JetBlue Airlines 2011 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in-flight entertainment systems and frequent flyer programs. In addition to the above challenges, industry

capacity and pricing actions taken by other airlines historically have significantly influenced passenger demand

and fare levels. During 2009, most traditional network airlines began to reduce capacity to overcome some of

these challenges, particularly economic conditions and high fuel costs. Industry wide capacity discipline has

continued throughout 2011, and we believe it will continue in 2012.

Price competition occurs through price discounting, fare matching, increased capacity, targeted sale

promotions, ancillary fee additions and frequent flyer travel initiatives, all of which are usually matched by other

airlines in order to maintain their share of passenger traffic. A relatively small change in pricing or in passenger

traffic could have a disproportionate effect on an airline’s operating and financial results. Our ability to meet this

price competition depends on, among other things, our ability to operate at costs equal to or lower than our

competitors, including only charging for fees that we believe carry an intrinsic value for the customer. All other

factors being equal, we believe customers often prefer JetBlue and the JetBlue Experience.

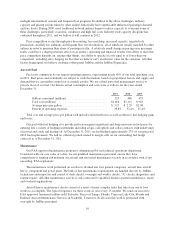

Aircraft Fuel

Fuel costs continue to be our largest operating expense, representing nearly 40% of our total operating costs

in 2011. Fuel prices and availability are subject to wide fluctuations based on geopolitical factors and supply and

demand that we can neither control nor accurately predict. We use a third party fuel management service to

procure most of our fuel. Our historical fuel consumption and costs were as follows for the years ended

December 31:

2011 2010 2009

Gallons consumed (millions) ........................... 525 486 455

Total cost (millions) .................................. $1,664 $1,115 $ 945

Average price per gallon .............................. $ 3.17 $ 2.29 $2.08

Percent of operating expenses .......................... 39.8% 32.4% 31.4%

Total cost and average price per gallon each include related fuel taxes as well as effective fuel hedging gains

and losses.

Our goal with fuel hedging is to provide protection against significant and sharp increases in fuel prices by

entering into a variety of hedging instruments including swaps, call options and collar contracts with underlyings

of jet fuel and crude and heating oil. At December 31, 2011, we had hedged approximately 27% of our projected

2012 fuel requirements. We had no collateral posted related to margin calls on our outstanding fuel hedge

contracts as of December 31, 2011.

Maintenance

Our FAA-approved maintenance program is administered by our technical operations department.

Consistent with our core value of safety, we use qualified maintenance personnel, ensure they have

comprehensive training and maintain our aircraft and associated maintenance records in accordance with, if not

exceeding, FAA regulations.

The maintenance work performed on our fleet is divided into four general categories: aircraft line, aircraft

heavy, component and power plant. The bulk of line maintenance requirements are handled directly by JetBlue

technicians and inspectors and consist of daily checks, overnight and weekly checks, “A” checks, diagnostics and

routine repairs. All other maintenance activity is sub-contracted to qualified business partner maintenance, repair

and overhaul organizations.

Aircraft heavy maintenance checks consist of a series of more complex tasks that take from one to four

weeks to accomplish. The typical frequency for these events is once every 15 months. We send our aircraft to

FAA approved Aeroman facilities in El Salvador, Pemco in Tampa, Florida, Timco in Lake City, Florida and

Embraer Aircraft Maintenance Services in Nashville, Tennessee. In all cases this work is performed with

oversight by JetBlue personnel.

10