Kodak 2002 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

18

paper decreased 2% in 2001 as compared with 2000, reflecting a

4% increase in volume, offset by a 4% decrease in price and a

2% decline attributable to exchange.

Net worldwide sales of origination and print film to the

entertainment industry decreased 4% in 2001 as compared with

2000. Origination film sales decreased 12%, reflecting a 9%

decline in volume and a 3% decline due to the negative impact of

exchange. The decrease in origination film sales was partially

offset by an increase in print film of 4%, reflecting a 9%

increase in volume, offset by declines attributable to exchange

and price of 3% and 2%, respectively. After several consecutive

years of growth in origination film sales, this decrease reflects a

slight downward trend beginning in the second half of 2001 due

to continued economic weakness in the U.S., which caused a

decrease in television advertising spend and the resulting decline

in the production of television commercials. Additionally, the

events of September 11th caused a number of motion picture film

releases and television show productions to be delayed or

postponed.

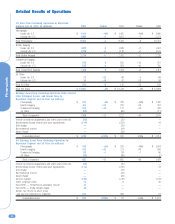

Gross profit for the Photography segment was $3,402 million

in 2001 as compared with $4,099 million in 2000, representing a

decrease of $697 million or 17%. The gross profit margin for the

Photography segment was 36.2% in 2001 as compared with

40.1% in 2000. The 3.9 percentage point decrease in gross

margin for the Photography segment was primarily attributable to

continued lower effective selling prices across virtually all product

groups, including the Company’s core products of traditional film,

paper, and digital cameras, unfavorable exchange and flat

distribution costs on a lower sales base.

SG&A expenses for the Photography segment remained

relatively flat, decreasing $10 million, or 1%, from $1,973 million

in 2000 to $1,963 million in 2001. As a percentage of sales,

SG&A increased from 19.3% in 2000 to 20.9% in 2001. SG&A,

excluding advertising, increased 4%, representing 14.6% of sales

in 2001 and 12.9% of sales in 2000. R&D expenses for the

Photography segment decreased $33 million, or 6%, from $575

million in 2000 to $542 million in 2001. As a percentage of

sales, R&D increased slightly from 5.6% in 2000 to 5.8% in

2001.

Earnings from continuing operations before interest, other

(charges) income, and income taxes for the Photography segment

decreased $643 million, or 45%, from $1,430 million in 2000 to

$787 million in 2001, reflecting the lower sales and gross profit

levels described above.

Health Imaging Net worldwide sales for the Health Imaging

segment were $2,262 million for 2001 as compared with $2,220

million for 2000, representing an increase of $42 million, or 2%

as reported, or a 5% increase excluding the negative net impact

of exchange.

Net sales in the U.S. were $1,089 million for 2001 as

compared with $1,067 million for 2000, representing an increase

of $22 million or 2%. Net sales outside the U.S. were $1,173

million for 2001 as compared with $1,153 million for 2000,

representing an increase of $20 million, or 2% as reported, or

7% excluding the negative impact of exchange. Sales in emerging

markets increased slightly, up 4% from 2000 to 2001.

Net worldwide sales of digital products, which include laser

imagers (DryView imagers and wet laser printers), digital media

(DryView and wet laser media), digital capture equipment

(computed radiography capture equipment and digital radiography

equipment) and PACS, increased 11% in 2001 as compared with

2000. The increase in digital sales was principally the result of a

184% increase in digital capture revenues resulting from a 201%

increase in volume, due to new product introductions in 2000 and

2001. In the second and third quarter of 2000, the Company

introduced new computer radiography and digital radiography

products. In 2001, the Company’s results include sales of these

products for the full year, as well as sales of newer Computed

Radiography products, which were launched in early 2001. The

increase in revenues was partially offset by declines attributable

to price and exchange. Laser imaging equipment, services and

film also contributed to the increase in digital sales, as sales in

these combined categories increased 3% in 2001 as compared

with 2000. The 3% increase in these product groups was the

result of increases in DryView laser imagers and media of 8%

and 33%, respectively, which were partially offset by the

expected decreases in wet laser printers and media of 8% and

29%, respectively, in 2001 as compared with 2000. Sales of

PACS increased 9% in 2001 as compared with 2000, reflecting a

16% increase in volume, partially offset by declines attributable

to price and exchange of 4% and 3%, respectively.

Net worldwide sales of traditional medical products, which

include analog film, equipment, chemistry and services, decreased

7% in 2001 as compared with 2000. This decline was primarily

attributable to a 12% decrease in non-specialty medical sales.

The decrease in these sales was partially offset by an increase in

specialty Mammography and Oncology sales, which increased 4%,

reflecting a 12% increase in volume, offset by declines

attributable to price/mix and exchange of 6% and 2%,

respectively. Additionally, Dental sales increased 3% in 2001 as

compared with 2000, reflecting a 5% increase in volume, which

was partially offset by declines of 1% attributable to both

price/mix and exchange.

Gross profit for the Health Imaging segment was $869

million for 2001 as compared with $1,034 million for 2000,

representing a decrease of $165 million or 16%. The gross profit

margin for the Health Imaging segment was 38.4% in 2001 as

compared with 46.6% in 2000. The 8.2 percentage point decrease

in gross margin was primarily attributable to selling price

declines in 2001, driven by the continued conversion of customers

to lower pricing levels under the Company’s Novation GPO

contracts and a larger product mix shift from higher margin

traditional analog film toward lower margin digital capture and

printing equipment. Additionally, in 2001 as compared with 2000,

the Company incurred higher service costs due to an increase in