Kodak 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

Table of Contents

Table of Contents

CHAIRMAN’S LETTER

To Our Shareholders 2

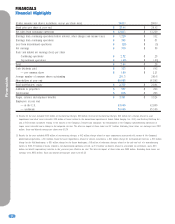

FINANCIALS

Financial Highlights 6

Management’s Discussion and Analysis 7

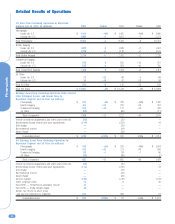

Detailed Results of Operations 10

Management's Responsibility 39

Report of Independent Accountants 39

Consolidated Statement of Earnings 40

Consolidated Statement of Financial Position 41

Consolidated Statement of Shareholders’ Equity 42

Consolidated Statement of Cash Flows 43

Notes to Financial Statements 44

Summary of Operating Data 78

PROXY STATEMENT

Letter to Shareholders 80

Notice of the 2003 Annual Meeting of Shareholders 80

Questions and Answers 81

Householding of Disclosure Documents 84

Audio Webcast of Annual Meeting 84

Proposals to be Voted On 85

Item 1 – Election of Directors 85

Item 2 – Ratification of Election of Independent

Accountants 85

Item 3 – Shareholder Proposal – Indexed Options 85

Item 4 – Shareholder Proposal – Option Expensing 86

Item 5 – Shareholder Proposal – Chemicals Policy 88

Board of Directors 89

Board Committees 90

Meeting Attendance 93

Director Compensation 93

Beneficial Security Ownership Table 94

Transactions with Management 95

PROXY STATEMENT (continued)

Compensation of Named Executive Officers 96

Summary Compensation Table 96

Option/SAR Grants Table 98

Option/SAR Exercises and Year-End Values Table 98

Repricing Table 99

Long-Term Incentive Plan 100

Employment Contracts and Arrangements 102

Change in Control Arrangements 103

Retirement Plan 104

Report of the Audit Committee 106

Report of the Corporate Responsibility and

Governance Committee 108

Report of the Executive Compensation and

Development Committee 110

Section 16(a) Beneficial Ownership Reporting Compliance 114

Performance Graph – Shareholder Return 115

Exhibit I – Audit Committee Charter 116

2003 Annual Meeting Map, Directions and Parking

Information 119

CORPORATE INFORMATION

2002 Kodak Health, Safety and Environment 120

2002 Global Diversity 121

Corporate Directory 123

Shareholder Information 124

Table of contents

-

Page 1

...43 44 78 Option/SAR Exercises and Year-End Values Table Repricing Table Long-Term Incentive Plan Employment Contracts and Arrangements Change in Control Arrangements Retirement Plan Report of the Audit Committee Report of the Corporate Responsibility and Governance Committee Report of the Executive... -

Page 2

...time-use cameras continued to grow as a major source of film revenues. We are leveraging our technical leadership in film and digital imaging technology to create imaging systems for consumer, health care, professional and commercial imaging markets. • Driving image output in all forms. As digital... -

Page 3

...at double-digit rates in the fourth quarter, and we are closer than ever to profitability for this product line. The system makes it easy to capture and produce hard-copy digital images, whether with home printing or through online and retail services. Online photo fulfillment business grew as Kodak... -

Page 4

... quarters, year-toyear HI sales were up slightly. Digital products and services - including digital printers, media, capture systems and picture archiving and communications systems (PACS) - achieved good gains. Sales of traditional x-ray films were lower due to pricing pressures and lower volumes... -

Page 5

...-digit growth for thermal print media in 2002. Commercial Imaging Group Organizational realignment around strategic product groups during 2002 helped this business, which serves commercial and government customers, achieve operational efficiencies and identify profitable business opportunities... -

Page 6

... Discontinued operations Total Cash dividends paid - per common share Average number of common shares outstanding Shareholders at year end Total shareholders' equity Additions to properties Depreciation Wages, salaries and employee benefits Employees at year end - in the U.S. - worldwide 2002(1) 35... -

Page 7

...contracts, the Company will account for these full service solutions under the percentage of completion methodology. The Company records reductions to revenue for customer incentive programs offered including cash and volume discounts, price protection, promotional, cooperative and other advertising... -

Page 8

... future operating results of the asset group, discount rate and long-term growth rate. To assess goodwill for impairment, the Company performs an assessment of the carrying value of its reporting units on an annual basis or when events and changes in circumstances occur that would more likely... -

