Kia 2005 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2005 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

KIA MOTORS

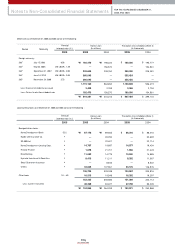

Notes to Non-Consolidated Financial Statements FOR THE YEARS ENDED DECEMBER 31,

2005 AND 2004

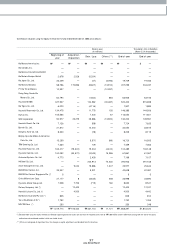

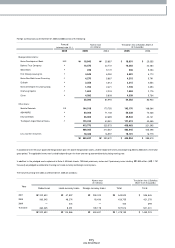

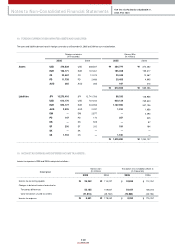

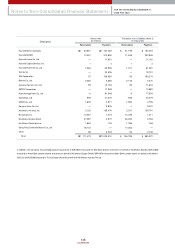

12. ACCRUED WARRANTIES :

The changes in accrued warranties for the year ended Decem ber 31, 2005 are as follow s :

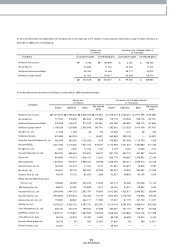

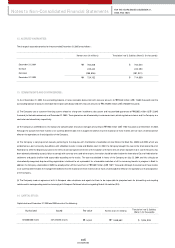

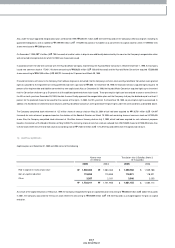

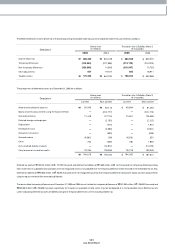

13. COMMITMENTS AND CONTINGENCIES :

(1) As of Decem ber 31, 2005, the outstanding balance of notes receivable discounted with recourse am ounts to ₩75,448 million (US$74,480 thousand) and the

outstanding balance of accounts receivable from export sales discounted with recourse amounts to ₩2,725,892 million (US$2,704,049 thousand).

(2) The Com pany uses a custom er financing system related to a long-term installm ent sales system and has provided guarantees of ₩23,952 m illion (US$23,645

thousand) to the banks concerned as of Decem ber 31, 2005. These guarantees are all covered by insurance contracts, which regulate a custom er and the Com pany as a

contractor and a beneficiary, respectively.

(3) The Com pany is a defendant to nine lawsuits for com pensation of losses or damages amounting to ₩7,884 million (US$7,783 thousand) as of December 31, 2005.

Although the outcom e of these m atters is not currently determ inable, the managem ent believes that the resolution of these m atters will not have a m aterial adverse

effect on the operations or financial position of the Com pany.

(4) The Com pany is carrying certain lawsuits pertaining to the disputes w ith the Brazilian shareholders of Asia Motors Do Brasil S.A. (AMB) and AMB, w hich w as

established as a joint venture by Asia Motors w ith a Brazilian investor, in local and Brazilian court. In 2002, the Company brought the case to the International Court of

Arbitration to settle the disputes pursuant to the term s of contract signed at the tim e of the inception of the joint venture, which stipulates that in case the business has

been adversely affected by a party’s failure to com ply with contract term s and other reasons, the m atter should be taken before the International Court of Arbitration for

settlement and parties shall be held accountable according to the results. The case was decided in favour of the Com pany on July 22, 2004, and this ruling by an

internationally-recognized dispute-settling organization is believed to set a precedent for a favourable resolution of all the rem aining lawsuits in progress in Brazil. In

addition, the Com pany, shareholder of AMB, has already written off this investm ent of ₩14,057 m illion (US$13,877 thousand). Although the outcom e of these m atters

is not currently determ inable, the managem ent believes that the resolution of these m atters w ill not have a material adverse effect on the operations or financial position

of the Com pany.

(5) The Com pany made an agreem ent with its European sales subsidiaries and agents for them to be responsible for projected costs for dism antling and recycling

vehicles sold in corresponding countries to com ply with European Parliament directive regarding End-of-Life vehicles (ELV).

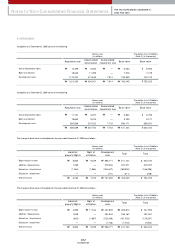

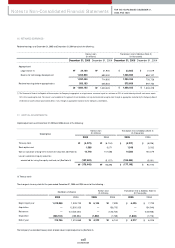

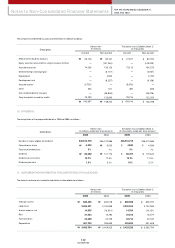

14. CAPITAL STOCK :

Capital stock as of December 31, 2005 and 2004 consist of the follow ing :

Korean w on (In millions) Translation into U.S.dollars (Note 2) (In thousands)

Decem ber 31, 2004

Increase

Decrease

Decem ber 31, 2005

764,308

245,440

(285,596)

724,152

₩

₩

754,500

242,290

(281,931)

714,859

$

$

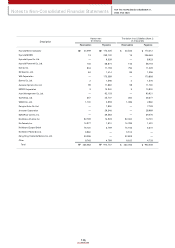

Korean w on (In millions)

Par valueIssuedAuthorized

Translation into U.S.dollars

(Note 2) (In thousands)

820,000,000 shares 347,230,455 shares ₩5,000 ₩1,848,652 $1,824,928