Kia 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

KIA MOTORS

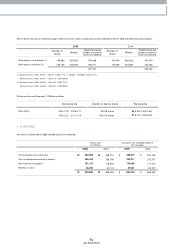

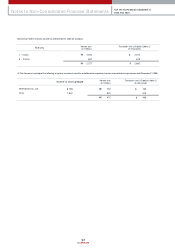

Pursuant to SKAS No. 17 - “Provisions, Contingent Liabilities and Contingent Assets”, effective January 1, 2005, the Com pany values the provision at present value of the

expenditures expected to be required to settle the obligation, if the effect of the tim e value of m oney is material. As a result, accrued warranties as of Decem ber 31, 2005

decreased by ₩43,432 million (US$42,875 thousand), and accrued warranties decreased and retained earnings increased as of December 31, 2004 by ₩50,922 m illion

(US

$50,269 thousand) and ₩36,919 million (US$36,445 thousand), respectively, com pared with the results based on the previous accounting methods.

The accom panying balance sheet, incom e statem ent and cash flow s as of and for the year ended Decem ber 31, 2004, which are prepared for com parative purposes,

have been restated, reflecting the adjustm ents resulting from retroactive application of SKAS No.16 and No.17.

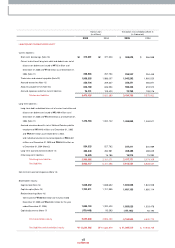

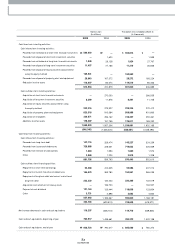

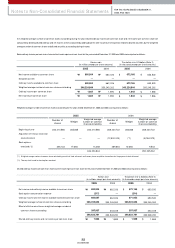

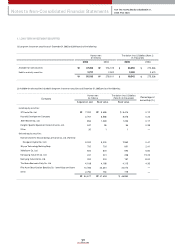

Major changes in accounts for the preceding three years due to the changes in accounting policies m entioned above are as follow s:

The significant accounting policies follow ed by the Com pany in the preparation of its non-consolidated financial statem ents are sum marized below .

REVENUE RECOGNITION

Sales, including long-term installm ent sales, are recognized at the tim e of shipment of motor vehicles and parts, which is when the significant risks and rewards of

ow nership of the goods have been transferred to the buyer. The interest incom e arising from long-term installm ent sales contracts is recognized using the level yielding

method.

ACCRUED WARRANTIES

The Com pany generally provides a w arranty to the ultim ate consum er for each product sold and accrues warranty expense at the tim e of sale based on actual claim s

history. Also, the Com pany accrues potential expenses, which may occur due to product liability suit and voluntary recall cam paign pending as of the balance sheet

date. Additionally, the Com pany recognizes accrued liabilities of the provision for the projected costs for dismantling and recycling vehicles that the Company sold in the

European Union region to com ply with a European Parliament directive regarding End-of-Life Vehicles (ELV), in which manufacturers are financially responsible for a

portion of the cost of dism antling and recycling of the vehicles placed in service. If the effect of the tim e value of money is material, the provision is valued at present

value of the expenditures expected to be required to settle the obligation.

ALLOWANCE FOR DOUBTFUL ACCOUNTS

The Com pany provides an allow ance for doubtful accounts based on m anagem ent’s estim ate of the collectibility of the receivables.

INVENTORIES

Inventories are stated at the low er of cost or net realizable value, cost being determ ined by the m oving average method, except for m aterials in transit for which cost is

determ ined using the specific identification method. Valuation loss incurred w hen the market value of an inventory falls below its carrying am ount is added to the cost

of goods sold.

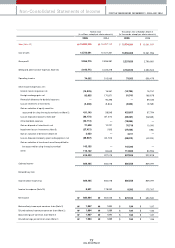

Deferred incom e tax assets (*)

Accrued warranties (*)

Ordinary incom e

Net incom e

Ordinary incom e per com m on share

Earnings per com mon share

(* ) Includes current portion

468,902

698,508

851,393

670,820

1,823

1,823

₩415,576

738,162

937,526

752,857

2,078

2,078

₩343,857

764,308

840,078

662,026

1,890

1,890

₩462,885

689,544

840,467

662,211

1.80

1.80

$410,243

728,689

925,495

743,195

2.05

2.05

$339,444

754,500

829,297

653,530

1.87

1.87

$

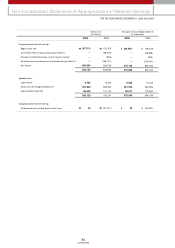

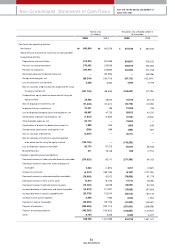

Korean w on

(In millions, except for share amounts)

Items

Translation into U.S.dollars (Note 2)

(In thousands, except per share amounts)

2002 2003 2004 2002 2003 2004

Notes to Non-Consolidated Financial Statements FOR THE YEARS ENDED DECEMBER 31,

2005 AND 2004