Page 9

... long-term rate of return on plan asset (EROA) assumption annually for the Kodak Retirement Income Plan (KRIP). To facilitate this evaluation, every two to three years, or when market conditions change materially, the Company undertakes a new asset liability study to reaffirm the current asset... -

Page 10

...) Photography Health Imaging Commercial Imaging All Other Total of segments Venture investment impairments and other asset write-offs Restructuring (costs) credits and asset impairments Wolf charge Environmental reserve Kmart charge Interest expense Other corporate items Tax benefit - PictureVision... -

Page 11

... traditional film and U.S. photofinishing services. Declines in price/mix reduced sales for 2002 by approximately 1.5 percentage points, driven primarily by traditional consumer film products and health film and laser imaging systems. Net sales in the U.S. were $5,993 million for the current year as... -

Page 12

... for the current year as compared with $4,921 million for the prior year, representing an increase of $47 million, or 1% as reported, with no impact from exchange. Net worldwide sales of consumer film products, including 35mm film, Advantix film and one-time-use cameras, decreased 6% in 2002 as... -

Page 13

... photo paper increased 43% in 2002 as compared with 2001, primarily due to higher volumes. The double-digit revenue growth and the maintenance of market share are primarily attributable to strong underlying market growth, introduction of new products, continued promotional activity at key accounts... -

Page 14

... productivity led by DryView digital media, analog medical film, laser imaging equipment, and PACS, which were complemented by lower service costs and improved supply chain management. The positive effects of productivity/cost on gross profit margins were partially offset by a decrease in price/mix... -

Page 15

... owned subsidiary, which was reported in the commercial and government products and services business in the Commercial Imaging segment. Due to a combination of factors, including the collapse of the telecommunications market, limitations on flying imposed by the events of September 11th, delays... -

Page 16

...both volume and exchange, and a 1% decline in price/mix. The composition of consumer film products in 2001 as compared with 2000 reflects a 2% decrease in volumes for Advantix film, a 7% increase in volume of one-time-use cameras and a 4% decline in volume of traditional film product lines. Sales of... -

Page 17

... the Company's increased promotional activity at key retail accounts, improved merchandising and broader channel distribution of the entire line of inkjet paper within the product group. Net worldwide sales of professional thermal paper remained flat, reflecting an 8% increase in volume offset by... -

Page 18

... full year, as well as sales of newer Computed Radiography products, which were launched in early 2001. The increase in revenues was partially offset by declines attributable to price and exchange. Laser imaging equipment, services and film also contributed to the increase in digital sales, as sales... -

Page 19

... of exchange. Net worldwide sales of document imaging equipment, products and services increased 8% in 2001 as compared with 2000. The increase in sales was primarily attributable to an increase in service revenue due to the acquisition of the Bell and Howell Imaging business in the first quarter of... -

Page 20

... in revenues due to the divestment of the Eastman Software business in 2000. These decreases were partially offset by a 10% increase in the sale of sensors. In December 2001, the Company and SANYO announced the formation of a business venture, SK Display Corporation, to manufacture and sell active... -

Page 21

... effectively in order to provide competitive products to the global market. Specifically, the operations in Rochester, New York that assemble one-time-use cameras and the operations in Mexico that perform sensitizing for graphic arts and x-ray films, will be relocated to other Kodak locations. In... -

Page 22

...of the third quarter of 2003. Most exit costs are expected to be paid during 2003. However, certain costs, such as long-term lease payments, will be paid over periods after 2003. These restructuring actions as they relate to the Photography, Health Imaging and Commercial Imaging segments amounted to... -

Page 23

...for use model of SFAS No. 121, was reported in cost of goods sold in the accompanying Consolidated Statement of Earnings. The severance and exit costs require the outlay of cash, while the inventory write-downs and long-lived asset impairments represented non-cash items. The severance charge related... -

Page 24

... for use model of SFAS No. 121, was reported in cost of goods sold in the accompanying Consolidated Statement of Earnings. The severance and exit costs require the outlay of cash, while the inventory write-downs and long-lived asset impairments represent non-cash items. The severance charge related... -

Page 25

... in the third quarter of 2002, the Company reversed $3 million of exit costs as a result of negotiating lower contract termination payments in connection with business or product line exits. These restructuring actions as they relate to the Photography, Health Imaging and Commercial Imaging segments... -

