Kia 2005 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2005 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

KIA MOTORS

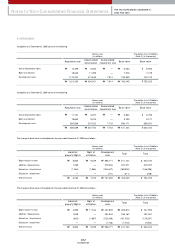

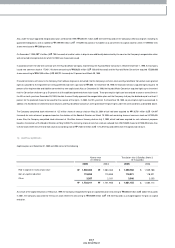

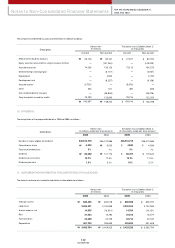

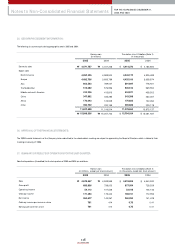

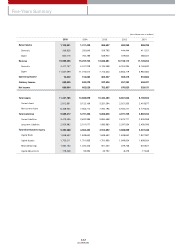

The com ponents of deferred tax assets as of Decem ber 31, 2004 are as follow s :

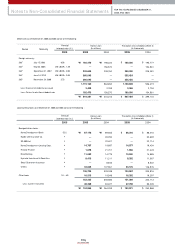

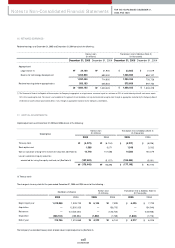

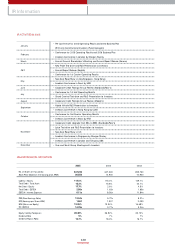

20. DIVIDENDS :

The com putation of the proposed dividends in 2005 and 2004 is as follow s :

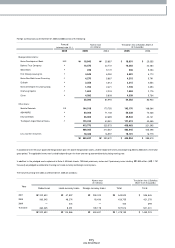

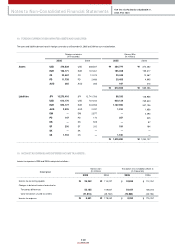

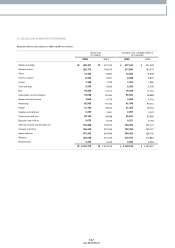

21. SUPPLEMENTARY INFORMATION FOR COMPUTATION OF VALUE ADDED :

The accounts and am ounts needed for calculation of value added are as follow s :

Notes to Non-Consolidated Financial Statements FOR THE YEARS ENDED DECEMBER 31,

2005 AND 2004

Description

Korean w on

(In millions)

Translation into U.S.dollars (Note 2)

(In thousands)

Current Non current Current Non current

Allow ance for doubtful accounts

Equity securities accounted for using the equity method

Accrued warranties

Deferred foreign exchange gain

Depreciation

Developm ent cost

Accrued incom e

Other

Item s credited directly to equity

Carry forw ard of unused tax credits

48,145

—

74,065

—

—

—

(5,750)

(36)

—

79,233

195,657

₩

₩

47,527

—

73,115

—

—

—

(5,676)

(36)

—

78,216

193,146

$

$

83,161

(151,264)

136,120

(3,107)

4,844

(9,257)

—

911

(36,848)

123,640

148,200

82,094

(149,323)

134,373

(3,067)

4,782

(9,138)

—

899

(36,375)

122,053

146,298

₩

₩

$

$

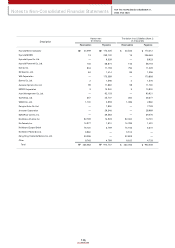

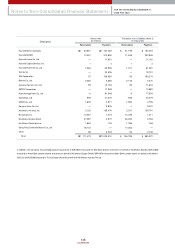

Description

Korean w on

(In millions, except per share amount)

Translation into U.S.dollars (Note 2)

(In thousands, except per share amount)

2005 2004 2005 2004

Number of shares eligible for dividend

Face value per share

Face value dividend rate

Dividend

Dividend to net incom e

Dividend yield ratio

346,516,719

5,000

5%

86,629

12.7%

1.0%

346,516,719

4,936

5%

85,517

12.7%

1.0%

₩

₩

₩

₩

$

$

$

$

346,210,586

5,000

7%

121,174

17.5%

3.2%

346,210,586

4,936

7%

119,620

17.5%

3.2%

Korean w on

(In millions)

Translation into U.S.dollars (Note 2)

(In thousands)

2005 2004 2005 2004

Ordinary incom e

Labor costs

Interest expense, net

Rent

Taxes and dues

Depreciation

689,405

2,259,521

14,976

21,083

23,009

461,760

3,469,754

680,558

2,230,524

14,784

20,812

22,714

455,834

3,425,226

₩

₩

840,078

2,150,595

(16,361)

15,780

22,729

396,699

3,409,520

829,297

2,122,996

(16,151)

15,577

22,437

391,608

3,365,764

₩

₩

$

$

$

$