Kia 2005 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2005 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

2005 Annual Report

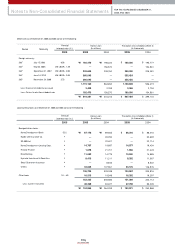

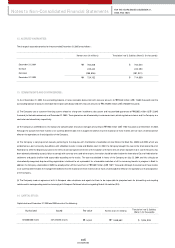

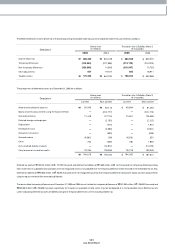

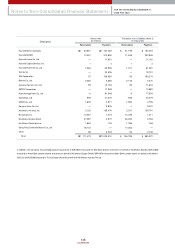

Also, under the court-approved reorganization plan, on March 30, 1999, ₩5,482,181 million (US$5,411,827 thousand) of the Com pany’s debt was forgiven, including its

guaranteed obligations, and an additional ₩1,799,999 million (US$1,776,899 thousand) of its liabilities was converted into capital stock for which 119,999,932 new

shares w ere issued at ₩15,000 per share.

On Decem ber 7, 2000, ₩714 m illion (US$705 thousand) of creditor’s claim in dispute was additionally determ ined by the court as the Com pany’s reorganization claim

and converted into capital stock for which 142,953 new shares were issued.

In accordance w ith the take-over contract with the Hyundai Motor Com pany, representing the Hyundai Motor Consortium , effective Decem ber 1, 1998, the Com pany

issued new com m on stock of 172,431,118 shares amounting to ₩938,656 million (US$926,610 thousand) and the Hyundai Motor Consortium acquired 153,000,000

shares amounting to ₩841,500 million (US$830,701 thousand) for 51 percent as of March 30, 1999.

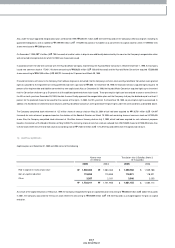

Financial institutions, with loans to the Com pany that had been forgiven or converted into the Com pany’s common stock, and Hyundai Motor Consortium were granted

rights to subscribe to the registered non-voting preferred stock w ith a par value of ₩5,000. On December 28, 1998, the financial institutions acquired rights equal to 10

percent of the forgiven debt and liabilities converted into new capital stock. Also, on Decem ber 28, 1998, the Hyundai Motor Consortium acquired rights up to the extent

that the Consortium shall ow n up to 51 percent of all the additional preferred shares to be issued. These pre-em ptive rights can be exercised at once or several times in

the fifth or tenth year from Decem ber 28, 1999, the date the court finally approved the reorganization plan and the Com pany shall pay the dividend equal to at least 2

percent for the preferred shares to be issued for the exercise of the rights. In 2003, the fifth year from the Decem ber 28, 1999, no pre-em ptive right was exercised. In

addition, the Asia Motors-invested financial institutions and Hyundai Motor Consortium w ere granted pre-em ptive rights under the sam e conditions as described above.

The Com pany com pleted stock retirem ent of 12.5 million shares of treasury stock on May 28, 2004, w hich had been acquired for ₩136,701 million (US$134,947

thousand) for such retirem ent purposes based on the decision of the Board of Directors on March 19, 2004 and rem aining shares of com mon stock are 347,230,455

shares. Also, the Com pany com pleted stock retirem ent of 10 million shares of treasury stock on July 2, 2003, which had been acquired for such retirem ent purposes

based on the decision of the Board of Directors on May 9, 2003. The rem aining shares of com mon stock are reduced from 359,730,455 shares to 347,230,455 shares. Due

to these stock retirem ents, the total face value of outstanding stock of ₩1,736,152 million (US$1,713,872 thousand) differs from the capital stock am ount.

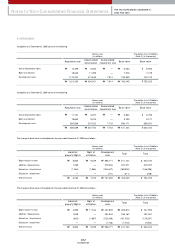

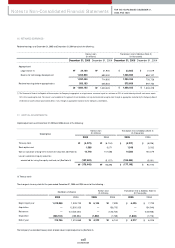

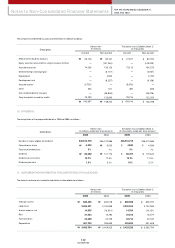

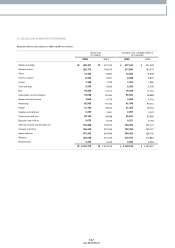

15. CAPITAL SURPLUS :

Capital surplus as of December 31, 2005 and 2004 consist of the follow ing :

As a result of the capital reduction on February 2, 1999, the Com pany recognized the gain on capital reduction amounting to ₩340,848 m illion (US$336,474 thousand).

In 2001, the Com pany accounted for the loss on stock retirem ent amounting to ₩220,989 million (US$218,153 thousand) as a charged against the gain on capital

reduction.

Korean w on

(In millions)

Translation into U.S.dollars (Note 2)

(In thousands)

2005 2004 2005 2004

Paid-in capital in excess of par value

Gain on capital reduction

Other

1,580,065

119,859

3,087

1,703,011

₩

₩

1,559,788

118,321

3,046

1,681,155

$

$

1,580,065

119,859

2,031

1,701,955

1,559,788

118,321

2,005

1,680,114

₩

₩

$

$