Page 26

...Company. This dividend was paid on July 16, 2002 to shareholders of record at the close of business on June 3, 2002. On October 10, 2002, the Company's Board of Director's declared a semi-annual cash dividend of $.90 per share on the outstanding common stock of the Company. This dividend was paid to... -

Page 27

... affect access to commercial paper borrowing. While this is not expected to occur, if such an event did take place the Company could use alternative sources of borrowing including its accounts receivable securitization program, long-term capital markets debt, and its revolving credit facilities. The... -

Page 28

... of December 31, 2002, the Company has not been required to guarantee any of the SK Display Corporation's outstanding debt. In certain instances when Kodak sells businesses either through asset or stock sales, the Company may retain certain liabilities for known exposures and provide indemnification... -

Page 29

... in Express Stop Financing (ESF), which is a joint venture partnership between Qualex and Dana Credit Corporation (DCC), a wholly owned subsidiary of Dana Corporation. Qualex accounts for its investment in ESF under the equity method of accounting. ESF provides a long-term financing solution to... -

Page 30

...plans to utilize the services of Eastman Kodak Credit Corporation, a wholly owned subsidiary of General Electric Capital Corporation, as an alternative financing solution for prospective leasing activity with its customers. At December 31, 2002, the Company had outstanding letters of credit totaling... -

Page 31

...year, particularly for consumer films, paper and digital cameras; and decreases in liabilities, excluding borrowings, of $808 million related primarily to severance payments for restructuring programs and reductions in accounts payable and accrued benefit costs. Net cash used in investing activities... -

Page 32

... responsible party (PRP) in connection with the nonimaging health businesses in five active Superfund sites. At December 31, 2002, estimated future remediation costs of $49 million are accrued on an undiscounted basis and are included in the $148 million reported in other long-term liabilities... -

Page 33

... operations. In June 2002, the FASB issued SFAS No. 146, "Accounting for Costs Associated with Exit or Disposal Activities." SFAS No. 146 addresses the financial accounting and reporting for costs associated with exit or disposal activities and supercedes the Emerging Issues Task Force (EITF) Issue... -

Page 34

...the market opportunities that could result from the use of this property. Kodak's failure to manage the costs associated with the pursuit of these licenses could adversely affect the profitability of these operations. In the event Kodak were unable to develop and implement e-commerce strategies that... -

Page 35

... the transition to digital products and services could also place pressures on Kodak's sales and market share. In the event Kodak was unable to successfully manage these issues in a timely manner, they could adversely impact the planned inventory reductions. Delays in Kodak's planned improvement in... -

Page 36

... and market share domestically. Continued economic weakness could also adversely impact Kodak's revenues and growth rate. Failure to successfully manage the consumers' return to branded products if and when the economic conditions improve could adversely impact Kodak's revenue and growth rate. If... -

Page 37

... sales. Silver forward contracts are used to mitigate the Company's risk to fluctuating silver prices. The Company's exposure to changes in interest rates results from its investing and borrowing activities used to meet its liquidity needs. Longterm debt is generally used to finance long-term... -

Page 38

... higher at December 31, 2002, the fair value of short-term and long-term borrowings would have decreased $1 million and $15 million, respectively. Using a sensitivity analysis based on estimated fair value of short-term and long-term borrowings, if available market interest rates had been 10% (about... -

Page 39

... the United States of America. Their resulting report follows. The Board of Directors exercises its responsibility for these financial statements through its Audit Committee, which consists entirely of non-management Board members. The independent accountants and internal auditors have full and free... -

Page 40

... Total Number of common shares used in basic earnings per share Incremental shares from assumed conversion of options Number of common shares used in diluted earnings per share Cash dividends per share The accompanying notes are an integral part of these consolidated financial statements. 2002... -

Page 41

...taxes Total current liabilities Long-term debt, net of current portion Postretirement liabilities Other long-term liabilities Total liabilities Commitments and Contingencies (Note 10) Shareholders' Equity Common stock, $2.50 par value; 950,000,000 shares authorized; 391,292,760 shares issued in 2002... -

Page 42

...Comprehensive income Cash dividends declared ($1.80 per common share) Treasury stock repurchased (7,354,316 shares) Treasury stock issued under employee plans (2,357,794 shares) Tax reductions - employee plans Shareholders' Equity December 31, 2002 - - - - $ 978 *There are 100 million shares of $10... -

