Kia 2005 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2005 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

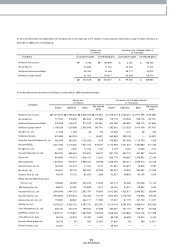

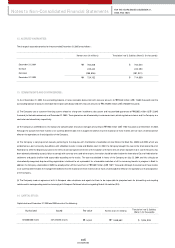

M arch 17, 2000

M arch 18, 2003 ~ M arch 17, 2008

₩5,500

February 20, 2003

February 21, 2006 ~ February 20, 2011

₩8,200

109

2005 Annual Report

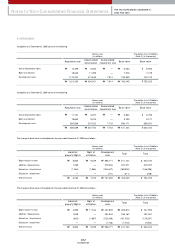

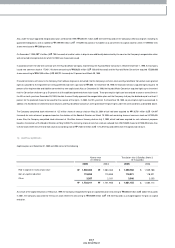

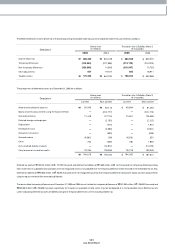

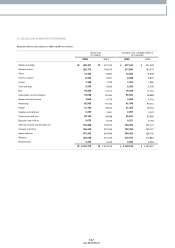

(2) Stock option cost

Stock options granted as of Decem ber 31, 2005 are summarized below .

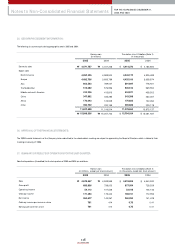

If all stock options, which require at least tw o-year continued service, are exercised, new shares or treasury stock will be issued in accordance w ith the decision of the

Board of Directors. The Com pany calculates the total com pensation expense using the option-pricing model. In the model, the risk-free rate of 10.0 percent and 4.74

percent, the expected exercise period of 5.5 years and the expected variation rate of stock price of 0.8387 and 0.9504 are adopted for the first and second stock options,

respectively. Total com pensation expense has been accounted for as a charge to current operations and a credit to capital adjustm ents over the required period of

service from the grant date using the straight-line m ethod.

Com pensation expenses associated with stock options of ₩99 million (US$98 thousand) have been charged to current operations and the com pensation expenses of

₩398 million (US$393 thousand), w hich w ere expensed before Decem ber 31, 2004, have been reversed due to cancellation of 100,000 shares of the second grant

stock options in 2005. Also, with the 306,133 shares of the first granted stock option exercised, treasury stock w as issued for the year ended Decem ber 31, 2005. No

compensation expense rem ains to be expensed over the required period of service as of Decem ber 31, 2005.

Granted

Cancelled

Exercised

Rem aining

Grant date

Exercise periods

Exercise price

950,000

(15,000)

(895,422)

39,578

3,735

(59)

(3,520)

156

3,687

(58)

(3,475)

154

₩

₩

$

$

695,000

(365,000)

—

330,000

2,974

(1,562)

—

1,412

2,936

(1,542)

—

1,394

₩

₩

$

$

Korean w on

(In millions)

Shares Shares

First Second

Description

Translation into U.S.dollars

(Note 2) (In thousands)

Korean w on

(In millions)

Translation into U.S.dollars

(Note 2) (In thousands)

Compensation expenses Compensation expenses