Kodak 2002 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

51

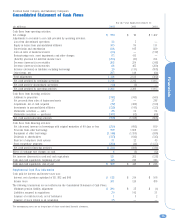

NOTE 5: GOODWILL AND OTHER

INTANGIBLE ASSETS

Effective January 1, 2002, the Company adopted the provisions of

SFAS No. 142, “Goodwill and Other Intangible Assets,” under

which goodwill is no longer amortized, but is required to be

assessed for impairment at least annually. Goodwill, net was

$981 million and $948 million at December 31, 2002 and 2001,

respectively. Accumulated amortization amounted to $920 million

at December 31, 2001. The changes in the carrying amount of

goodwill by reportable segment for 2002 and 2001 were as

follows:

Photo- Health Commercial Consolidated

(in millions) graphy Imaging Imaging Total

Balance at

December 31, 2000 $ 719 $ 197 $ 31 $ 947

Goodwill related to

acquisitions 105 — 94 199

Goodwill impairment (43) — — (43)

Amortization of goodwill (110) (28) (15) (153)

Finalization of purchase

accounting 2 1 1 4

Currency translation

adjustments (4) (1) (1) (6)

Balance at

December 31, 2001 669 169 110 948

Goodwill related to

acquisitions 19 1 6 26

Goodwill written off

related to disposals — — (17) (17)

Finalization of purchase

accounting (1) 4 3 6

Currency translation

adjustments 15 2 1 18

Balance at

December 31, 2002 $ 702 $ 176 $ 103 $ 981

The aggregate amount of goodwill acquired during 2001 of

$199 million was attributable to $40 million for the purchase of

Ofoto, Inc. within the Photography segment, $77 million relating

to the purchase of Bell & Howell Company within the Commercial

Imaging segment and $82 million related to additional acquisitions

within the Photography and Commerical Imaging segments that

are all individually immaterial. The goodwill impairment charge of

$43 million related to the Company's PictureVision subsidiary

within the Photography segment, which was determined to be

impaired as a result of the Company's acquisition of Ofoto.

The aggregate amount of goodwill acquired during 2002 of

$26 million was attributable to acquisitions that are all

individually immaterial. The goodwill written off related to

disposals during 2002 of $17 million was attributable to the

disposal of Kodak Global Imaging, Inc. within the Commercial

Imaging segment. The $17 million charge to earnings relating to

the write-off of this goodwill is included in the loss from

discontinued operations, net of income taxes of $23 million in the

Consolidated Statement of Earnings. See Note 21, “Discontinued

Operations.”