Page 43

... to shareholders Exercise of employee stock options Stock repurchase programs Net cash used in financing activities Effect of exchange rate changes on cash Net increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year $ 770... -

Page 44

... to Financial Statements NOTE 1: SIGNIFICANT ACCOUNTING POLICIES Company Operations Eastman Kodak Company (the Company or Kodak) is engaged primarily in developing, manufacturing, and marketing traditional and digital imaging products, services and solutions to consumers, the entertainment industry... -

Page 45

... estimated returns. At the time revenue is recognized, the Company also records reductions to revenue for customer incentive programs offered including cash and volume discounts, price protection, promotional, cooperative and other advertising allowances, slotting fees and coupons. For product sales... -

Page 46

...sales as sufficient history does not currently exist to allow the Company to accurately estimate total costs to complete these transactions. Revenue from other long-term contracts, primarily government contracts, is generally recognized using the percentage-ofcompletion method. The Company may offer... -

Page 47

... market prices in active markets or, if quoted market prices are unavailable, through the performance of internal analysis of discounted cash flows or external appraisals. In connection with its assessment of recoverability of its long-lived assets and its ongoing strategic review of the business... -

Page 48

... exchange program. See Note 19, "Stock Option and Compensation Plans." Segment Reporting The Company reports net sales, operating income, net income, certain expense, asset and geographical information about its operating segments. Public companies report information about their business activities... -

Page 49

...free products or services as well as arrangements labeled as slotting fees, cooperative advertising and buydowns. The adoption of EITF Issue No. 01-09 did not have a material impact on the Company's Consolidated Statement of Earnings. In June 2002, the FASB issued SFAS No. 146, "Accounting for Costs... -

Page 50

... value of inventories to a lower of cost or market basis for those items that are potentially excess, obsolete or slow-moving based on management's analysis of inventory levels and future sales forecasts. The Company also reduces the carrying value of inventories whose net book value is in excess of... -

Page 51

...amortization amounted to $920 million at December 31, 2001. The changes in the carrying amount of goodwill by reportable segment for 2002 and 2001 were as follows: Photo- Health Commercial Consolidated graphy Imaging Imaging Total $ 197 - - (28) 1 (1) 169 1 - 4 2 $ 176 $ 31 94 - (15) 1 (1) 110 6 (17... -

Page 52

...to Qualex extending long-term credit (see Note 10 under "Other Commitments and Contingencies"). NexPress, Phogenix and SK Display are each operating entities that were formed to develop, manufacture and commercialize specific imaging products and equipment for sale to customers. Total assets for ESF... -

Page 53

...included in other long-term assets in the accompanying Consolidated Statement of Financial Position. NOTE 7: ACCOUNTS PAYABLE AND OTHER CURRENT LIABILITIES (in millions) Accounts payable, trade Accrued advertising and promotional expenses Accrued employment-related liabilities Accrued restructuring... -

Page 54

... secured borrowings level of $74 million and the average of the conduits' commercial paper rates at December 31, 2002, the estimated annualized borrowing cost rate is 2.13%. Interest expense for the year ended December 31, 2002 was not material. The Program agreement contains a number of customary... -

Page 55

... responsible party (PRP) in connection with the nonimaging health businesses in five active Superfund sites. At December 31, 2002, estimated future remediation costs of $49 million are accrued on an undiscounted basis and are included in the $148 million reported in other long-term liabilities... -

Page 56

... financing agreements and related guarantees typically have a term of 90 days for product and short-term equipment financing arrangements, and up to 3 years for long-term equipment financing arrangements. These guarantees would require payment from Kodak only in the event of default on payment... -

Page 57

... in total put options will be exercised and the related cash payments will occur over the next twelve months. Qualex, a wholly owned subsidiary of Kodak, has a 50% ownership interest in Express Stop Financing (ESF), which is a joint venture partnership between Qualex and Dana Credit Corporation (DCC... -

Page 58

...plans to utilize the services of Eastman Kodak Credit Corporation, a wholly owned subsidiary of General Electric Capital Corporation, as an alternative financing solution for prospective leasing activity with its customers. At December 31, 2002, the Company had outstanding letters of credit totaling... -

Page 59

... sales. Silver forward contracts are used to mitigate the Company's risk to fluctuating silver prices. The Company's exposure to changes in interest rates results from its investing and borrowing activities used to meet its liquidity needs. Longterm debt is generally used to finance long-term... -

