Kodak 2002 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials

13

retail industry’s leading e-commerce platform for business-to-

business collaboration. In addition, the number of images scanned

in the current year increased 19% as compared with the prior

year.

Net sales from the Company’s consumer digital products and

services, which include picture maker kiosks/media and consumer

digital services revenue from Picture CD, “You’ve Got Pictures”,

and Retail.com, remained flat in 2002 as compared with 2001.

The Company has broadly enabled the retail industry in the U.S.

with its picture maker kiosks and is focused on bringing to

market new kiosk offerings, creating new kiosk channels,

expanding internationally and continuing to increase the media

burn per kiosk. Net worldwide sales of thermal media used in

picture maker kiosks increased 11% in the current year as

compared with the prior year.

Net worldwide sales of consumer digital cameras increased

10% in 2002 as compared with 2001 due to strong consumer

acceptance of the EasyShare digital camera system, despite

sensor component shortages earlier in the year. As a result,

consumer digital camera market share increased modestly in

2002 compared with 2001.

Net worldwide sales of inkjet photo paper increased 43% in

2002 as compared with 2001, primarily due to higher volumes.

The double-digit revenue growth and the maintenance of market

share are primarily attributable to strong underlying market

growth, introduction of new products, continued promotional

activity at key accounts and success in broadening channel

distribution.

Net worldwide sales of professional sensitized products,

including color negative, color reversal and commercial black and

white films and sensitized paper, decreased 13% in 2002 as

compared with 2001, reflecting primarily a decline in volume,

with no impact from exchange. Overall sales declines were

primarily the result of ongoing digital substitution and continued

economic weakness in markets worldwide.

Net worldwide sales of origination and print film to the

entertainment industry remained flat in 2002 as compared with

2001, with a 1% favorable impact from exchange offset by a 1%

decline attributable to lower volumes. The decrease in volumes of

net worldwide film sales was primarily attributable to economic

factors impacting origination film for commercials and

independent feature films, partially offset by an increase in print

film volumes.

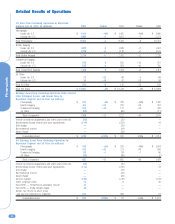

Gross profit for the Photography segment was $3,219 million

for 2002 as compared with $3,402 million for 2001, representing

a decrease of $183 million or 5%. The gross profit margin was

35.8% in the current year as compared with 36.2% in the prior

year. The 0.4 percentage point decrease was primarily

attributable to decreases in price/mix that impacted gross profit

margins by approximately 3.0 percentage points, partially offset

by an increase in productivity/cost improvements that impacted

gross margins by approximately 2.6 percentage points.

SG&A expenses for the Photography segment were $1,935

million for 2002 as compared with $1,963 million for 2001,

representing a decrease of $28 million or 1%. The net decrease

in SG&A spending is primarily attributable to the cost reduction

activities and expense management, partially offset by increases

in SG&A expense related to CIS photofinishing acquisitions in

Europe. As a percentage of sales, SG&A expense increased from

20.9% in the prior year to 21.5% in the current year.

R&D costs for the Photography segment decreased $29

million or 5% from $542 million in 2001 to $513 million in 2002.

As a percentage of sales, R&D costs decreased slightly from 5.8%

in the prior year to 5.7% in the current year.

Earnings from continuing operations before interest, other

(charges) income, and income taxes for the Photography segment

decreased $16 million, or 2%, from $787 million in 2001 to $771

million in 2002, reflecting the combined effects of lower sales and

a lower gross profit margin, partially offset by SG&A and R&D

cost reductions and the elimination of goodwill amortization in

2002, which was $110 million in 2001.

Health Imaging Net worldwide sales for the Health Imaging

segment were $2,274 million for 2002 as compared with $2,262

million for 2001, representing an increase of $12 million, or 1%

as reported, or an increase of 2% excluding the negative net

impact of exchange. The increase in sales was attributable to an

increase in price/mix and volume of approximately 0.4 and 1.1

percentage points, respectively, primarily due to laser imaging

systems and equipment services, partially offset by a decrease

from negative exchange of approximately 0.8 percentage point.

Net sales in the U.S. decreased slightly from $1,089 million

for the prior year to $1,088 million for the current year. Net

sales outside the U.S. were $1,186 million for 2002 as compared

with $1,173 million for 2001, representing an increase of $13

million, or 1% as reported, or an increase of 2% excluding the

negative impact of exchange.

Net worldwide sales of digital products, which include laser

printers (DryView imagers and wet laser printers), digital media

(DryView and wet laser media), digital capture equipment

(computed radiography capture equipment and digital radiography

equipment), services and Picture Archiving and Communications

Systems (PACS), increased 5% in 2002 as compared with 2001.

The increase in digital product sales was primarily attributable to

higher digital media, service, digital capture and PACS volumes as

the market for these products continues to grow.

Net worldwide sales of traditional products, including analog

film, equipment, chemistry and services, decreased 4% in 2002

as compared with 2001. The decrease in sales was primarily

attributable to a net decline in sales of analog film products. This

net decrease was partly mitigated by an increase in sales of

Mammography and Oncology (M&O) analog film products. Analog

film products (excluding M&O) decreased 8% in 2002 as

compared with 2001, reflecting declines due to volume, exchange

and price/mix of approximately 5%, 2% and 1%, respectively.