Kodak 2002 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

69

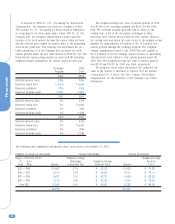

NOTE 17: OTHER POSTRETIREMENT BENEFITS

The Company provides healthcare, dental and life insurance

benefits to U.S. eligible retirees and eligible survivors of retirees.

In general, these benefits are provided to U.S. retirees that are

covered by the Company’s KRIP plan. Additionally, these benefits

are funded from the general assets of the Company as they are

incurred. The Company’s subsidiaries in the United Kingdom and

Canada offer similar healthcare benefits.

Changes in the Company’s benefit obligation and funded

status are as follows:

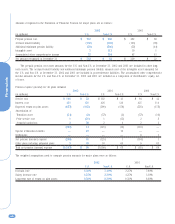

(in millions) 2002 2001

Net benefit obligation at beginning

of year $ 3,110 $ 2,659

Service cost 16 15

Interest cost 213 199

Plan participants’ contributions 43

Plan amendments 31 —

Actuarial loss 549 453

Benefit payments (239) (216)

Currency adjustments 3(3)

Net benefit obligation at end of year $ 3,687 $ 3,110

Funded status at end of year $ (3,687) $ (3,110)

Unamortized net actuarial loss 1,600 1,109

Unamortized prior service cost (360) (451)

Net amount recognized and recorded

at end of year $ (2,447) $ (2,452)

The U.S. plan represents approximately 98% of the total

other postretirement net benefit obligation and, therefore, the

weighted-average assumptions used to compute the other

postretirement benefit amounts approximate the U.S. assumptions,

which were as follows:

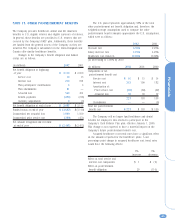

2002 2001

Discount rate 6.50% 7.25%

Salary increase rate 4.25% 4.25%

Healthcare cost trend (a) 12.00% 10.00%

(a) decreasing to 5.00% by 2010

(in millions) 2002 2001 2000

Components of net

postretirement benefit cost

Service cost $16 $15 $14

Interest cost 213 199 172

Amortization of:

Prior service cost (60) (60) (67)

Actuarial loss 58 39 17

227 193 136

Curtailments —— (6)

Total net postretirement

benefit cost $ 227 $ 193 $ 130

The Company will no longer fund healthcare and dental

benefits for employees who elected to participate in the

Company’s Cash Balance Plus plan, effective January 1, 2000.

This change is not expected to have a material impact on the

Company’s future postretirement benefit cost.

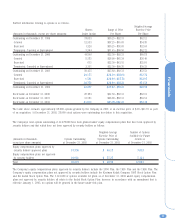

Assumed healthcare cost trend rates have a significant effect

on the amounts reported for the healthcare plans. A one

percentage point change in assumed healthcare cost trend rates

would have the following effects:

1% 1%

increase decrease

Effect on total service and

interest cost components $ 1 $ (7)

Effect on postretirement

benefit obligation 29 (114)