Page 60

...of exchange rate risk related to forecasted foreign currency denominated intercompany sales, primarily those denominated in euros and Japanese yen. At December 31, 2002, KPG had open forward contracts with maturity dates ranging from January 2003 to December 2003. At December 31, 2002, Kodak's share... -

Page 61

... effective tax rate for the full year. The decrease in the effective tax rate was attributable to an increase in earnings in lower tax rate jurisdictions relative to original estimates. Additionally, in the fourth quarter of 2002, the Company recorded a tax benefit of $8 million relating to a land... -

Page 62

...more effectively in order to provide competitive products to the global market. Specifically, the operations in Rochester, New York that assemble one-time-use cameras and the operations in Mexico that perform sensitizing for graphic arts and x-ray films will be relocated to other Kodak locations. In... -

Page 63

... for product discontinuances was reported in cost of goods sold in the accompanying Consolidated Statement of Earnings. The severance and exit costs require the outlay of cash, while the inventory write-downs and long-lived asset impairments represent non-cash items. The severance charge related to... -

Page 64

...for use model of SFAS No. 121, was reported in cost of goods sold in the accompanying Consolidated Statement of Earnings. The severance and exit costs require the outlay of cash, while the inventory write-downs and long-lived asset impairments represented non-cash items. The severance charge related... -

Page 65

... for use model of SFAS No. 121, was reported in cost of goods sold in the accompanying Consolidated Statement of Earnings. The severance and exit costs require the outlay of cash, while the inventory write-downs and long-lived asset impairments represent non-cash items. The severance charge related... -

Page 66

..., partnership and joint venture investments, interests in pooled funds, and various types of interest rate, foreign currency and equity market financial instruments. At December 31, 2001, Kodak common stock represented approximately 3.4% of trust assets. In December 2002, in connection with Wilshire... -

Page 67

... plans covering substantially all employees. Contributions by the Company for these plans are typically deposited under government or other fiduciary-type arrangements. Retirement benefits are generally based on contractual agreements that provide for benefit formulas using years of service... -

Page 68

... 2000 Non-U.S. $ 42 114 (157) (10) 8 3 - - 1 1 63 $ 64 $ The weighted assumptions used to compute pension amounts for major plans were as follows: 2002 Discount rate Salary increase rate Long-term rate of return on plan assets U.S. 6.50% 4.25% 9.50% Non-U.S. 5.40% 3.30% 8.30% U.S. 7.25% 4.25% 9.50... -

Page 69

... in the United Kingdom and Canada offer similar healthcare benefits. Changes in the Company's benefit obligation and funded status are as follows: (in millions) Net benefit obligation at beginning of year Service cost Interest cost Plan participants' contributions Plan amendments Actuarial... -

Page 70

...50. In January 2002, the Company's shareholders voted in favor of a voluntary stock option exchange program for its employees. Under the program, employees were given the opportunity, if they so chose, to cancel outstanding stock options previously granted to them at exercise prices ranging from $26... -

Page 71

... holders include the Eastman Kodak Company 1997 Stock Option Plan and the Kodak Stock Option Plan. The 5,124,000 of options available for grant as of December 31, 2002 under equity compensation plans not approved by security holders all relate to the Kodak Stock Option Plan; however, in accordance... -

Page 72

... information as if the Company had accounted for stock options granted under the fair value method of SFAS No. 123. The Black-Scholes option pricing model was used with the following weighted-average assumptions for options issued in each year: Exchange Program 2002 Risk-free interest rates Expected... -

Page 73

... accelerate Kodak's growth in the online photography market and help drive more rapid adoption of digital and online services. Ofoto offers digital processing of digital images and traditional film, top-quality prints, private online image storage, sharing, editing and creative tools, frames, cards... -

Page 74

... owned subsidiary, which was reported in the commercial and government products and services business in the Commercial Imaging segment. Due to a combination of factors, including the collapse of the telecommunications market, limitations on flying imposed by the events of September 11th, delays... -

Page 75

..., printers, scanners, other business equipment, media sold to commercial and government customers, and from graphics film products sold to the Kodak Polychrome Graphics joint venture. The All Other group derives revenues from the sale of OLED displays, imaging sensor solutions and optical products... -

