Kodak 2002 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

14

Although analog film volumes declined on a worldwide basis,

current sales levels reflect an increase in traditional film market

share. M&O sales increased 6% in the current year as compared

with the prior year, reflecting higher volumes of approximately

8%, partially offset by decreases in price/mix and exchange of

approximately 1% and 1%, respectively.

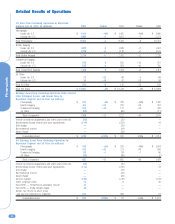

Gross profit for the Health Imaging segment was $930

million for 2002 as compared with $869 million for 2001,

representing an increase of $61 million, or 7%. The gross profit

margin was 40.9% in 2002 as compared with 38.4% in 2001.

The 2.5 percentage point increase was attributable to

productivity/cost improvements, which increased gross profit

margins by 2.9 percentage points due to favorable media and

equipment manufacturing productivity led by DryView digital

media, analog medical film, laser imaging equipment, and PACS,

which were complemented by lower service costs and improved

supply chain management. The positive effects of productivity/cost

on gross profit margins were partially offset by a decrease in

price/mix that impacted margins by approximately 0.5 percentage

point due to declining digital laser media and analog medical film

prices.

The Company substantially completed the conversion of

customers to the Novation Group Purchasing Organization (GPO)

in 2001 and, therefore, the Company does not anticipate that this

arrangement will have any additional significant potential impacts

on gross profit trends in the future as was experienced in 2001.

SG&A expenses for the Health Imaging segment decreased

$20 million, or 5%, from $367 million for 2001 to $347 million

for 2002. As a percentage of sales, SG&A expenses decreased

from 16.2% for 2001 to 15.3% for 2002. The decrease in SG&A

expenses is primarily a result of cost reduction activities and

expense management.

R&D costs for the Health Imaging segment remained constant

at $152 million for 2002 and 2001. As a percentage of sales,

R&D costs remained unchanged at 6.7% for both years.

Earnings from continuing operations before interest, other

(charges) income, and income taxes for the Health Imaging

segment increased $108 million, or 33%, from $323 million for

2001 to $431 million for 2002. The increase in earnings from

operations and the resulting operational earnings margin are

primarily attributable to the combined effects of improvements in

gross profit margins, lower SG&A expense, and the elimination of

goodwill amortization in 2002, which was $28 million in 2001.

Commercial Imaging Net worldwide sales for the Commercial

Imaging segment for 2002 increased slightly from $1,454 million

for 2001 to $1,456 million for 2002, representing an increase of

$2 million, with no net impact from exchange. The slight increase

in sales was attributable to an increase in price/mix of

approximately 1.0 percentage point, which was almost entirely

offset by declines in volume of approximately 0.9 percentage

point related to graphic arts and micrographic products.

Net sales in the U.S. were $818 million for 2002 as

compared with $820 million for 2001, representing a decrease of

$2 million. Net sales outside the U.S. were $638 million in the

current year as compared with $634 million in the prior year,

representing an increase of $4 million, or 1%, with no impact

from exchange.

Net worldwide sales of the Company’s commercial and

government products and services increased 7% in 2002 as

compared with 2001. The increase in sales was principally due to

an increase in revenues from government products and services

under its government contracts.

Net worldwide sales for inkjet products were a contributor to

the net increase in Commercial Imaging sales as these revenues

increased 175% in 2002 as compared with 2001. The increase in

sales was attributable to the acquisition of ENCAD, Inc., which

has improved the Company’s channel to the inkjet printer market.

Net worldwide sales of graphic arts products to Kodak

Polychrome Graphics (KPG), an unconsolidated joint venture

affiliate in which the Company has a 50% ownership interest,

decreased 10% in 2002 as compared with 2001, primarily

reflecting volume declines in graphic arts film. This reduction

resulted largely from digital technology substitution and the effect

of continuing economic weakness in the commercial printing

market. The Company’s equity in the earnings of KPG contributed

positive results to other charges during 2002, but was not

material to the Company’s results from operations.

Gross profit for the Commercial Imaging segment for 2002

decreased slightly from $451 million for 2001 to $449 million for

2002. The gross profit margin was 30.8% for 2002 as compared

with 31.0% for 2001. The gross profit margin remained relatively

flat due to declines related to price/mix, which reduced margins

by approximately 1.9 percentage points. These declines were

offset by productivity/cost improvements, which increased margins

by approximately 1.9 percentage points.

SG&A expenses for the Commercial Imaging segment

decreased $14 million, or 7%, from $208 million for 2001 to

$194 million for 2002. As a percentage of sales, SG&A expenses

decreased from 14.3% for 2001 to 13.3% for 2002. The primary

contributors to the decrease in SG&A expenses were cost

reductions from the prior year restructuring actions, which had a

larger impact on the results of 2002 as compared with 2001,

partially offset by the acquisition of ENCAD, Inc. in 2002, which

increased SG&A by $23 million.

R&D costs for the Commercial Imaging segment increased $5

million, or 9%, from $58 million for 2001 to $63 million for

2002. The increase was due to the acquisition of ENCAD, Inc. in

2002, which increased R&D costs by $8 million. As a percentage

of sales, R&D costs increased from 4.0% in 2001 to 4.3% in 2002.

Earnings from continuing operations before interest, other

(charges) income, and income taxes for the Commercial Imaging

segment increased $20 million, or 12%, from $172 million in

2001 to $192 million in 2002. The increase in earnings from

operations is primarily attributable to overall expense