Kia 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

KIA MOTORS

Management’s Discussion & Analysis

Overview of the Korean Automotive Industry

Current Status

(1) Characteristics

The autom otive industry requires a broad industrial base and influences other sectors through upstream and dow nstream links. The industry can be categorized

into three phases: production, distribution, ow nership & m aintenance. Production involves over 20,000 parts and inputs such as steel, chem icals, nonferrous m etals,

electrical products, electronics, rubber, glass and plastics. Distribution is carried out by sales subsidiaries, franchise dealers, and installm ent finance com panies and

shippers. Maintenance issues, in contrast, fall under the realm of repair shops and after sales parts, as well as insurers.

Given its integration with so many other suppliers and related industries, it’s not surprising that the industry represents a good chunk of the national econom y. As of

2003, the Korean autom otive industry generated 74.9 trillion KRW in production, up 6.38% year on year; this represents 11.1% of the nation’s manufacturing sector

and 39.0% of dom estic machinery output. The industry contributes greatly to Korean exports. Som e US$26.4 billion worth of Korean-made autom obiles were sold

overseas in 2004, a 39.3% increase from a year earlier, representing 10.4% of the nation’s export total. With autom otive industry employm ent at around a quarter of a

million people (220,000) in 2003, it com prises 8.0% of entire manufacturing sector em ploym ent.

(2) Grow th Potential

The Korean autom otive industry has grow n phenom enally through steady expansion of domestic and overseas operations on the back of favorable governm ent

policies as w ell as ceaseless R&D efforts. Exports of the Hyundai Pony, the first indigenous Korean passenger car, began in 1976. Korea has produced an aggregate

total of about 47 million units betw een 1976 and 2005, of which 24.5 m illion units (52.1%) w ere sold in dom estically and 22.5 million units (47.9%) were exported.

After experiencing steady grow th, the industry suffered a 50% year-on-year drop in annual sales to some 780,000 units in 1998 because of the Asian financial crisis.

The unprecedented event drove the entire industry to the brink of collapse, forcing som e autom akers to near bankruptcy. How ever, the subsequent strong

recovery of the Korean econom y boosted dom estic dem and for cars. Exports increased rapidly to industrialized countries, even while the Asian and Latin Am erican

econom ies struggled. Thanks to the quick turnaround in sales both at hom e and abroad, the output of the Korean autom otive industry surpassed the 3 million-unit

mark in 2000 for the first tim e. Sluggish global econom ic grow th caused the Korean econom y to slow in 2001, putting dow nw ard pressure on autom obile

production. The governm ent launched an econom ic stimulus package in 2001 and the effects began to be felt the follow ing year. Annual dom estic auto sales

exceeded the 1.6 m illion-unit level for the second tim e in 2001 (the first time was in 1996).

Since 2003, dom estic dem and for new vehicles has rem ained stagnant ow ing to high oil prices and the aftereffects of the governm ent’s economy-boosting policy.

On the other hand, autom obile exports have recorded rem arkable grow th, thanks to im proved product quality, a better brand im age, and the introduction of

competitive new models. Total autom obile production in 2005 reached a new record for the third consecutive year despite sluggish dom estic sales.

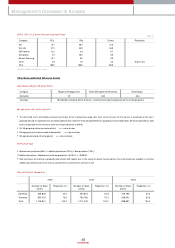

The num ber of vehicles on Korea’s roads broke the 15 million m ark at the end of February 2005, a fifteen-fold increase from tw o decades earlier, w hen the num ber

was only 1 million. Put differently, the ratio of persons per autom obile dropped from 36.6 in 1985 to 3.2 in 2004. The figure is still higher than the 1.2 for the US, 1.7

for Japan, and 2.0 for Western Europe. The Korean autom otive industry has experienced a dropped off in sales during the last couple of years; consum er spending

tem porarily dried up after a credit card bubble burst in 1992-1993. Nevertheless sales at hom e are forecast to pick up again soon, as most analysts feel that we’ve

turned the corner of consum er credit bubble. Industry pundits also feel Korea will reach sim ilar penetration levels as those found in advanced countries.

Overseas sales are also expected to achieve stable grow th. In the first half of 2005, Hyundai Motor scored 110 on J.D. Pow er & Associates’ quality survey, ranking 3rd

behind BMW and Toyota. Even though total 2005 autom obile sales in the US increased a m ere 0.5% from the previous year, Hyundai and Kia Motors saw sales

increases of 8.7% and 2.1%, respectively, thanks to their enhanced product quality and brand im age. In Western Europe, their sales surpassed the 500,000-vehicle

mark for the first time, boosted by the introduction of strategic new models and sports marketing activities. Their sales grow th is also robust in the emerging

markets of China, India and Russia. The upw ard trend in overseas sales is likely to be sustained thanks to not only price com petitiveness, a traditional strength, but

also rapidly im proving quality, consum er satisfaction, and brand recognition, w hich w as boosted by successful sports marketing activities during the 2002 FIFA

World Cup Finals. On balance, the Korean autom otive industry still has a strong grow th potential.