Page 76

... Consolidated total 2002 2001 2000 Net earnings from continuing operations Photography $ 550 $ 535 Health Imaging 313 221 Commercial Imaging 83 84 All Other (23) (38) Total of segments 923 802 Venture investment impairments and other asset write-offs (50) (15) Restructuring costs and credits and... -

Page 77

... income taxes) tax benefit related to changes in the corporate tax rate and asset write-offs. (4) Refer to Note 21, "Discontinued Operations" for a discussion regarding loss from discontinued operations. (5) Includes relocation charges (included in cost of goods sold) related to the sale and exit of... -

Page 78

...Property, plant and equipment, net Total assets Short-term borrowings and current portion of long-term debt Long-term debt, net of current portion Total shareholders' equity Supplemental Information Net sales from continuing operations Photography Health Imaging Commercial Imaging All Other Research... -

Page 79

... $11 million of charges related to this restructuring program; $103 million of charges associated with business exits; a gain of $95 million on the sale of The Image Bank; and a gain of $25 million on the sale of the Motion Analysis Systems Division. These items reduced net earnings by $227 million... -

Page 80

... Guangdong. • Kodak received a 2002 WasteWise "Program Champion" Award from the EPA for its impressive waste reduction efforts. The continued recycling of one-time-use cameras prevents hundreds of tons of plastic and printed circuit boards from entering the waste stream each year. Altogether, more... -

Page 81

...the 2002 CEO Diversity Award. Catherine M. Lipari, general manager, Photo Group Customer Order Services, earned the award for initiatives that included launching Change Management training for employees, forming and leading a diversity council in her organization, and enhancing communications around... -

Page 82

... provides support to address strategic social issues, community involvement, and commitment to diversity. As such, programs and initiatives are focused on partnerships, volunteerism and grants in diverse markets. In 2002, 26% of Kodak's corporate funding was directed to programs that benefit diverse... -

Page 83

...Mark A. Schneider Chief Technical Officer & Director, Output Systems Development, consumer imaging products and services; Vice President HEALTH IMAGING GROUP Daniel I. Kerpelman* President, Health Imaging; Senior Vice President John J. Chiazza General Manager, Global Integrated Supply Chain; Vice... -

Page 84

Shareholder Information CORPORATE OFFICES 343 State Street Rochester, NY 14650 USA 585/724-4000 For copies of the Summary Annual Report and Proxy Statement, 10-K or 10-Q, contact: Literature & Marketing Support Eastman Kodak Company 343 State Street Rochester, NY 14650-0532 585/724-2783 For ... -

Page 85

... of record at the close of business on March 10, 2003, you are entitled to vote at the Annual Meeting. If you have any questions about the Meeting, please contact: Coordinator, Shareholder Services, Eastman Kodak Company, 343 State Street, Rochester, New York 14650-0211, (585) 724-5492. The... -

Page 86

...a term of one year: William H. Hernandez 2. Ratification of election of PricewaterhouseCoopers LLP as independent accountants. 3. Shareholder proposal requesting indexed options. 4. Shareholder proposal requesting expensing of stock options. 5. Shareholder proposal requesting adoption of a chemicals... -

Page 87

... by your card represent all the shares of Kodak stock you own, including those in the Eastman Kodak Shares Program and the Employee Stock Purchase Plan, and those credited to your account in the Eastman Kodak Employees' Savings and Investment Plan and the Kodak Employees' Stock Ownership Plan. The... -

Page 88

... at www.kodak.com/US/en/corp/principles/governance.shtml. • Business Conduct Guide on Kodak's website at www.kodak.com/US/en/corp/principles/businessConduct.shtml. You may request copies by contacting: Coordinator, Shareholder Services Eastman Kodak Company 343 State Street Rochester, New York... -

Page 89

... holds your Kodak shares, please contact ADP and inform them of your request by phone: (800) 542-1061, or by mail: Householding Department, 51 Mercedes Way, Edgewood, NY 11717. Be sure to include your name, the name of your brokerage firm and your account number. Audio Webcast of Annual Meeting... -

Page 90

... of a stock option program that rewarded superior long-term corporate performance. In response to strong negative public and shareholder reactions to the excessive financial rewards provided executives by non-performance based option plans, a growing number of shareholder organizations, executive... -

Page 91

...'s current stock option plan (the 2000 Omnibus Long-Term Compensation Plan) was approved by the shareholders at the 1999 Annual Meeting. Like all of the Company's executive compensation programs, this plan is overseen by the Executive Compensation and Development Committee of the Board of Directors... -

