Kia 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

KIA MOTORS

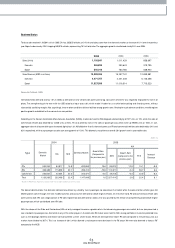

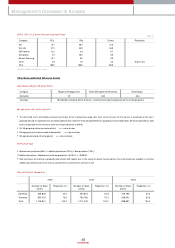

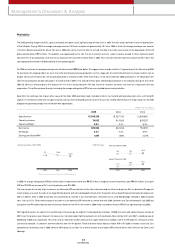

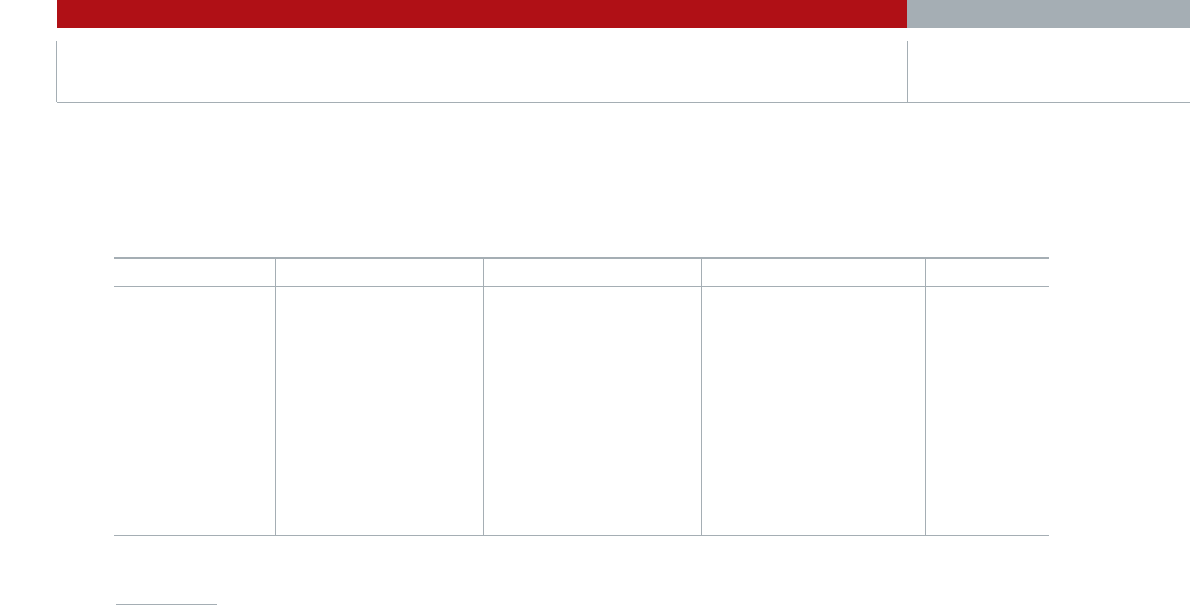

Region 2005 2004 2003 Particulars

USA 275,140 301,573 229,426

Canada 26,624 29,134 30,523

Western Europe 302,614 220,621 127,364

Eastern Europe 49,917 44,251 27,865

Central South America 42,229 40,005 25,695

Africa & Middle East 65,336 58,585 39,383

Asia-Pacific 61,776 54,652 43,644

China Region 16,310 11,328 6,229

Other 70 637 8,773

Total 840,016 760,786 538,902

• Per Region Export Results (Unit)

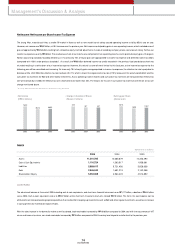

Management’s Discussion & Analysis

Sales Strategy

Domestic Business

There are still negative factors holding back the dom estic market, such as high oil prices and increasing raw material costs. Analysts expect car sales to be hindered

by falling exchange rates, a slight contraction in dem and, and by an increase in car im ports. Still, there are signs that a recovery is w ell under w ay. We expect overall

dom estic car sales to expand at a level of 100,000 vehicles per month. Grow th w ill be spurred by diesel passenger cars, as w ell as medium and large sized cars.

Under such mixed market forecasts, KIA will m ake beef up its global prom otional activities. We also plan to strengthen our sales com petitiveness through bolstered

custom er contact and m arketing activities. We are confident in our ability to successfully launch new passenger cars and RVs into the market, and intend to

establish a stable demand for the Lotze model.

One of the opportunities for grow th is the rising popularity of diesel Passenger Car which is igniting new interest in the market. KIA will capitalize on this with the

launch of our Lotze model, a diesel pow ered m id-size sedan. The Lotze ought to give us a firm foothold in the sm all to medium diesel segm ent. We w ill be the first

to roll-out such a m odel, which should give us an edge. And we will further leverage our foothold in the sm all autom obile sector by aggressively prom oting the

Pride model, which leads market share in this sector. Expanding Morning model sales w ill likely allow us to achieve dom inant sales in the light passenger cars

market as w ell.

We at KIA are also highly focused on establishing ourselves more firm ly as the “num ber 1 RV Corporation.” We expect to create a lot of positive buzz and excitement

in the RV sector through expanded sales of our Grand Carnival (11-seater) m odel, and with the release of the New Carnival model, a 9-seater premium minivan. We

will also roll out the Sorento Upgrade and a new UN model, based on our popular Carens brand. These multiple launchings will at tract a lot of attention and w ill

help us spur next generation grow th. We understand that we can ill afford to rest on past successes, but must endeavor to create new lines that will create lifetim e

value for the changing needs of households.

Despite our ambitions to further dom inate the RV sector, we at KIA will actively expand prom otions activities to protect our strong share in the small com mercials

vehicle sector. We w ill carry out continuous trade marketing and direct marketing activities geared towards previous custom ers, delivery service companies, and

commercial vehicle com panies. These prom otional efforts will aim to draw m ore attention to our superiority within our minivan m odels, so that consum ers and key

distributors are made aware of the advanced features and service involving our m inivan models.

To enhance sales promotions during the second quarter of 2006, our com pany will take a closer look at the factors that drive the replacem ent of old autom obiles;

we need better onsite support through front-line sales to better manage potential turnover custom ers. Through better data mining w e have made progress in

selectively segm enting key custom ers and offering them incentives to replace their older KIA m odels with newer ones. Active face-to-face management with

potential repeat custom ers must be pursued rigorously to maintain the trust that we have built over several decades in the market. KIA will also pursue m ore

alliance marketing and co-branding to achieve higher sales targets for each autom obile type. Many of our efforts w ill revolve around sports & culture marketing

including those linked to 2006 Germany World Cup festivities, and we will carry out traffic & environm ent marketing.

KIA will continue to bolster its brand im age through superior products and services and through our focused Brand Identity dubbed “Exciting & Enabling.”

*CKD Excluded