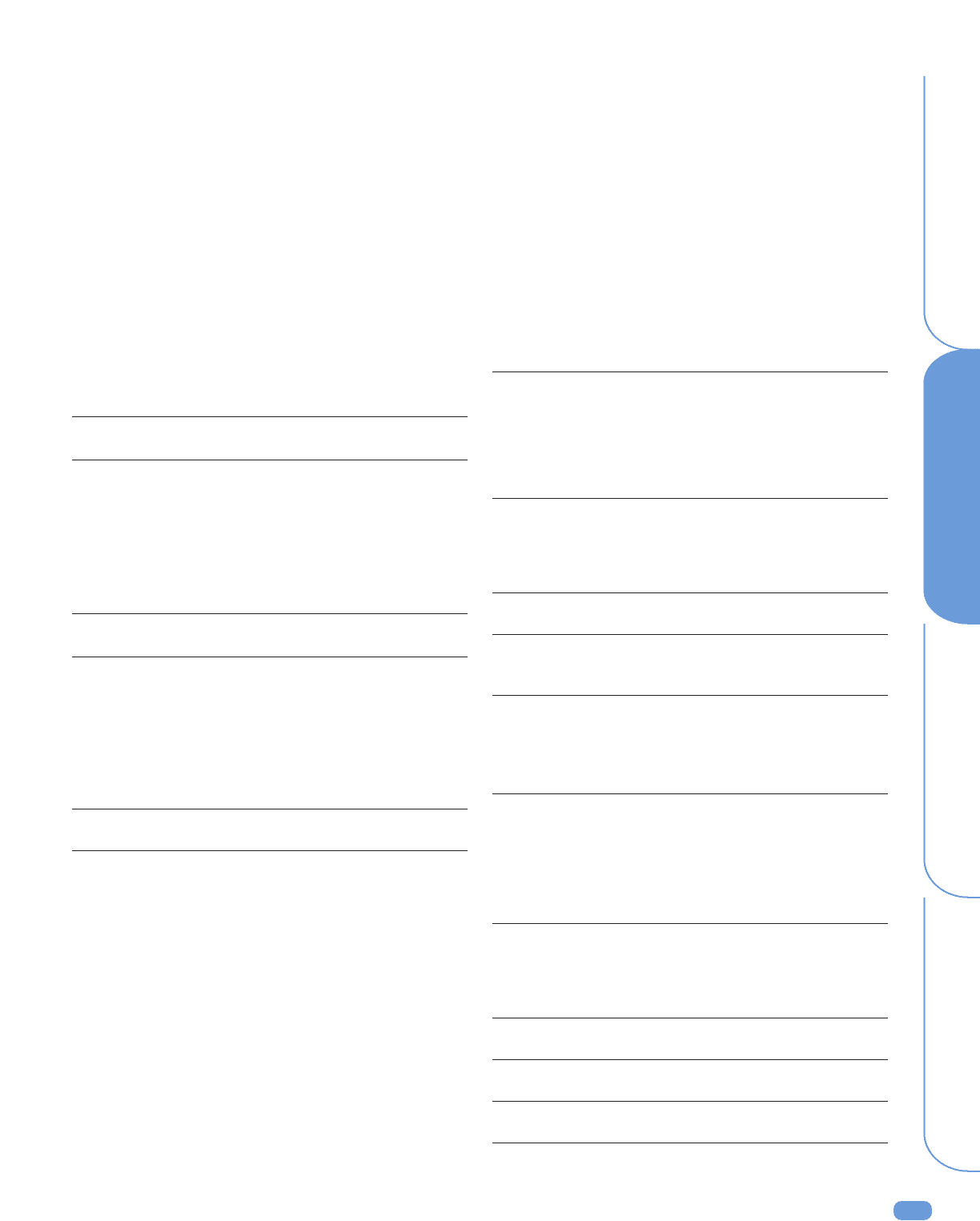

Earnings and earnings per share from continuing operations

for the years ended December 31, 2001 and 2000, as adjusted

for the exclusion of goodwill amortization expense, were as

follows (in millions, except per share amounts):

Impact of

Year Ended Exclusion of

December 31, 2001 Goodwill

As Reported As Adjusted Amort. Exp.

Earnings from continuing

operations before income

taxes (as originally

reported) $ 115 $ 115 $ —

Adjustment for the

exclusion of goodwill

amortization — 153 153

Earnings from continuing

operations before income

taxes 115 268 153

Provision for income

taxes 34 58 24

Earnings from continuing

operations $ 81 $ 210 $ 129

Basic and diluted

earnings per share from

continuing operations $ .28 $ .72 $ .44

Impact of

Year Ended Exclusion of

December 31, 2000 Goodwill

As Reported As Adjusted Amort. Exp.

Earnings from continuing

operations before income

taxes (as originally

reported) $ 2,132 $ 2,132 $ —

Adjustment for the

exclusion of goodwill

amortization — 151 151

Earnings from continuing

operations before income

taxes 2,132 2,283 151

Provision for income

taxes 725 744 19

Earnings from continuing

operations $ 1,407 $ 1,539 $ 132

Basic earnings per share

from continuing operations $ 4.62 $ 5.05 $ .43

Diluted earnings per share

from continuing operations $ 4.59 $ 5.02 $ .43