JetBlue Airlines 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.affect our business. Although it is not expected that the costs of complying with current environmental

regulations will have a material adverse effect on our financial position, results of operations or cash flows, no

assurance can be made that the costs of complying with environmental regulations in the future will not have

such an effect. The impact to us and our industry from such actions is likely to be adverse and could be

significant, particularly if regulators were to conclude that emissions from commercial aircraft cause significant

harm to the upper atmosphere or have a greater impact on climate change than other industries.

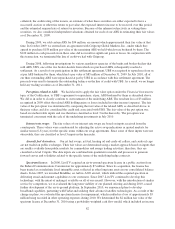

In December 2009, the Department of Transportation, or DOT, issued a series of passenger protection rules

which, among other things, impose tarmac delay limits for U.S. airline domestic flights. The rules became

effective in April 2010, and require U.S. airlines to allow passengers to deplane within three hours on the tarmac,

with certain safety and security exceptions. Violators can face fines up to a maximum of $27,500 per passenger.

The new rules also introduce requirements to disclose on-time performance and delay statistics for certain flights.

These new rules may have adverse consequences on our business and our results of operations.

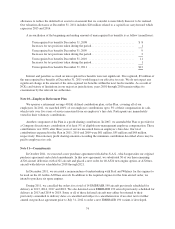

In October 2011, a severe winter storm and multiple failures of critical navigational equipment in the New

York City area severely impacted air travel in the northeast. As a result, we and other domestic and international

carriers diverted flights to Hartford, CT’s Bradley International Airport, or Bradley. We diverted a total of six

flights to Bradley, five of which were held on the tarmac for three hours or more. The DOT is investigating these

incidents and we may be subject to a monetary penalty under the DOT’s tarmac delay regulations. Based on the

allowable maximum DOT fine proscribed by the regulation, we could be assessed a fine of up to approximately

$15 million. Since the tarmac delay rule went into effect in April 2010, there have been multiple instances where

carriers have experienced extended tarmac delays in excess of three hours; however, the DOT has only assessed

one penalty against another carrier, for an amount well below the maximum allowable fine of $27,500 per

passenger. As a result of the circumstances surrounding the airport, weather and air traffic conditions on that day,

as well as the discretion granted to the DOT by the regulation, we are unable to determine whether a fine will be

assessed, and if so, the amount of such fine. We have issued compensation to the impacted customers in

accordance with our Customer Bill of Rights, and are complying with the requests of the DOT investigation. We

believe the final determination from the DOT should be made in the next few months.

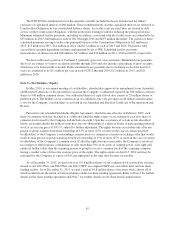

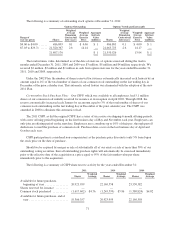

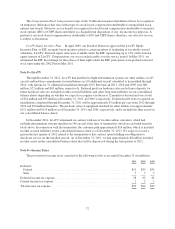

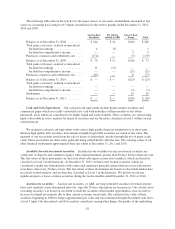

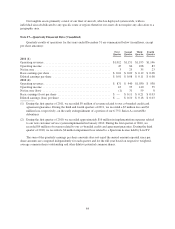

Note 13—Financial Derivative Instruments and Risk Management

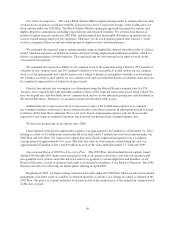

As part of our risk management strategy, we periodically purchase crude or heating oil option contracts to

manage our exposure to the effect of changes in the price and availability of aircraft fuel. Prices for these

commodities are normally highly correlated to aircraft fuel, making derivatives of them effective at providing

short-term protection against sharp increases in average fuel prices. We also periodically enter into jet fuel

swaps, as well as basis swaps for the differential between heating oil and jet fuel, to further limit the variability in

fuel prices at various locations. To manage the variability of the cash flows associated with our variable rate debt,

we have also entered into interest rate swaps. We do not hold or issue any derivative financial instruments for

trading purposes.

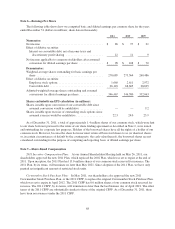

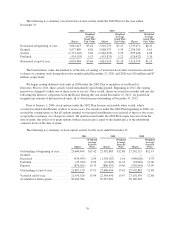

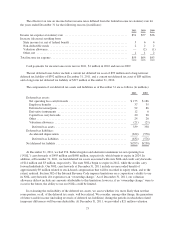

Aircraft fuel derivatives: We attempt to obtain cash flow hedge accounting treatment for each aircraft fuel

derivative that we enter into. This treatment is provided for under the Derivatives and Hedging topic of the

Codification, which allows for gains and losses on the effective portion of qualifying hedges to be deferred until

the underlying planned jet fuel consumption occurs, rather than recognizing the gains and losses on these

instruments into earnings during each period they are outstanding. The effective portion of realized aircraft fuel

hedging derivative gains and losses is recognized in fuel expense in the period the underlying fuel is consumed.

Ineffectiveness results, in certain circumstances, when the change in the total fair value of the derivative

instrument differs from the change in the value of our expected future cash outlays for the purchase of aircraft

fuel and is recognized immediately in interest income and other. Likewise, if a hedge does not qualify for hedge

accounting, the periodic changes in its fair value are recognized in the period of the change in interest income

and other. When aircraft fuel is consumed and the related derivative contract settles, any gain or loss previously

77