Kia 2005 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2005 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

91

2005 Annual Report

Company

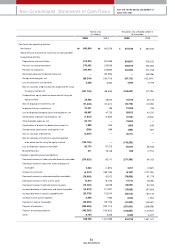

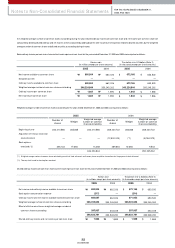

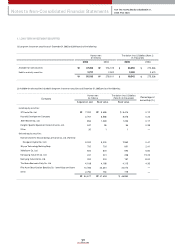

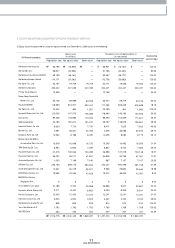

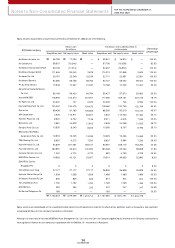

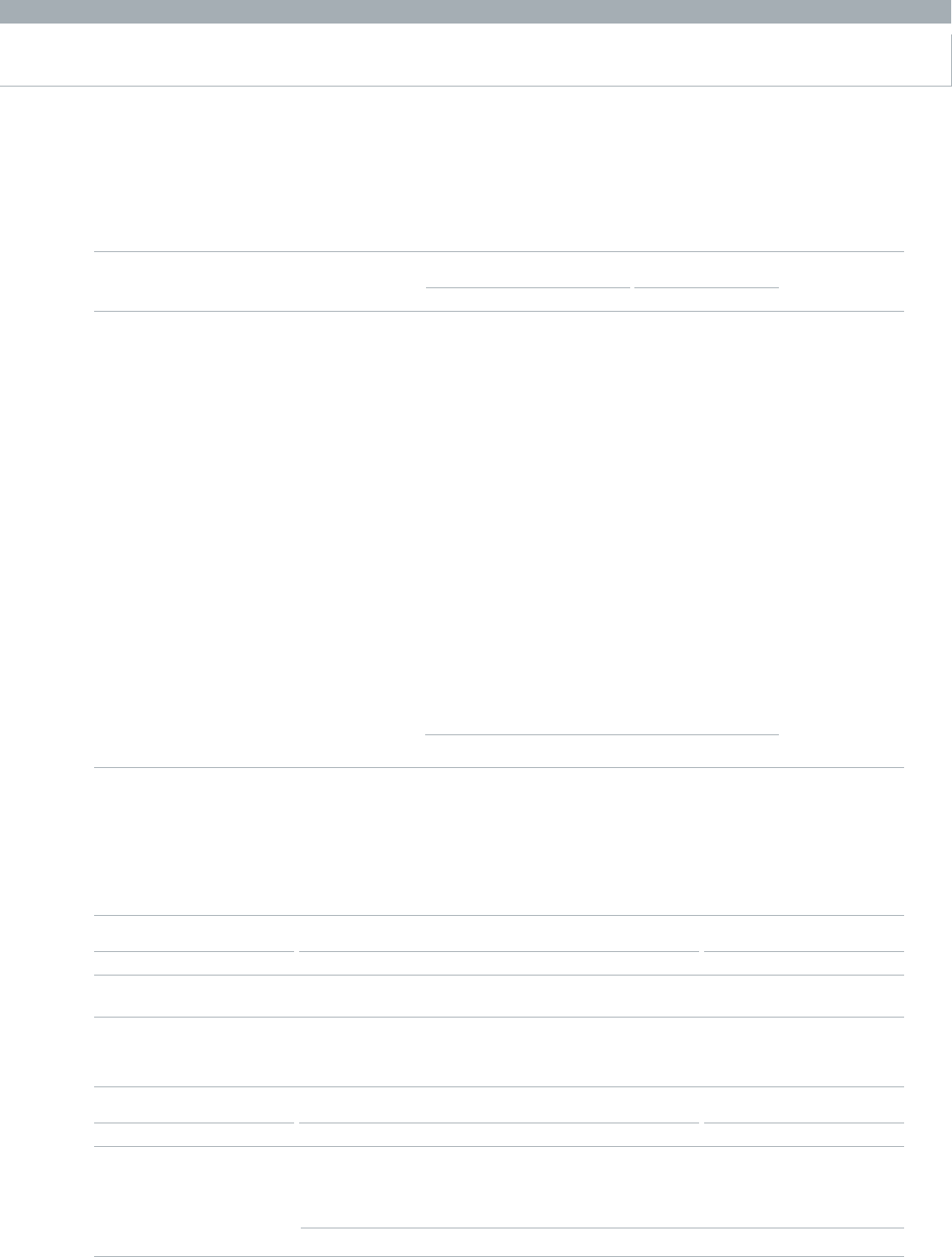

Available-for-sale securities included in long-term investm ent securities as of Decem ber 31, 2004 consist of the follow ing :

The difference betw een the book value and the acquisition cost of available-for-sale securities as of Decem ber 31, 2005 and 2004 w as accounted for gain on valuation of

long-term investm ent securities reflected in capital adjustm ents, except for an im pairm ent loss on investm ents of ₩2,000 million (US$1,974 thousand) in 2002.

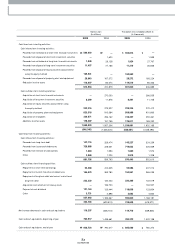

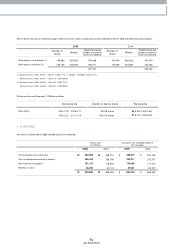

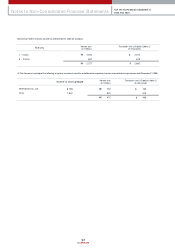

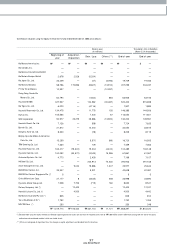

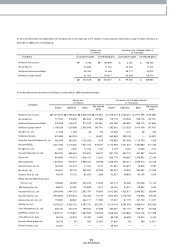

(3) Held-to-m aturity securities included in long-term investm ent securities as of Decem ber 31, 2005 consist of the follow ing :

Held-to-m aturity securities included in long-term investm ent securities as of Decem ber 31, 2004 consist of the follow ing :

Korean w on

(In millions)

Translation into U.S.dollars

