Kodak 2002 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy Statement

106

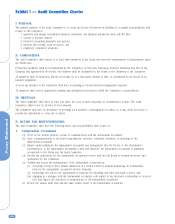

The Audit Committee is composed solely of independent directors and operates under a written charter adopted by the Committee

and the Board, and most recently amended in May, 2002. A copy of the Committee’s charter is attached to this Proxy Statement as

Exhibit I. The members of the Audit Committee, as of December 31, 2002, were Dr. Hector de J. Ruiz (Chairman), Martha Layne

Collins, Timothy M. Donahue and Richard S. Braddock.

Committee Responsibilities

The Committee performs a number of key functions, including:

• Overseeing and evaluating the Company’s financial reporting process, including evaluating the adequacy of its system of

disclosure controls and procedures and internal controls, and the acceptability and appropriateness of the financial accounting

and disclosure principles it employs;

• Selecting and retaining the Company’s independent accountants, subject to approval of the Board and ratification by the shareholders;

• Approving the budget for fees to be paid to the independent accountants for audit services and for appropriate non-audit services;

• Overseeing the relationship between the Company and the independent accountants and acting as the Board’s primary avenue of

communication with them;

• Serving as the Board’s primary avenue of communication with the Company’s internal auditors, with the express purpose of

ensuring, through a variety of means, that they are adequately staffed and funded and free from any potentially improper influences;

• Approving the audit plans of the Company’s internal auditors and independent accountants;

• Overseeing and reviewing the preparation and disclosure of the Company’s consolidated financial statements and the preparation

and filing of the Company’s periodic financial reports, including their certification by the Company’s Chief Executive Officer and

Chief Financial Officer, as required;

• Discussing with the independent accountants matters required to be discussed by Statement on Auditing Standards No. 61

“Communications with Audit Committee;”

• Monitoring significant risks and exposures to the Company;

• Monitoring legal and other liabilities to which the Company is exposed;

• Overseeing the Company’s ethics and compliance programs; and

• Other matters as set forth in the Committee’s charter.

The Committee’s Response to Corporate Reform Initiatives

The year 2002 brought a wave of new legislation and regulations in the area of corporate governance and financial reporting as the

U.S. government took unprecedented measures to set new standards for corporate behavior and to restore investor confidence. The

Company has a long history of corporate responsibility and good citizenship, and has taken appropriate measures to respond to the

new standards. The Audit Committee took a lead role in overseeing the efforts of the Company’s Controller’s Group, Internal Audit

Department, Legal Department, and independent accountants in ensuring the Company’s compliance with these reforms.

In particular, the Audit Committee was instrumental in monitoring the Company’s compliance with an SEC order of June 27, 2002,

which required the CEOs and CFOs of nearly 1000 large publicly traded companies to attest to the accuracy of their companies’ most

recent Annual Reports on Form 10-K and other subsequent “covered reports.” The Company’s Chief Executive Officer and Chief

Financial Officer have signed all certifications required by Sections 302 and 906 of the Sarbanes-Oxley Act in connection with the

Company’s reports on Form 10-Q and Form 10-K.

The Company has created a Corporate Disclosure Committee that is responsible for ensuring that all events potentially subject to

disclosure are identified, and for reviewing those events and recommending to senior management whether they should be disclosed.

This Committee leverages the efforts of the Controller’s Group with respect to the Company’s certification roll-up process undertaken at

the end of each financial reporting period.

The Company has also established a Steering Committee composed of representatives of the Internal Audit Department, the Controller’s

Group, and the Legal Department, led by an experienced financial manager, to coordinate the Company’s compliance with all relevant

laws and regulations in this area, including the Sarbanes-Oxley Act, SEC Regulations and the New York Stock Exchange Listing

Standards. This group and the operational teams working under it will be very active in the months ahead, ensuring the Company’s

continued compliance as revised listing standards are issued and as new SEC regulations become effective.

Report of the Audit Committee