Kodak 2002 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

12

impairments, higher losses related to minority interests and an

increase in foreign exchange losses. This activity was partially

offset by a gain recognized on the sale of assets in the current

year.

The Company’s effective tax rate from continuing operations

decreased from 30% for 2001 to 16% for 2002. The effective tax

rate from continuing operations of 16% for 2002 is less than the

U.S. statutory rate of 35% primarily due to the charges for the

focused cost reductions and asset impairments being deducted in

jurisdictions that have a higher tax rate than the U.S. federal

income tax rate, and also due to discrete period tax benefits of

approximately $99 million relating to the closure and

restructuring of certain of the Company’s business activities and

other one-time items, which were partially offset by the impact of

recording a valuation allowance to provide for certain tax benefits

that the Company would be required to forgo in order to fully

realize the benefits of its foreign tax credit carryforwards.

The effective tax rate from continuing operations of 30% for

2001 is less than the U.S. statutory rate of 35% primarily

because of a tax benefit from favorable tax settlements in the

third quarter of 2001, which was partially offset by the impact of

nondeductible goodwill amortization in 2001.

Excluding the items described above, the Company’s effective

tax rate from continuing operations decreased from 31% for 2001

to 27% for 2002. The lower effective tax from continuing

operations in the current year as compared with the prior year is

primarily attributable to the tax benefits from the elimination of

goodwill amortization in 2002 and further increases in earnings in

lower tax rate jurisdictions. The Company expects its effective tax

rate to be approximately 27% in 2003.

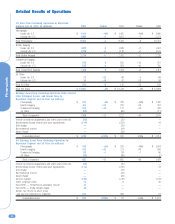

Net earnings from continuing operations for 2002 were $793

million, or $2.72 per basic and diluted share, as compared with

net earnings from continuing operations for 2001 of $81 million,

or $.28 per basic and diluted share, representing an increase of

$712 million, or 879%. The increase in net earnings from

continuing operations is primarily attributable to the reasons

outlined above.

Photography Net worldwide sales for the Photography segment

were $9,002 million for 2002 as compared with $9,403 million

for 2001, representing a decrease of $401 million, or 4% as

reported, with no net impact from exchange. Approximately 2.0

percentage points of the decrease were attributable to declines in

volume, driven primarily by volume decreases in consumer and

professional film and photofinishing, and approximately 2.0

percentage points of the decrease were attributable to declines in

price/mix, driven primarily by consumer film products.

Photography segment net sales in the U.S. were $4,034

million for the current year as compared with $4,482 million for

the prior year, representing a decrease of $448 million, or 10%.

Photography segment net sales outside the U.S. were $4,968

million for the current year as compared with $4,921 million for

the prior year, representing an increase of $47 million, or 1% as

reported, with no impact from exchange.

Net worldwide sales of consumer film products, including

35mm film, Advantix film and one-time-use cameras, decreased

6% in 2002 as compared with 2001, reflecting declines due to

lower volumes of 2%, negative price/mix of 3%, and 1% negative

impact of exchange. Sales of the Company’s consumer film

products within the U.S. decreased 12% in the current year as

compared with the prior year, reflecting declines due to lower

volumes of 7% and negative price/mix of 5%. The lower film

product sales are attributable to a declining industry demand

driven by a weak economy and the impact of digital substitution.

Sales of the Company’s consumer film products outside the U.S.

remained flat, with declines related to negative exchange of 1%

offsetting increases related to higher volumes of 1%.

The U.S. film industry volume decreased approximately 3%

in 2002 as compared with 2001 due to continuing economic

weakness and the impact of digital substitution. For the fifth

consecutive year, the Company has met its goal of maintaining

full year U.S. consumer film market share.

Net worldwide sales of consumer color paper decreased 3%

in 2002 as compared with 2001, reflecting declines due to

volume and exchange of 2% and 1%, respectively. Net sales of

consumer color paper in the U.S. decreased 7% in the current

year as compared with the prior year, reflecting declines from

lower volumes of 8%, partially offset by favorable price/mix of

1%. Net sales of consumer color paper outside the U.S.

decreased 1%, reflecting a 1% decline related to negative

price/mix and a 2% decline related to negative exchange, partially

offset by a 2% increase in volume.

Net worldwide photofinishing sales, including Qualex in the

U.S. and Consumer Imaging Services (CIS) outside the U.S.,

decreased 4% in 2002 as compared with 2001, 5% of which was

attributable to lower volumes, partially offset by 1% favorable

impact of exchange. In the U.S., Qualex’s processing volumes

(wholesale and on-site) decreased approximately 14% in 2002 as

compared with 2001, which is composed of decreases in

wholesale and on-site processing volumes of 13% and 16%,

respectively. These declines reflect the effects of a continued

weak film industry, the adverse impact of several hundred store

closures by a major U.S. retailer, and the impact of digital

substitution. During the current year, CIS revenues in Europe

benefited from the acquisition of (1) Spector Photo Group’s

wholesale photofinishing and distribution operations in France,

Germany, and Austria, (2) ColourCare Limited’s wholesale

processing and printing operations in the United Kingdom and (3)

Percolor photofinishing operations in Spain. These benefits were

partially offset by weak industry trends for photofinishing in the

second half of the year.

The average penetration rate for the number of rolls scanned

at Qualex’s wholesale labs averaged 7.5% for 2002, reflecting an

increase from the 5.3% rate in 2001. The growth was driven by

continued consumer acceptance of Picture CD and Retail.com, the