Kia 2005 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2005 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

2005 Annual Report

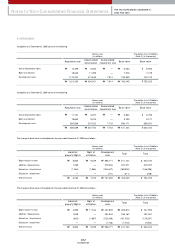

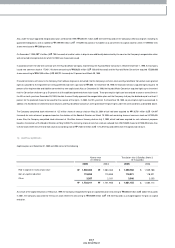

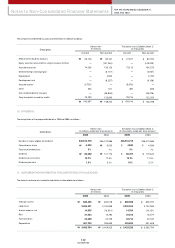

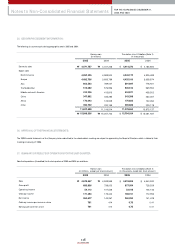

The difference betw een incom e before tax in financial accounting and taxable incom e pursuant to Corporate Incom e Tax Law of Korea is as follow s :

Description

Korean w on

(In millions)

Translation into U.S.dollars (Note 2)

(In thousands)

2005 2004 2005 2004

Incom e before tax

Tem porary differences

Non-temporary differences

Other adjustm ents

Taxable incom e

689,405

(215,944)

(303,948)

937

170,450

₩

₩

680,558

(213,173)

(300,047)

925

168,263

$

$

840,078

(227,898)

10,893

19,157

642,230

829,297

(224,973)

10,753

18,911

633,988

₩

₩

$

$

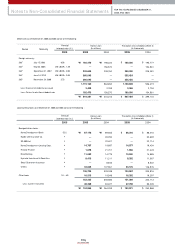

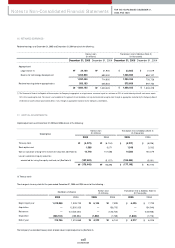

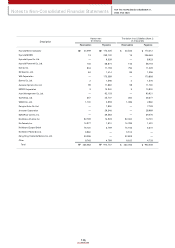

The com ponents of deferred tax assets as of Decem ber 31, 2005 are as follow s :

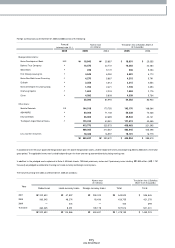

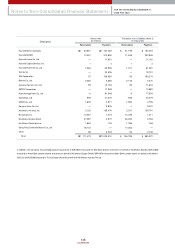

Deferred tax assets of ₩194,194 m illion (US$191,702 thousand) and deferred tax liabilities of ₩1,695 million (US$1,673 thousand) for tem porary differences arising

from investm ents in subsidiaries and associates were not recognized since it is not probable that the tem porary difference w ill be reversed in the foreseeable future. Also,

deferred tax liabilities of ₩87,832 m illion (US$86,705 thousand) were not recognized assuming that tem porary difference arising from equity securities accounted for

using the equity method will be reversed by dividends.

The accum ulated tem porary differences as of December 31, 2005 and 2004 do not include the tem porary differences of ₩261,893 million (US$258,532 thousand) and

₩262,000 million (US$258,638 thousand), respectively, for the gain on revaluation of land, which may not be disposed of in the foreseeable future. Effective tax rate

used in calculating deferred tax assets or liabilities arising from tem porary differences is 27.5% including resident tax.

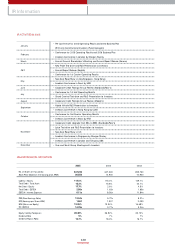

Description

Korean w on

(In millions)

Translation into U.S.dollars (Note 2)

(In thousands)

Current Non current Current Non current

Allow ance for doubtful accounts

Equity securities accounted for using the equity method

Accrued warranties

Deferred foreign exchange gain

Depreciation

Developm ent cost

Derivative instrum ents

Accrued incom e

Other

Item s credited directly to equity

Carry forw ard of unused tax credits

50,543

—

71,418

—

—

—

—

(4,562)

(18)

—

79,234

196,615

₩

₩

49,894

—

70,501

—

—

—

—

(4,503)

(18)

—

78,218

194,092

$

$

82,116

(202,777)

127,724

(2,150)

1,972

(2,989)

(839)

356

1,884

(10,812)

195,555

190,040

81,062

(200,175)

126,085

(2,122)

1,947

(2,951)

(828)

351

1,860

(10,673)

193,045

187,601

₩

₩

$

$