Page 92

...shareholders that options are cost-free...When a company gives something of value to its employees in return for their services, it is clearly a compensation expense. And if expenses don't belong in the earnings statement, where in the world do they belong? Many companies have responded to investors... -

Page 93

... an annual summary report to shareholders on these virtual elimination options and progress toward these goals. Supporting Statement: This policy makes business sense because preventing pollution is cost effective in the short term and avoids costly long-term liabilities related to toxic chemical... -

Page 94

... Director since February 2003 Mr. O'Neill, 67, served as Secretary of the Treasury of the United States from 2001 to 2002. Previously he was Chairman of Alcoa and held that position from April 1987 to December 2000. From April 1987 until May 1999, he also held the position of Chief Executive Officer... -

Page 95

... held a number of positions at BorgWarner Corporation, including Assistant Controller, Chemicals; Controller, Chemicals; Business Director, ABS Polymers; Assistant Corporate Controller; Vice President, Finance; and Chief Financial Officer, Borg-Warner Automotive, Inc. Earlier in his career, he was... -

Page 96

... 2002. Mr. Carp served as Executive Vice President and Assistant Chief Operating Officer from November 1995 to January 1997. Mr. Carp began his career with Kodak in 1970 and has held a number of increasingly responsible positions in market research, business planning, marketing management and line... -

Page 97

... listed below. All committee members are non-employee, independent directors as defined by the New York Stock Exchange (NYSE) listing standards. Audit Committee - 11 meetings in 2002 discussed the independence of the independent accountants; discussed the quality of the accounting principles used... -

Page 98

... on the Board. A change in the timing of the annual stock option grant to the non-employee directors was approved by the Board of Directors in October 2002. In order for it to coincide with the Company's annual management stock option grant, this grant will now be made in the fourth quarter, rather... -

Page 99

... include shares held for the account of the above persons in the Eastman Kodak Shares Program and the Kodak Employees' Stock Ownership Plan, and the interests of the above persons in the Kodak Stock Fund of the Eastman Kodak Employees' Savings and Investment Plan, stated in terms of Kodak shares. -

Page 100

... December 31, 2002, was $2,100,000. In March 2001, the Company loaned Mr. Carp, Chairman, President and Chief Executive Officer, $1,000,000 for the purchase of a home. The loan is unsecured and bears interest at 5.07% per year, the applicable federal rate for mid-term loans, compounded annually, in... -

Page 101

... named executive officers under Section 229.402(a)(3) of Volume 17 of the Code of Federal Regulations during 2002. The figures shown include both amounts paid and amounts deferred. SUMMARY COMPENSATION TABLE Annual Compensation Other Annual Compensation(b) $26,030 25,695 - - - - 20,953 Long-Term... -

Page 102

...restricted units as and when dividends are paid on Kodak common stock. The restrictions on the awards granted under the Executive Incentive Program lapse on December 31, 2003. D. A. Carp - For 2002, 100,000 shares granted as a retention based award, valued on December 2, 2002 at $36.73 per share and... -

Page 103

... of Financial Accounting Standards No. 123, "Accounting for Stock-Based Compensation." For the options granted in November 2002 under the management stock option program, the following weighted-average assumptions were used: risk-free interest rate - 3.8%, expected option life - 7 years, expected... -

Page 104

... this information. Under the Program, all of our employees, excluding our then six most senior executive officers, were given a one-time opportunity to exchange all of their then current options for proportionately fewer options at a new exercise price. The only named executive officer eligible... -

Page 105

...executive officers. Each participant's target award under the program is 75% of the participant's total target annual compensation (annual base salary plus target EXCEL award) expressed in the form of shares of common stock based on a March 8, 2002, stock price of $32.37 per share. Any awards earned... -

Page 106

LONG-TERM INCENTIVE PLAN - AWARDS IN LAST FISCAL YEAR Estimated Future Payouts Under Non-Stock Price-Based Plans Number of Shares, Units or Other Rights N/A Performance or Other Period Until Maturation or Payout 2000-2002 2001-2003 2002-2004 R. H. Brust N/A 2000-2002 2001-2003 2002-2004 2000-2002 ... -

Page 107

... Mr. Carp's employment without cause, Mr. Carp will be permitted to retain his stock options and restricted stock. He will also receive severance pay equal to three times his base salary plus target annual bonus and prorated awards under the Company's bonus plans. The letter agreement also provides... -

