Kodak 2002 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy Statement

110

ROLE OF THE COMMITTEE

The Executive Compensation and Development Committee, as of December 31, 2002, was made up of four independent members of the

Board of Directors. The Committee members are neither employees nor former employees of the Company. The principal functions of

the Committee include:

• periodically reviewing and approving the Company’s executive compensation strategy and principles to ensure that they are

aligned with the Company’s business strategy and objectives, shareholder interests, desired behaviors and corporate culture;

• periodically reviewing the Company’s executive compensation plans to ensure that they are consistent with the Company’s

executive compensation strategy and principles;

• reviewing and approving the adoption of, and changes to, the Company’s executive compensation and its equity-based

compensation plans;

• overseeing the administration of the Company’s executive compensation plans;

• annually reviewing and approving the goals and objectives relevant to the compensation of the CEO, evaluating the CEO’s

performance in light of these goals and objectives, and setting the CEO’s individual elements of total compensation based on

this evaluation;

• overseeing the compensation of the Company’s executive officers;

• reviewing the process and plans for the assessment and selection of candidates for the positions of CEO and President; and

• periodically reviewing the Company’s executive staffing plan for meeting present and future leadership needs.

To help it perform its functions, the Committee makes use of Company resources and periodically uses the services of outside

compensation consultants. In the past, the Company alone has retained the services of such consultants. In order to play a more

significant role in the selection and engagement of these consultants, the Committee recently revised its policy concerning the use of

outside compensation consultants. As a result of this change, the Committee will retain the services of outside consultants to assist in

the fulfilling of its responsibilities.

EXECUTIVE COMPENSATION PHILOSOPHY

The goal of the Company’s executive compensation program is to attract, retain and motivate world-class executive talent to achieve the

Company’s short- and long-term business goals. Towards this end, the Company’s executive compensation strategy leverages all elements of

market competitive total compensation to drive profitable growth and superior long-term shareholder value consistent with the Company’s

values. Plan design and performance-based differentiation are designed to drive extraordinary rewards for outstanding performance.

Consistent with this strategy, the following principles provide a framework for the Company’s executive compensation program:

• total target compensation for executives should be market competitive. Market competitive is defined as the 50th percentile with

differences where warranted;

• the mix of total compensation elements will reflect competitive market requirements and strategic business needs;

• a significant portion of each executive’s compensation should be at risk, the degree of which will positively correlate to the level

of the executive’s responsibility;

• compensation is linked to both qualitative and behavioral expectations, and key operational and strategic metrics;

• interests of executives are linked with the Company’s owners through stock ownership; and

• executive compensation will be differentiated on the following bases:

• base salaries – on relative responsibility,

• short-term variable elements – on performance, and

• long-term variable elements – on performance and potential.

EXECUTIVE COMPENSATION PRACTICES

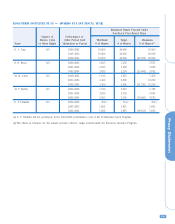

Each year, the Company participates in surveys conducted by external consultants. The companies included in these surveys are those

the Company competes with for executive talent. Most, but not all, of these companies are included in the Dow Jones Industrial Index

shown in the Performance Graph on page 115. Starting in 2002, the Company also began measuring the competitiveness of its executive

compensation program against a comparison group of approximately 15 other leading companies, referred to in this Report as the “Peer

Group.” The following criteria was used to select the Peer Group: market capitalization, revenue, consumer/commercial/hi-tech mix, mix

of high growth and steady growth companies, similar industry and data availability. The data received from the Peer Group is size

adjusted so proper comparisons may be drawn. Based on the survey data and Peer Group results and consistent with the Company’s

executive compensation principles, the target compensation of the Company’s senior executives is set at market competitive levels.

Report of the Executive Compensation and Development Committee