Kia 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

KIA MOTORS

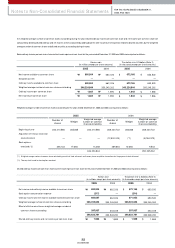

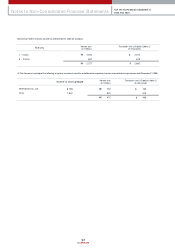

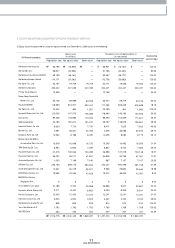

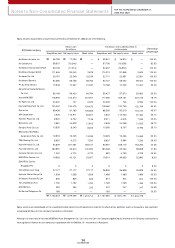

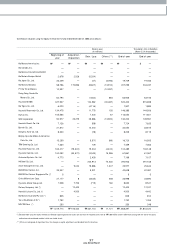

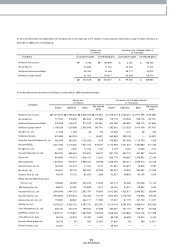

Equity securities accounted for using the equity method as of December 31, 2004 consist of the follow ing :

Korean w on

(In millions)

Translation into U.S.dollars (Note 2)

(In thousands)

Acquisition cost Net equity value Book value Acquisition cost Net equity value Book value

Ow nership

percentage

Affiliated company

Kia Motors Am erica, Inc.

Kia Canada, Inc.

Kia Motors Deutschland Gm bH

Kia Motors Europe Gm bH

Kia Japan Co., Ltd.

Kia Motors Slovakia

PT. Kia Tim or Motors

Dong Feng Yueda-Kia Motors

Co., Ltd.

Hyundai MOBIS

Kia Tigers Co., Ltd.

Hyundai Pow ertech Co., Ltd.

Dymos Inc.

WIA Corporation

Haevichi Resort Co. Ltd.

Bontek Co., Ltd.

Donghui Auto Co., Ltd.

Beijing Hyundai Mobis

Autom otive Parts Co. Ltd.

TRW Steering Co., Ltd.

Hyundai Hysco Co., Ltd.

Hyundai Card Co., Ltd.

Autoever System s Co., Ltd.

EUKOR Car Carriers, Inc.

EUKOR Car Carriers

Singapore Pte.

China Millennium Corp.

Hyundai- Motor Group Ltd.

Kia Motors Australia Pty Ltd.

Yan Ji Kia Motors A/ S

NGVTEK Com

Kia Service Philippines Co.

66,798

58,507

53,139

111,646

33,197

64,566

10,908

56,148

118,993

20,300

120,000

89,438

4,905

8,520

2,581

10,530

13,518

8,952

64,829

182,591

1,000

19,565

5

27,177

1,508

825

1,792

250

185

1,152,373

17,033

(16,246)

(17,213)

93,040

23,249

58,756

10,337

58,420

414,470

107

134,475

91,183

115,911

6,702

24,523

8,243

13,205

6,072

231,081

29,610

4,770

40,121

5

27,177

1,508

825

1,792

250

—

1,379,406

—

—

—

2,678

23,249

58,756

10,337

64,794

427,907

6,023

134,475

105,565

92,977

7,126

21,812

8,303

13,239

7,330

165,417

100,092

4,770

33,307

5

27,177

1,508

825

1,792

250

—

1,319,714

65,941

57,756

52,457

110,213

32,771

63,737

10,768

55,427

117,466

20,039

118,460

88,290

4,842

8,411

2,548

10,395

13,345

8,837

63,997

180,248

987

19,314

5

26,828

1,489

814

1,769

247

183

1,137,584

16,814

(16,038)

(16,992)

91,848

22,951

58,002

10,204

57,670

409,151

106

132,749

90,013

114,423

6,616

24,208

8,137

13,036

5,994

228,115

29,230

4,709

39,606

5

26,828

1,489

814

1,769

247

—

1,361,704

—

—

—

2,643

22,951

58,002

10,204

63,962

422,416

5,946

132,749

104,210

91,784

7,035

21,532

8,196

13,069

7,236

163,294

98,808

4,709

32,880

5

26,828

1,489

814

1,769

247

—

1,302,778

100.00

82.53

100.00

100.00

100.00

100.00

30.00

50.00

18.19

100.00

50.00

45.37

45.14

40.00

39.72

35.10

30.00

29.00

24.06

21.50

20.00

8.00

8.00

30.30

30.00

100.00

100.00

24.39

20.00

$

$

$

$

$

$

₩

₩

₩

₩

₩

₩

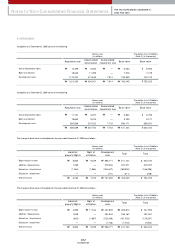

Notes to Non-Consolidated Financial Statements FOR THE YEARS ENDED DECEMBER 31,

2005 AND 2004

Equity securities are valued based on the unaudited financial statem ents w ith adjustm ents m ade for the effects of any significant events or transactions. Also, significant

unrealized profit (loss) on inter-company transactions is eliminated.

Although the share ratio for Hyundai MOBIS and Asset Managem ent Co., Ltd. is less than 20%, the Com pany applied equity method as the Company is presum ed to

have significant influence on such com pany in accordance with the SKAS No. 15 - “Investm ents in Associates”.