlying Value of Unexercised

Unexercised Options/SARs In-the-Money Options/

Number of at Fiscal Year-End SARs at Fiscal Year-End*Value

Shares Acquired Value

Name on Exercise Realized Exercisable Unexercisable Exercisable Unexercisable

D. A. Carp 7,638 $15,757 891,086 528,590 $477,023 $954,046

R. H. Brust 0 0 184,622 163,378 148,831 298,109

M. M. Coyne 2,630 6,188 231,473 161,389 181,269 362,538

M. P. Morley 0 0 259,671 95,696 80,140 160,520

D. P. Palumbo 0 0 70,977 98,466 265,454 232,127

*Based on the closing price on the New York Stock Exchange – Composite Transactions of the Company’s common stock on

December 31, 2002, of $35.04 per share.