Kodak 2002 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Proxy Statement

111

In the summer of 2002, the Committee conducted an in depth analysis of the compensation it pays to its executive officers. With the

assistance of the Company and an independent compensation consultant, the market competitiveness of each of the three components

of executive compensation paid to its executive officers, i.e., base salary, target short-term variable pay and long-term incentives, was

evaluated. The results of this study reveal that the base salary and target short-term variable pay paid to the Company’s executive

officers is market competitive. With regard to the long-term incentive compensation paid to the Company’s executive officers, the study

found that this component was also market competitive due in significant part to the adoption of the Executive Incentive Program

described later in this Report and awards of restricted stock to selected executive officers.

COMPONENTS OF EXECUTIVE COMPENSATION PROGRAM

The three components of the Company’s executive compensation program are:

• base salary,

• short-term variable pay, and

• long-term incentives.

Base Salary

Base salary is the only fixed portion of an executive’s compensation. Each executive’s base salary is reviewed annually based on the

executive’s relative responsibility.

Short-Term Variable Pay

Effective January 1, 2002, Kodak implemented EXCEL (Executive Compensation for Excellence and Leadership), a new executive

assessment and short-term variable pay plan for its executives. Three key principles underlie EXCEL: alignment, simplicity and

discretion. Alignment to Company objectives is achieved through the two performance metrics used to fund the plan: revenue growth

and economic profit. The inclusion of revenue growth as a performance metric emphasizes the Company’s need for sustained profitable

growth. The use of economic profit stresses the continuing need for earnings growth and balance sheet management. Simplicity is

accomplished through ease of plan administration. Under EXCEL, each participant has 3-4 key performance goals. Discretion, the third

key principle, may be used to adjust the size of the plan’s funding pool, modify the funding pool’s allocation to the Company’s units, and

determine the performance and rewards of the plan’s participants.

Participants in EXCEL are assigned target awards for the year based on a percentage of their base salaries as of the end of that year.

This percentage is determined by the participant’s wage grade. For 2002, target awards ranged from 25% of base salary, to 155% of

base salary for the CEO.

Each year the Compensation Committee establishes a performance matrix for the year based on the plan’s two performance metrics of

revenue growth and economic profit. This matrix determines the percentage of the plan’s target corporate funding pool that will be

earned for the year based on the Company’s actual performance against these two metrics. The target corporate funding pool is the

aggregate of all participants’ target awards for the year. Under the performance matrix, the corporate funding pool will fund at 100%

if target performance for each performance metric is met.

The Compensation Committee may use its discretion to adjust (upward or downward) the amount of the corporate funding pool for any

year. Examples of situations where the Compensation Committee may choose to exercise this discretion include unanticipated economic

or market changes, extreme currency exchange effects, management of significant workforce issues, significant changes in investable

cash flow, inventory turns, receivables, or capital expenditures, or dramatic shifts in customer satisfaction.

The CEO allocates the corporate funding pool among the Company’s units. Each business unit has its own targets for revenue growth

and economic profit for the year. Actual performance against these targets accounts for 75% of the business unit’s allocation. The

remaining 25% is determined based on overall Company performance for the year measured against the Company’s revenue growth

and economic profit targets.

Within each staff, regional, functional, and business unit, local senior management allocates the unit’s funds to its participants based

on each participant’s individual performance.

In 2002, Kodak substantially beat its performance target for economic profit. In terms of revenue, Kodak exceeded its threshold

performance goal and came close to achieving its performance target in 2002. As a result of these strong results, EXCEL’s corporate

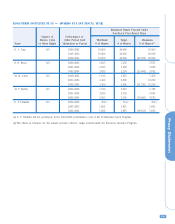

funding pool funded at a level sufficient to pay out at a 143% of target level under the performance matrix established for the year.