Kia 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

2005 Annual Report

Overseas Business

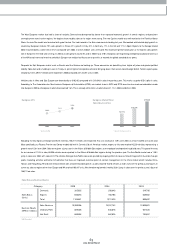

We have set our 2006 export goal at 958,000 vehicles, a 14% rise in grow th from the previous year’s figure of 840,016 vehicles. While the export environm ent is

expected to rem ain fierce with drops in exchange rates continuing on from the previous year and continuous increases in oil & raw m aterial prices, we are

diversified and feel well positioned to localize strategies that will win greater m arket share in many of the regions that we operate in. We are rolling out a new series

of innovative m odels and global car sales are expected to pick up; we intend to outperform som e of our bigger com petitors and export 958,000 cars.

Prospects in the North American market are far from bright w ith a glut in overcapacity, which is forcing bigger players to sell low er margin vehicles just to rem ain

afloat. The huge injection of incentives tends to distort the m arket by raising the pow er of sales dealers. Nevertheless we see some opportunities within these

conditions as our models continue to gain acceptance within the m arket. Com prehensive launches of our new Carnival, Optim a, & Carens models will differentiate

us from the pack. Our 2006 export goal for this region is 333,100 vehicles, a 10% increase over the 2005 figure of 301,764 vehicles.

With the West European market now the largest trading bloc globally, KIA is keener than ever to penetrate this market. We will strengthen our brand im age through

diverse marketing and prom otions activities linked to the 2006 World Cup in Germany. We are expanding the number of KIA dealers throughout the region and

im proving the technology of our cars. During 2006 a long-term European sales strategy will be laid out. We look forward to the successful launch of new m odels

into the local m arket, such as the roll-out of the new Carnival model in the March Geneva Motor Show . We envision that we’ll be able to export 307,300 vehicles to

the Euro region, or 2% grow th over 2005. This will be the foundation for even greater grow th in the future.

The prospects in East European market also appear prom ising. Russia m ay very w ell becom e an im portant source of future dem and, as its econom y continues to

perk up on the back of higher oil prices and hefty injections of FDI. We intend to fine tune our sales netw ork within Russian and neighboring markets, so that we can

ready ourselves to meet pent up dem and in Russia, the Ukraine and Kazakhstan. Rather than focusing on narrow short-term gains, we are building foundations for

long-term sales grow th. With such forw ard-thinking strategies guiding our objectives, we aim to export 56,800 vehicles into the East European m arket, a rise of 14%

over the previous year (49,917 vehicles).

In the general markets excluding Europe and North America, we have set an am bitious sales target: 260,800 vehicles, a grow th rate target of 40% com pared to the

previous year’s figure of 185,721 vehicles. In the Central & South Am erican market we will achieve our export target and at the same tim e raise profitability through

differentiated prom otion activities taking into account the characteristics of each autom obile type. Our overall objective is to further develop strategies to expand

sales of high profit margin types by establishing an infrastructure that will facilitate mid to long term sales expansions.

Our strategy for the African & Middle East m arkets consists of im proving our sales com petencies through better training for KIA dealerships, coupled w ith notching

up our maintenance abilities, so that w e retain and build KIA custom er loyalty. We also plan to proactively take part in orders from local tenders.

We have strengthened our sales netw ork in the Asia-Pacific rim by establishing sales companies in Australia and New Zealand. We’ve added an elem ent of

excitem ent into our brand im age in this region through sports marketing activities in connection w ith the Australian Open and other grand slam sporting events. In

the greater China region we are working on building a greater sales netw ork by bringing on board more dealers w ithin China. Kia is also prom oting itself through

international motor show s in Beijing, Guangzhou, and Taiw an. Our marketing activities will focus on World Cup festivities as w ell as leveraging upon the ‘Korean

Wave’ movem ent within Asia.

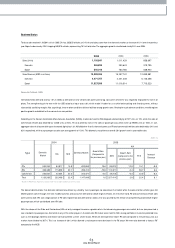

Market Share

Per Company Market Share (Domestic)

2005 2004 2003 Particulars

KIA 22.4 22.4 23.0

Hyundai 48.3 48.6 47.1

GM Daewoo 9.5 9.9 9.8

Ssangyong 6.5 9.0 9.8

Renault Sam sung 10.0 7.3 8.2

Other 3.3 2.8 2.1 Imports etc.

Total 100.0 100.0 100.0

(Unit: %)

*Based on KAMA new registrations data