Kodak 2002 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

70

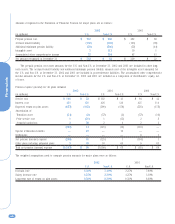

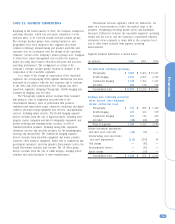

NOTE 18: ACCUMULATED OTHER COMPREHENSIVE

(LOSS) INCOME

The components of accumulated other comprehensive (loss)

income at December 31, 2002, 2001 and 2000 were as follows:

(in millions) 2002 2001 2000

Accumulated unrealized holding

(losses) gains related to

available-for-sale securities $— $ (6) $ 7

Accumulated unrealized losses

related to hedging activity (9) (5) (38)

Accumulated translation

adjustments (306) (524) (425)

Accumulated minimum pension

liability adjustments (456) (62) (26)

Total $(771) $ (597) $ (482)

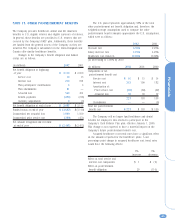

NOTE 19: STOCK OPTION AND COMPENSATION

PLANS

The Company’s stock incentive plans consist of the 2000 Omnibus

Long-Term Compensation Plan (the 2000 Plan), the 1995 Omnibus

Long-Term Compensation Plan (the 1995 Plan), and the 1990

Omnibus Long-Term Compensation Plan (the 1990 Plan). The

Plans are administered by the Executive Compensation and

Development Committee of the Board of Directors.

Under the 2000 Plan, 22 million shares of the Company’s

common stock may be granted to a variety of employees between

January 1, 2000 and December 31, 2004. The 2000 Plan is

substantially similar to, and is intended to replace, the 1995

Plan, which expired on December 31, 1999. Option prices are not

less than 100% of the per share fair market value on the date of

grant, and the options generally expire ten years from the date of

grant, but may expire sooner if the optionee’s employment

terminates. The 2000 Plan also provides for Stock Appreciation

Rights (SARs) to be granted, either in tandem with options or

freestanding. SARs allow optionees to receive payment equal to

the increase in the Company’s stock market price from the grant

date to the exercise date. At December 31, 2002, 39,581

freestanding SARs were outstanding at option prices ranging from

$29.31 to $62.44.

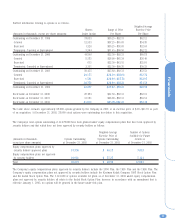

Under the 1995 Plan, 22 million shares of the Company’s

common stock were eligible for grant to a variety of employees

between February 1, 1995 and December 31, 1999. Option prices

are not less than 100% of the per share fair market value on the

date of grant, and the options generally expire ten years from the

date of grant, but may expire sooner if the optionee’s employment

terminates. The 1995 Plan also provides for SARs to be granted,

either in tandem with options or freestanding. SARs allow

optionees to receive payment equal to the difference between the

Company’s stock market price on grant date and exercise date. At

December 31, 2002, 325,659 freestanding SARs were outstanding

at option prices ranging from $31.30 to $90.63.

Under the 1990 Plan, 22 million shares of the Company’s

common stock were eligible for grant to key employees between

February 1, 1990 and January 31, 1995. Option prices could not

be less than 50% of the per share fair market value on the date

of grant; however, no options below fair market value were

granted. The options generally expire ten years from the date of

grant, but may expire sooner if the optionee’s employment

terminates. The 1990 Plan also provided that options with

dividend equivalents, tandem SARs and freestanding SARs could

be granted. At December 31, 2002, 69,656 freestanding SARs

were outstanding at option prices ranging from $30.25 to $44.50.

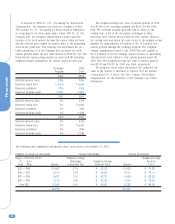

In January 2002, the Company’s shareholders voted in favor

of a voluntary stock option exchange program for its employees.

Under the program, employees were given the opportunity, if they

so chose, to cancel outstanding stock options previously granted

to them at exercise prices ranging from $26.90 to $92.31, in

exchange for new options to be granted on or shortly after August

26, 2002, over six months and one day from February 22, 2002,

the date the old options were canceled. The number of shares

subject to the new options was determined by applying an

exchange ratio in the range of 1:1 to 1:3 (i.e., one new option

share for every three canceled option shares) based on the

exercise price of the canceled option. As a result of the exchange

program, approximately 23.7 million old options were canceled on

February 22, 2002, with approximately 16 million new options

granted on, or shortly after, August 26, 2002. The exchange

program did not result in variable accounting, as it was designed

to comply with FASB Interpretation No. 44 (FIN 44), “Accounting

for Certain Transactions Involving Stock-Based Compensation.”

Also, the new options had an exercise price equal to the fair

market value of the Company’s common stock on the new grant

date, so no compensation expense was recorded as a result of

the exchange program.