Kia 2005 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2005 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

2005 Annual Report

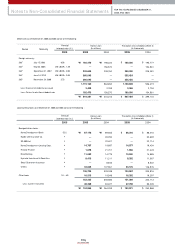

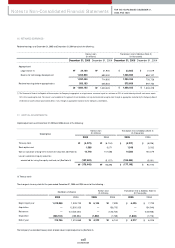

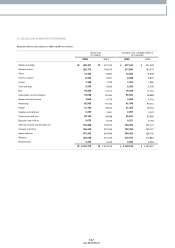

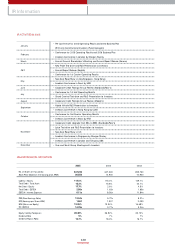

22. DERIVATIVE INSTRUMENTS:

The Com pany had entered into derivative instrum ent contracts (Range forward) to hedge the exposure to variability in expected future cash flow s of forecasted export

sales that is attributable to changes in foreign exchange rate. Derivative instrum ent contracts unsettled as of Decem ber 31, 2005 are sum marized below .

As the above derivative contracts did not qualify the highly effective hedging relationship condition as of Decem ber 31, 2005, the adjustm ent to fair value of ₩3,050

million (US$3,011 thousand) was reflected in current operations.

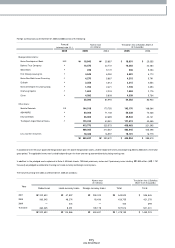

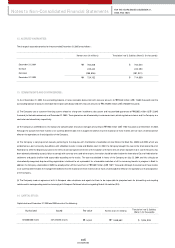

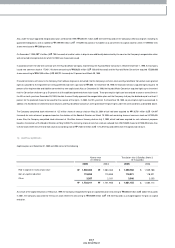

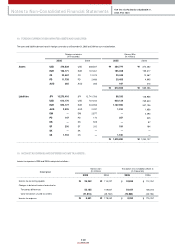

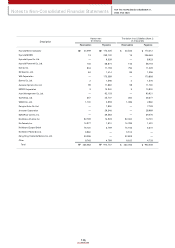

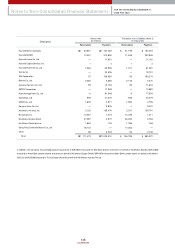

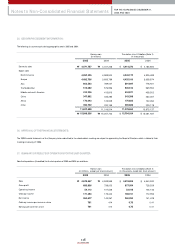

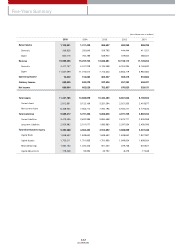

23. RELATED PARTY TRANSACTIONS :

Significant transactions with affiliated com panies and related balances for the year ended and as of Decem ber 31, 2005 are sum marized below .

Description

Korean w on

(In millions)

Translation into U.S.dollars (Note 2)

(In thousands)

Revenues Expenses Revenues Expenses

Hyundai Motor Company

Hyundai MOBIS

Hyundai Hysco Co., Ltd.

Hyundai Capital Services, Inc.

Hyundai Pow ertek Co., Ltd.

Dymos Inc.

WIA Corporation

Bontec Co., Ltd.

Autoever System s Co., Ltd.

KEFICO Corporation

Asset Managem ent Co., Ltd.

GLOVIS Co., Ltd.

WISCO Co., Ltd.

Donghui Auto Co., Ltd.

Kia Motors Am erica, Inc.

Kia Canada, Inc.

Kia Motors Europe Gm bH

Kia Motors Polska Sp.z.o.o.

EUKOR Car Carriers, Inc.

Dong Feng Yueda-Kia Motors Co., Ltd.

Rotem Com pany

BNG Steel Co., Ltd.

Other

Total

448,155

46,598

38

52,288

2,100

1,674

3,866

11

3,135

41

600

54,969

28

19

3,929,627

367,698

2,572,564

63,135

33

113,295

167

—

27,243

7,687,284

₩

₩

981,996

1,914,575

53,886

108

300,304

134,124

974,813

28,194

47,671

87,411

173,919

176,325

10,958

85,297

189,801

18,971

58,909

1,930

437,366

—

48,719

15,801

36,164

5,777,242

₩

₩

442,404

46,000

38

51,617

2,073

1,653

3,816

11

3,095

40

592

54,264

28

19

3,879,197

362,979

2,539,550

62,325

33

111,841

165

—

26,892

7,588,632

$

$

969,394

1,890,005

53,194

107

296,450

132,403

962,303

27,832

47,059

86,289

171,687

174,062

10,817

84,202

187,365

18,728

58,153

1,905

431,753

0

48,094

15,598

35,702

5,703,102

$

$

Korean w on

(In millions)

Date of Contract Date of Settlement

Fair value amount

Contract amounts

(In thousands)

Contracting parties

Translation into U.S.dollars

(Note 2) (In thousands)

Korea Developm ent Bank

and others

EUR 180,000 Decem ber 6, 2005

~ Decem ber 9, 2005

March 6, 2006

~ Decem ber 13, 2006

₩3,050 $3,011