Kia 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

2005 Annual Report

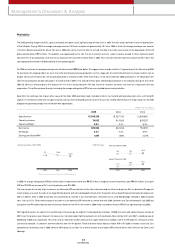

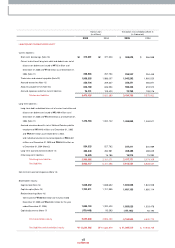

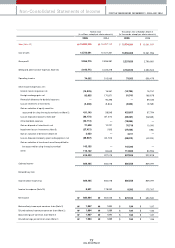

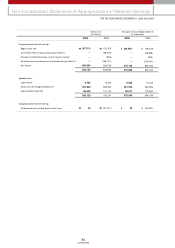

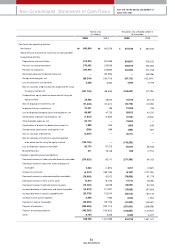

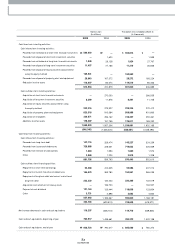

Non-Consolidated Statements of Cash Flows FOR THE YEARS ENDED DECEMBER 31,

2005 AND 2004

Korean w on

(In millions)

Translation into U.S.dollars (Note 2)

(In thousands)

2005 2004 2005 2004

Cash flow s from operating activities :

Net incom e

Adjustm ents to reconcile net incom e to net cash provided

by operating activities :

Depreciation and am ortization

Provision for severance benefits

Provision for warranties

Reversal of allow ance for doubtful accounts

Foreign exchange gain, net

Loss on retirem ent of inventories

Gain on valuation of equity securities accounted for using

the equity method, net

Dividend from equity securities accounted for using the

equity method

Gain on disposal of investm ents, net

Impairm ent loss on investm ents

Loss on disposal of property, plant and equipm ent, net

Am ortization of present value discount, net

Other bad debt expenses, net

Am ortization of discount on debentures issued, net

Com pensation expenses on stock options, net

Gain on valuation of derivatives

Gain on valuation of investm ent securities qualified

to be accounted for using the equity method

Loss on disposal of accounts receivable

Miscellaneous loss

Changes in operating assets and liabilities :

Decrease (increase) in trade notes and accounts receivable

Decrease (increase) in long-term notes and accounts

receivable

Increase in inventories

Decrease (increase) in advances and other receivables

Decrease (increase) in other current assets

Decrease (increase) in deferred incom e tax assets

Increase (decrease) in trade notes and accounts payable

Increase (decrease) in accounts payable-other

Increase in other current liabilities

Decrease in incom e tax payable

Paym ent of warranties

Paym ent of severance benefits

Other

680,904

612,815

270,082

245,440

—

(88,244)

5,008

(431,140)

34,460

(71,638)

27,421

89,967

(1,535)

20,112

1,889

(299)

(3,050)

(145,155)

86,173

211

(274,923)

3,243

(6,247)

(79,883)

15,914

(16,762)

(16,873)

(20,779)

8,408

(42,062)

(285,596)

(185,265)

6,164

438,760

₩662,026

524,969

229,526

318,860

(90,396)

(134,115)

5,844

(58,545)

28,500

(10,221)

185

40,723

(2,839)

—

643

589

—

—

57,270

18,148

85,117

(1,891)

(199,758)

92,972

(5,705)

63,825

311,807

152,074

1,982

(49,705)

(292,714)

(133,622)

6,306

1,621,855

672,166

604,951

266,616

242,290

—

(87,112)

4,944

(425,607)

34,018

(70,719)

27,069

88,812

(1,516)

19,854

1,865

(295)

(3,011)

(143,292)

85,067

208

(271,395)

3,201

(6,167)

(78,858)

15,710

(16,547)

(16,656)

(20,512)

8,300

(41,522)

(281,931)

(182,887)

6,085

433,129

653,530

518,232

226,580

314,768

(89,236)

(132,394 )

5,769

(57,794)

28,134

(10,090)

183

40,200

(2,802)

—

635

581

—

—

56,535

17,914

84,025

(1,867)

(197,194)

91,779

(5,633)

63,006

307,806

150,122

1,957

(49,067)

(288,958)

(131,907)

6,227

1,601,041

₩$ $