Kodak 2002 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

77

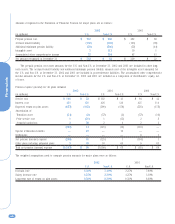

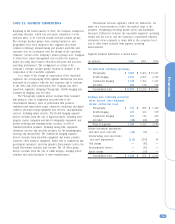

NOTE 23: QUARTERLY SALES AND

EARNINGS DATA - UNAUDITED

(in millions, except per share data)

4th 3rd 2nd 1st

Quarter Quarter Quarter Quarter

2002

Net sales from

continuing operations $ 3,441 $ 3,352 $ 3,336 $ 2,706

Gross profit from

continuing operations 1,206 1,290 1,254 860

Earnings from

continuing operations 130(3) 336(2) 286(1) 41

Loss from discontinued

operations(4) (17) (2) (2) (2)

Net earnings 113 334 284 39

Basic and diluted

net earnings per share(9)

Continuing operations .45 1.16 .98 .14

Discontinued operations (.06) (.01) (.01) (.01)

Total .39 1.15 .97 .13

2001

Net sales from

continuing operations $ 3,358 $ 3,305 $ 3,591 $ 2,975

Gross profit from

continuing operations 1,028 1,134 1,339 1,067

(Loss) earnings from

continuing operations (204)(8) 97(7) 38(5)(6) 150(5)

Loss from discontinued

operations(4) (2) (1) (2) —

Net earnings (206) 96 36 150

Basic and diluted

net earnings per share(9)

Continuing operations (.70) .33 .13 .52

Discontinued operations (.01) — (.01) —

Total (.71) .33 .12 .52

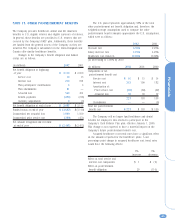

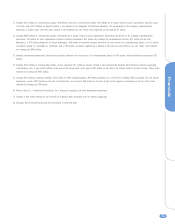

(1) Includes $13 million ($10 million included in SG&A and $3 million included in

other charges) for a charge related to asset impairments, which reduced net

earnings by $9 million; and a $45 million (included in provision for income

taxes) tax benefit related to the closure of the Company’s PictureVision

subsidiary.

(2) Includes $29 million (included in restructuring costs (credits) and other)

reversal of restructuring charges related to costs originally recorded as part

of the Company’s 2001 restructuring programs, which increased net earnings

by $18 million; $20 million (included in restructuring costs (credits) and

other) of restructuring costs, which reduced net earnings by $20 million; $21

million ($13 million included in SG&A and $8 million included in other

charges) for a charge related to asset impairments, which reduced net

earnings by $13 million; and a $46 million (included in provision for income

taxes) tax benefit related to the consolidation of its photofinishing operations

in Japan.

(3) Includes $123 million ($16 million included in cost of goods sold and $107

million included in restructuring costs (credits) and other) of restructuring

charges, which reduced net earnings by $78 million; $16 million ($9 million

included in SG&A and $7 million included in other charges) for a charge

related to asset impairments and other asset write-offs, which reduced net

earnings by $12 million; and a $30 million (included in provision for income

taxes) tax benefit related to changes in the corporate tax rate and asset

write-offs.

(4) Refer to Note 21, “Discontinued Operations” for a discussion regarding loss

from discontinued operations.

(5) Includes relocation charges (included in cost of goods sold) related to the sale

and exit of a manufacturing facility of $10 million and $8 million, which

reduced net earnings by $7 million and $5 million in the first and second

quarters, respectively. First quarter also includes amortization expense on

goodwill of $42 million, which reduced net earnings by $36 million.

(6) Includes $316 million ($57 million included in cost of goods sold and $259

million included in restructuring costs (credits) and other) of restructuring

costs, which reduced net earnings by $232 million; $77 million (included in

restructuring costs (credits) and other) for the Wolf bankruptcy charge, which

reduced net earnings by $52 million; and $37 million of amortization expense

on goodwill, which reduced net earnings by $31 million.

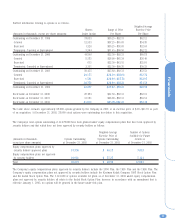

(7) Includes $53 million ($41 million included in cost of goods sold and $12

million included in restructuring costs (credits) and other) of restructuring

costs, which reduced net earnings by $41 million; $42 million ($23 million

included in restructuring costs (credits) and other and $19 million included in

cost of goods sold) for a charge related to asset impairments associated with

certain of the Company’s photofinishing operations, which reduced net

earnings by $26 million; $37 million of amortization expense on goodwill,

which reduced net earnings by $31 million; and an $11 million (included in

provision for income taxes) tax benefit related to favorable tax settlements

reached during the quarter.

(8) Includes $309 million ($21 million included in cost of goods sold and $288

million included in restructuring costs (credits) and other) of restructuring

costs, which reduced net earnings by $210 million; $15 million ($12 million

included in SG&A and $3 million included in other (charges) income for asset

impairments related to venture investments, which reduced net earnings by

$10 million; a $41 million (included in SG&A) charge for environmental

reserves, which reduced net earnings by $28 million; a $20 million (included

in SG&A) Kmart bankruptcy charge, which reduced net earnings by

$14 million; $37 million of amortization expense on goodwill, which reduced

net earnings by $31 million; and a $20 million (included in provision for

income taxes) tax benefit related to a decline in the year-over-year effective

tax rate.

(9) Each quarter is calculated as a discrete period and the sum of the four

quarters may not equal the full year amount.