Kodak 2002 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

61

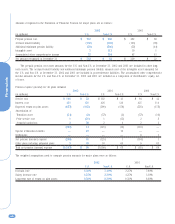

NOTE 13: INCOME TAXES

The components of earnings from continuing operations before

income taxes and the related provision for U.S. and other income

taxes were as follows:

(in millions) 2002 2001 2000

Earnings (loss) before

income taxes

U.S. $ 217 $ (266) $ 1,294

Outside the U.S. 729 381 838

Total $ 946 $ 115 $ 2,132

U.S. income taxes

Current provision (benefit) $56 $ (65) $ 145

Deferred (benefit) provision (31) (67) 225

Income taxes outside the U.S.

Current provision 101 177 268

Deferred provision (benefit) 22 (5) 37

State and other income taxes

Current provision 12 335

Deferred (benefit) provision (7) (9) 15

Total $ 153 $ 34 $ 725

The net losses from discontinued operations for 2002 and

2001 were $23 million and $5 million, respectively, which

included tax benefits of $15 million and $2 million, respectively.

There were no discontinued operations in 2000.

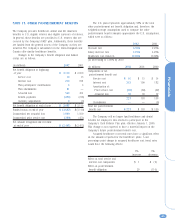

The differences between income taxes computed using the

U.S. federal income tax rate and the provision for income taxes

for continuing operations were as follows:

(in millions) 2002 2001 2000

Amount computed using the

statutory rate $ 331 $ 40 $ 746

Increase (reduction) in taxes

resulting from:

State and other income taxes,

net of federal 3(4) 33

Goodwill amortization —45 40

Export sales and manufacturing

credits (23) (19) (48)

Operations outside the U.S. (96) (10) (70)

Valuation allowance 56 (18) (9)

Business closures, restructuring

and land donation (99) ——

Tax settlement —(11) —

Other, net (19) 11 33

Provision for income taxes $ 153 $ 34 $ 725

During the second quarter of 2002, the Company recorded a tax

benefit of $45 million relating to the closure of its PictureVision

subsidiary. The decision to close the subsidiary was preceded by

unsuccessful attempts to sell the subsidiary. As a result of these

activities, the Company made the formal decision in the second quarter

of 2002 to close the subsidiary, as a determination was made that the

business was worthless for tax purposes. Accordingly, the Company

recorded a $45 million tax benefit in the second quarter of 2002 based

on the Company’s remaining tax basis in the PictureVision stock.

During the third quarter of 2002, the Company recorded a

tax benefit of $46 million relating to the consolidation of its

photofinishing operations in Japan and the loss realized from the

liquidation of a subsidiary as part of this consolidation. The

Company expects this loss to be utilized during the next five

years to reduce taxable income from operations in Japan.

During the fourth quarter of 2002, the Company recorded an

adjustment of $22 million to reduce its income tax provision due to

a decrease in the estimated effective tax rate for the full year. The

decrease in the effective tax rate was attributable to an increase in

earnings in lower tax rate jurisdictions relative to original

estimates. Additionally, in the fourth quarter of 2002, the Company

recorded a tax benefit of $8 million relating to a land donation.

During the third quarter of 2001, the Company reached a

favorable tax settlement, which resulted in a tax benefit of $11

million. In addition, during the fourth quarter of 2001 the

Company recorded an adjustment of $20 million to reduce its

income tax provision due to a decrease in the estimated effective

tax rate for the full year. The decrease in the effective tax rate

was primarily attributable to an increase in earnings in lower tax

rate jurisdictions relative to original estimates, and an increase in

creditable foreign tax credits as compared to estimates.

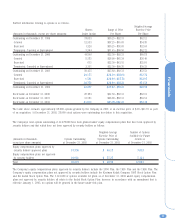

The significant components of deferred tax assets and

liabilities were as follows:

(in millions) 2002 2001

Deferred tax assets

Pension and postretirement obligations $ 988 $ 867

Restructuring programs 144 122

Foreign tax credit 99 34

Employee deferred compensation 187 120

Inventories 75 81

Tax loss carryforwards 16 56

Other 558 723

Total deferred tax assets 2,067 2,003

Deferred tax liabilities

Depreciation 700 551

Leasing 156 188

Other 341 596

Total deferred tax liabilities 1,197 1,335

Valuation allowance 72 56

Net deferred tax assets $ 798 $ 612