(Note 2) (In thousands)

Acquisition cost Book value Book value

Percentage of

ow nership (% )

Listed equity securities :

INI Steel Co., Ltd.

LG Telecom Co., Ltd.

KT Freetel Co., Ltd.

SeAH Besteel Co., Ltd.

Kanglim Specific Equipm ent Automotive Co., Ltd.

Other

Unlisted equity securities :

Dongw on Capital Co., Ltd.

Asset Managem ent Co., Ltd.

Kihyup Technology Banking Corp.

Mobil.com Co., Ltd.

Dongyung Industries Co., Ltd.

Namyang Industrial Co., Ltd.

The Korea Econom ic Daily Co., Ltd.

Pilot Asset Securitization Specialty Co. - beneficiary certificate

Other

99,999

10,056

7,200

854

347

30

3,000

1,024

700

600

241

200

168

10,786

2,790

137,995

₩

₩

242,007

7,280

5,426

536

31

1

2,962

1,011

691

592

238

197

166

10,648

780

272,566

$

$

245,153

7,375

5,497

543

31

1

3,000

1,024

700

600

241

200

168

10,786

790

276,109

19.87

0.66

0.12

0.17

0.38

—

1.77

19.99

2.41

5.80

19.23

8.00

0.22

—

—

₩

₩

Acquisition cost Book value Book value

Korean w on

(In millions)

Translation into U.S.dollars (Note 2)

(In thousands)

Governm ent and municipal bonds ₩2,727 ₩2,727 $2,692

Acquisition cost Book value Book value

Korean w on

(In millions)

Translation into U.S.dollars (Note 2)

(In thousands)

Governm ent and municipal bonds

Corporate bonds:

Acrow ave Co., Ltd.

2,413

89

2,502

₩

₩

2,413

89

2,502

₩

₩

2,382

88

2,470

$

$