Kia 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

2005 Annual Report

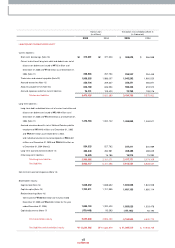

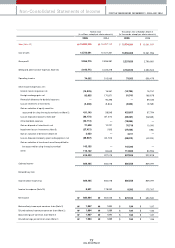

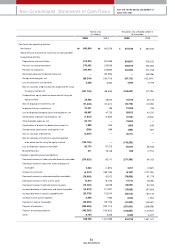

Fixed Assets

With regard to fixed assets, investm ents totaled ₩2,333 billion, an increase of ₩356 billion over 2004. We changed our evaluation m ethod for our INI Steel shares

from the market value method to the equity method, w hich resulted in a ₩228 billion of reduction in the book value of the long-term investm ent securities from

the previous year. Meanw hile, the application of the equity method allow ed us to realize total gains of ₩549 billion with regard to KIA’s stakes in Hyundai Mobis,

Wia, and Kia Motors Slovakia, etc (in which we had invested a certain or total sum of paid-in capital).

Tangible assets for 2005 am ounted to ₩5,233 billion, a ₩258 billion increase over the previous year; this resulted from investm ents relating to new vehicle

developm ents including new Pride, new Carnival, and Lotze, as w ell as investm ents in new engine and transm ission factories.

Intangible assets increased by ₩152 billion com pared to the previous year due to increases in capitalization of R&D expenses required for the roll-out of new

models such as new Carens and m id-large SUVs.

Liabilities

Current Liabilities

Despite the increase in the production and sales of com pletely built-up vehicles, the trade payables turnover period decreased slightly due to a increase in 100%

cash payment for material costs related to export vehicles; this means that the trade payables figure reached ₩1,969 billion, a sim ilar level to the previous year.

Short-term borrow ings w ere ₩313 billion, a ₩59 billion decrease from the previous year mainly due to a ₩50 billion reduction in com mercial paper issues. The

amount of current debentures and long-term borrow ings that matured in 2006 was ₩259 billion, a similar level to 2004. Other payables also decreased by

approxim ately ₩60 billion over the previous year; this resulted from low er incom e tax payable due to a reduction in 2005 taxable incom e, etc.

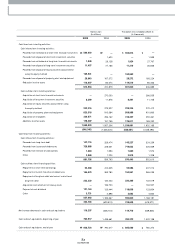

Non-current Liabilities

Total debentures rose by ₩515 billion over the previous year. This was m ainly due to the issue of 0.6 billion in corporate debentures and the reclassification of

debentures m aturing w ithin 1 year into the current debenture account. Approximately 116 million in foreign borrow ings were raised for the establishm ent of

overseas factories, but with the early repaym ent of ₩220 billion of the reorganized debts under court receivership and the valuation gains due to exchange rate

depreciation, etc, our long-term borrowings decreased by ₩102 billion com pared to 2004.

Despite the increase of units in operation (UIO) to keep up w ith increased sales volum e, short and long-term warranty provisions declined by ₩40 billion, which

reflected globally improved quality level of our products and the fall in foreign currency reserves, which takes up more than 80% of warranty provisions.

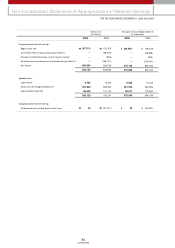

Equity

As of the end of 2005, total equity was ₩5,252 billion, an increase of ₩288 billion over the 2004 figure.

Retained earnings increased by ₩560 billion. And while net incom e was ₩681 billion, ₩121 billion was paid out in dividends to our shareholders. Capital

adjustm ents declined by ₩179 billion. There were tw o reasons for the decline in capital adjustm ents. First, the switch to the equity method with regard to our INI

Steel shares reduced the gains in the valuation of long-term investm ent by ₩91 billion. Second, the sw itch to the equity method led to lowering equity valuation

amount by ₩178 billion, resulting from Hyundai Motor Com pany and Hyundai Mobis shares held by INI Steel.

• Liability/Equity • Debt/ Total Assets

2003

129.1%

2004

115.2%

2005

114.0%

2003

20.7%

2004

15.8%

2005

18.2%