Kia 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

2005 Annual Report

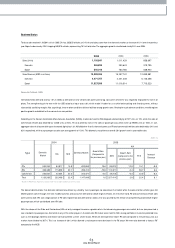

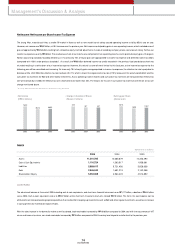

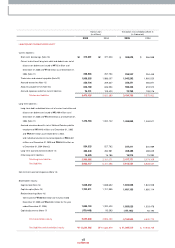

• China M/ S • China Market Retail Sales

Volum e (Units)

* Source: Com pany data

2003

2.4%

2004

2.5%

2005

3.5%

2003

51,008

2004

62,506

2005

110,008

Demand Fluctuation Factors

▶The autom otive industry is highly interdependent on a complex web of parts suppliers; car m akers are therefore highly sensitive to flux from other industries.

▶Autom obiles are the highest priced product of all durable goods. Even our most econom ical cars exceed 5 million Won. Mid-sized autom obiles sell for about 14

million Won, while larger luxury cars on average cost over 30 million w on. This has a large im pact on sales elasticity; during econom ic slow dow ns, many

households choose to put off the purchase of a car. Moreover, cars also require regular maintenance and repairs, and this amount varies according the price tag

of the vehicle. This in turn requires precise planning with regards to A/ S maintenance and warranties; car m akers must therefore offer a diverse range of after

sales service solutions that meet the dem ands of various custom er segm ents.

New Business Prospects

KIA is planning to venture into new business lines that will raise the com petitiveness and synergies betw een our various divisions, with the aim of cutting overall

costs and adding more lifetim e value to the purchase of every car. We intend to expand business into areas such as recycling, telecom munications, and auto

memberships. We believe that by doing so we can raise the technological innovation of our cars while minimizing the lifetim e maintenance costs associated with

the initial purchase, operation & maintenance, and final disposal of our cars.

By moving first into the recycling business, w e believe KIA can not only im prove the margins on our cars by incorporating more recycled parts, we also believe we

will be able to use our hi-tech m anufacturing expertise to produce more environm entally-friendly materials. Moreover, the recycling business w ill allow s us to

develop a w ider variety of autom obile related products and services available to the public, through m ore diverse sales channels, which in turn w ill raise custom er

satisfaction levels.

In the future our com pany plans to actively develop and provide various products and services through telecom m unications sales channels to our custom ers. With

regard to the autom obile related membership business, we plan to develop various products and services required for the “Ow nership & Maintenance.” This

business would focus on offering our custom ers with a diverse range of autom obile related m erchandise that they need after the purchase of their new vehicle.

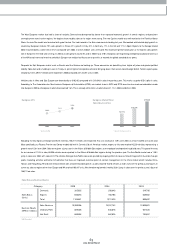

Overseas Plant Sales Results

KIA currently has a single overseas production facility. The China plant has an annual capacity of 130,000 units. Sales in China totaled 110,008 units in 2005, a 76.0%

jum p over the previous year’s figure of 62,506 units. Our Chinese m arket share rose by 1% points to hit 3.5%. C-segm ent Cerato sales, which com menced from

August 2005, have sold consistently. The Cerato becam e our best selling model within China, surpassing sales of the TianLiMa.

Excluding com mercial vehicles, total car sales in China reached 3,131,950 units in 2005; this means the market grew by 25.8% over 2004, in which stood 2,490,611

units w ere sold. Our sales grow th rate of 76.0% did exceed the industry dem and grow th rate, but in absolute num bers, our sales w ere not very large. Sales grow th

for most of the top 10 m akers outpaced the industry dem and growth rate, meaning that w e maintained our 12th spot rank in China. We project that we’ll nudge

up in the rankings once the new Pride m odel replaces the TianLiMa in late 2006. And we will be in a better position to eclipse som e of our com petitors after the

completion of the plant num ber 2 in China, which is slated for com pletion by the 2nd half of 2007.