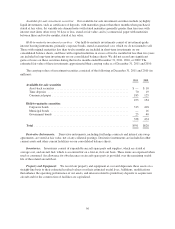

JetBlue Airlines 2011 Annual Report Download - page 72

Download and view the complete annual report

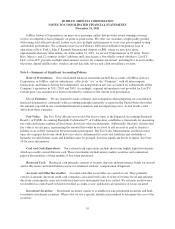

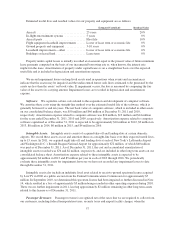

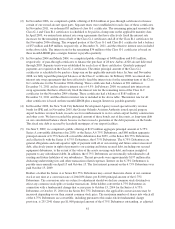

Please find page 72 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We may redeem any of the 6.75% Debentures for cash at a redemption price of 100% of their principal

amount, plus accrued and unpaid interest at any time on or after October 15, 2014 for the Series A 6.75%

Debentures and October 15, 2016 for the Series B 6.75% Debentures. Holders may require us to repurchase

the 6.75% Debentures for cash at a repurchase price equal to 100% of their principal amount plus accrued

and unpaid interest, if any, on October 15, 2014, 2019, 2024, 2029 and 2034 for the Series A 6.75%

Debentures and October 15, 2016, 2021, 2026, 2031 and 2036 for the Series B 6.75% Debentures; or at any

time prior to their maturity upon the occurrence of a certain designated event.

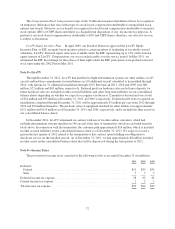

During 2011, we repurchased a total of $39 million principal amount of our Series A 6.75% Debentures for

approximately $45 million. We recognized a loss of approximately $6 million on these transactions, which

is included in interest income and other on our consolidated statements of operation during 2011.

We evaluated the various embedded derivatives within the supplemental indenture for bifurcation from the

6.75% Debentures under the applicable provisions, including the basic conversion feature, the fundamental

change make-whole provision and the put and call options. Based upon our detailed assessment, we

concluded these embedded derivatives were either (i) excluded from bifurcation as a result of being clearly

and closely related to the 6.75% Debentures or are indexed to our common stock and would be classified in

stockholders’ equity if freestanding or (ii) are immaterial embedded derivatives.

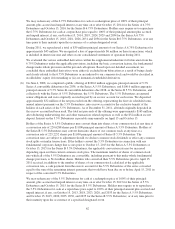

(6) On June 4, 2008, we completed a public offering of $100.6 million aggregate principal amount of 5.5%

Series A convertible debentures due 2038, or the Series A 5.5% Debentures, and $100.6 million aggregate

principal amount of 5.5% Series B convertible debentures due 2038, or the Series B 5.5% Debentures, and

collectively with the Series A 5.5% Debentures, the 5.5% Debentures. The 5.5% Debentures are general

senior obligations and were originally secured in part by an escrow account for each series. We deposited

approximately $32 million of the net proceeds from the offering, representing the first six scheduled semi-

annual interest payments on the 5.5% Debentures, into escrow accounts for the exclusive benefit of the

holders of each series of the 5.5% Debentures. As of December 31, 2011, all funds originally deposited in

the escrow account had been used. The total net proceeds of the offering were approximately $165 million,

after deducting underwriting fees and other transaction related expenses as well as the $32 million escrow

deposit. Interest on the 5.5% Debentures is payable semi-annually on April 15 and October 15.

Holders of the Series A 5.5% Debentures may convert them into shares of our common stock at any time at

a conversion rate of 220.6288 shares per $1,000 principal amount of Series A 5.5% Debenture. Holders of

the Series B 5.5% Debentures may convert them into shares of our common stock at any time at a

conversion rate of 225.2252 shares per $1,000 principal amount of Series B 5.5% Debenture. The

conversion rates are subject to adjustment should we declare common stock dividends or effect any common

stock splits or similar transactions. If the holders convert the 5.5% Debentures in connection with any

fundamental corporate change that occurs prior to October 15, 2013 for the Series A 5.5% Debentures or

October 15, 2015 for the Series B 5.5% Debentures, the applicable conversion rate may be increased

depending upon our then current common stock price. The maximum number of shares of common stock

into which all of the 5.5% Debentures are convertible, including pursuant to this make-whole fundamental

change provision, is 54.4 million shares. Holders who converted their 5.5% Debentures prior to April 15,

2011 received, in addition to the number of shares of our common stock calculated at the applicable

conversion rate, a cash payment from the escrow account for the 5.5% Debentures of the series converted

equal to the sum of the remaining interest payments that would have been due on or before April 15, 2011 in

respect of the converted 5.5% Debentures.

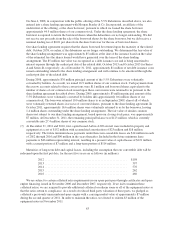

We may redeem any of the 5.5% Debentures for cash at a redemption price of 100% of their principal

amount, plus accrued and unpaid interest at any time on or after October 15, 2013 for the Series A 5.5%

Debentures and October 15, 2015 for the Series B 5.5% Debentures. Holders may require us to repurchase

the 5.5% Debentures for cash at a repurchase price equal to 100% of their principal amount plus accrued and

unpaid interest, if any, on October 15, 2013, 2018, 2023, 2028, and 2033 for the Series A 5.5% Debentures

and October 15, 2015, 2020, 2025, 2030, and 2035 for the Series B 5.5% Debentures; or at any time prior to

their maturity upon the occurrence of a specified designated event.

62