Page 108

... for severance pay equal to three times their total target annual compensation. In addition, the named executive officers would be eligible to participate in the Company's medical, dental, disability and life insurance plans until the first anniversary of the date of their termination of employment... -

Page 109

...case of the named executive officers, is base salary and EXCEL awards, including allowances in lieu of salary for authorized periods of absence, such as illness, vacation or holidays. For an employee with up to 35 years of accrued service, the annual normal retirement income benefit is calculated by... -

Page 110

...the years of service credited as of December 31, 2002, to each of the named executive officers. This table also shows the amount of each named executive officer's APC at the end of 2002. Mr. Brust and Mr. Palumbo, who participated in the cash balance feature in 2002, are not listed. Retirement Plan... -

Page 111

... SEC order of June 27, 2002, which required the CEOs and CFOs of nearly 1000 large publicly traded companies to attest to the accuracy of their companies' most recent Annual Reports on Form 10-K and other subsequent "covered reports." The Company's Chief Executive Officer and Chief Financial Officer... -

Page 112

... in the Company's Annual Report on Form 10-K for the year ended December 31, 2002, and the Board accepted the Committee's recommendations. The following fees were paid to PricewaterhouseCoopers LLP for services rendered in 2002: Audit Fees: $7.9 million Financial Systems Design and Implementation... -

Page 113

...corporate governance; • Kodak conducts its business activities in an environmentally responsible manner; • Kodak promotes a work environment of equal opportunity for all employees, and treats its employees in non-discriminatory manner; and • Kodak is committed to employing a diverse work force... -

Page 114

... at Kodak. The Company and its Board have long felt that good corporate governance is a prerequisite to providing sustained, long-term value to the Company's shareholders. Highlighted below are some activities that demonstrate this belief. • Board Independence For a number of years, a substantial... -

Page 115

... short- and long-term business goals. Towards this end, the Company's executive compensation strategy leverages all elements of market competitive total compensation to drive profitable growth and superior long-term shareholder value consistent with the Company's values. Plan design and performance... -

Page 116

... to the long-term incentive compensation paid to the Company's executive officers, the study found that this component was also market competitive due in significant part to the adoption of the Executive Incentive Program described later in this Report and awards of restricted stock to selected... -

Page 117

...year-end 2002. Since both of these goals were achieved, each program participant received an interim award in the form of restricted shares or units of the Company's common stock, the restrictions on which lapse on December 31, 2003. The interim awards paid to the named executive officers are listed... -

Page 118

... approved the plan amendments necessary to implement this program at their Special Meeting on January 25, 2002. Under this program, all of the Company's employees, excluding its six then most senior executive officers, were given a one-time opportunity to exchange all of their current options for... -

Page 119

...under the Executive Incentive Plan, a special program established under the 2002-2004 performance cycle. The interim award earned by Mr. Carp is listed under the column entitled "Restricted Stock Awards" in the Summary Compensation Table on page 96. Restricted Stock Unit Award In November 2002, the... -

Page 120

... addition, the graph weighs the constituent companies on the basis of their respective market capitalizations, measured at the beginning of each relevant time period. By Order of the Board of Directors James M. Quinn Secretary and Assistant General Counsel Eastman Kodak Company March 28, 2003 115 -

Page 121

... amount of time, as determined by the Board in its business judgement. At least one member of the Committee shall have accounting or related financial management expertise. All members shall receive appropriate training and information necessary to fulfill the Committee's responsibilities. III... -

Page 122

... the General Counsel, Director of Corporate Auditing, the Controller and the independent accountant. (d) Review and discuss with management and the independent accountant, the Company's quarterly financial information prior to releasing the quarterly earnings, and any material changes thereto, prior... -

Page 123

... in executive session as necessary and appropriate. (c) Report Committee actions to the Board of Directors with such recommendations as the Committee may deem appropriate. 7. Reporting (a) Review its charter annually and recommend changes, as necessary, to the Board. (b) Report its activities to... -

Page 124

Eastman Kodak Company 2003 Annual Meeting KODAK THEATRE 6801 Hollywood Blvd. Hollywood, California 90028 DIRECTIONS From Orange County Take the 405 North to the 55 North, towards Riverside. Take the 5 North, towards Los Angeles, to the 101 North towards Los Angeles/Civic Center. From Los Angeles ...