Kia 2005 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2005 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

105

2005 Annual Report

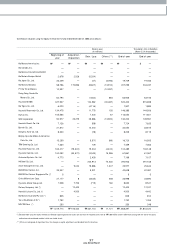

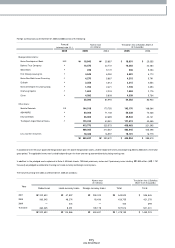

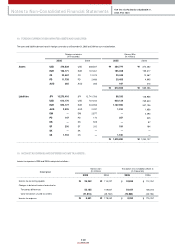

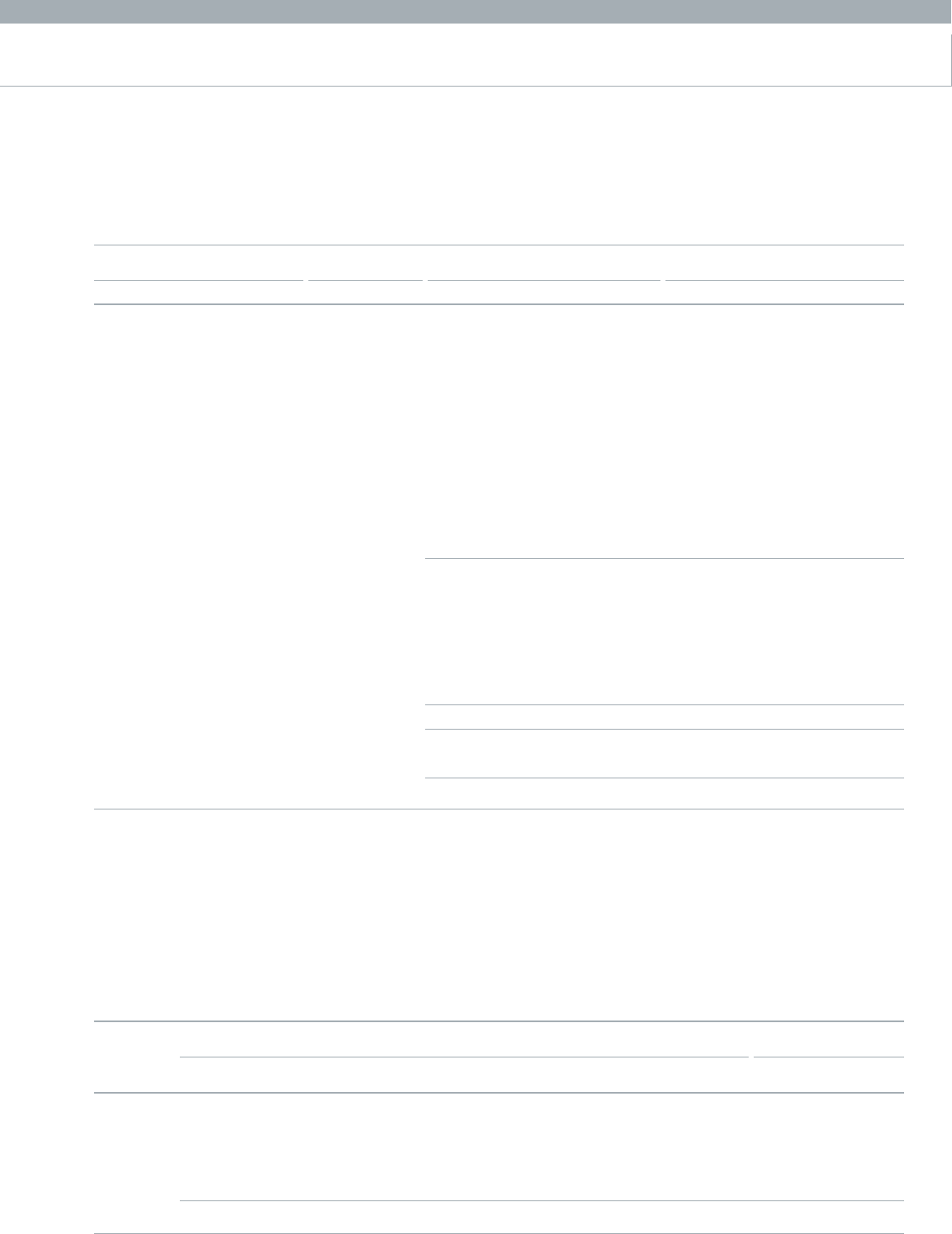

Foreign currency loans as of December 31, 2005 and 2004 consist of the follow ing :

Korean w on

(In millions)

Annual

interest rate (% )

Translation into U.S.dollars (Note 2)

(In thousands)

20052005 2004 2005 2004

Reorganization claim s :

Korea Developm ent Bank 5.52

Bankers Trust Com pany 〃

Woori Bank 〃

First Citicorp Leasing Inc. 〃

Korea Non-Bank Lease Financing 〃

Citibank 〃

Korea Developm ent Leasing Corp. 〃

Chohung Capital 〃

Other 〃

Other loans :

Societe Generale 3.8

ABN-AMRO 〃

Deutsche Bank 〃

The Export-Import Bank of Korea 〃

Less: Current maturities

18,843 25,887 18,601 25,555

16,575 22,772 16,362 22,480

239 9,172 236 9,054

4,549 6,250 4,491 6,170

4,270 5,867 4,215 5,791

3,358 4,613 3,315 4,554

1,762 2,421 1,739 2,390

1,604 2,203 1,584 2,175

4,092 5,809 4,039 5,734

55,292 84,994 54,582 83,903

144,018 170,755 142,170 168,564

60,008 71,148 59,238 70,235

36,005 42,689 35,543 42,141

173,742 40,981 171,512 40,455

413,773 325,573 408,463 321,395

469,065 410,567 463,045 405,298

18,428 16,997 18,191 16,779

450,637 393,570 444,854 388,519

₩

₩

$

$

₩

₩

$

$

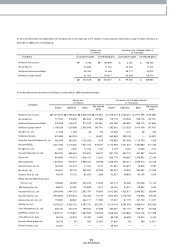

In accordance w ith the court-approved reorganization plan, the above reorganization claim s, shall be repaid over seven years beginning 2002 to 2008, after a three-year

grace period. The applicable interest rate is variable depending on the three-year non-guaranteed bond circulating earnings rate.

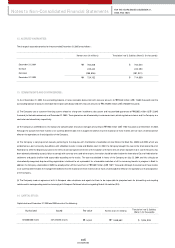

In addition to the pledged assets explained in Note 6, 40 blank checks, 130 blank prom issory notes and 2 prom issory notes totalling ₩1,820 m illion (US

$1,797

thousand) are pledged as collateral for the long-term local currency and foreign currency loans.

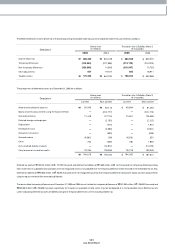

The m aturities of long-term debt as of Decem ber 31, 2005 are as follow s :

Korean w on

(In millions)

Translation into U.S.dollars

(Note 2) (In thousands)

Debentures

Year Local currency loans Foreign currency loans Total Total

2007

2008

2009

Thereafter

202,600 47,897 293,023 543,520 536,545

360,045 48,274 18,436 426,755 421,278

—404 —404 399

360,045 8,291 139,178 507,514 501,001

922,690 104,866 450,637 1,478,193 1,459,223

₩

₩

₩

₩

₩

₩

₩

₩

$

$