JetBlue Airlines 2011 Annual Report Download - page 43

Download and view the complete annual report

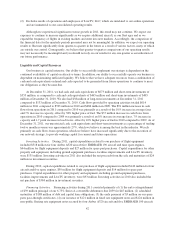

Please find page 43 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Another key component in optimizing our route network and managing unit revenues and yield is our

continued expansion of our portfolio of strategic commercial partnerships. During 2011, we added seven new

partnerships with prestigious international airlines, bringing our total commercial partnerships to 14 airlines as of

December 31, 2011. In 2012, we announced two additional partnerships. We believe these agreements provide

additional revenue opportunities for us and increased travel benefits and opportunities to our customers by

allowing access to diverse international markets and a seamless check-in process. Our current partnerships are

structured with gateways, which allow access for international travelers on many of our key domestic and

Caribbean routes, including in New York, Boston, Newark, Orlando, Fort Meyers, San Juan, or Washington DC.

Since re-launching our customer loyalty program, TrueBlue, in November 2009, we have seen a 30%

increase in membership. The program was re-designed based on customer feedback, and is aimed at making our

frequent flyer benefits more robust, rewarding, and flexible. TrueBlue points are earned based on the value paid

for a flight as opposed to the length of travel. There are no blackout dates for award flights and points expirations

can be extended. Based on extensive customer surveys, we believe this enhanced program is making our product

more appealing to the business customer.

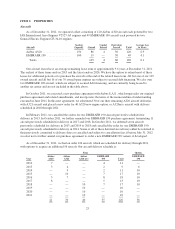

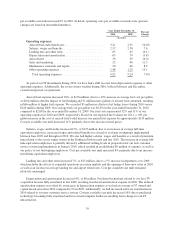

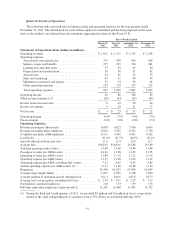

We derive our revenue primarily from transporting passengers on our aircraft. Passenger revenue accounted

for 91% of our total operating revenues for the year ended December 31, 2011. Revenues generated from

international routes, including Puerto Rico, accounted for 26% of our total passenger revenues in 2011. Revenue

is recognized either when transportation is provided or after the ticket or customer credit expires. We measure

capacity in terms of available seat miles, which represents the number of seats available for passengers

multiplied by the number of miles the seats are flown. Yield, or the average amount one passenger pays to fly

one mile, is calculated by dividing passenger revenue by revenue passenger miles.

We strive to increase passenger revenue primarily by increasing our yield per flight which produces higher

revenue per available seat mile, or RASM. Our objective is to optimize our fare mix to increase our overall

average fare while continuing to provide our customers with competitive fares. When we enter a new market our

fares are designed to stimulate demand, particularly from fare-conscious leisure and business travelers who might

otherwise have used alternate forms of transportation or would not have traveled at all. In addition to our regular

fare structure, we frequently offer sale fares with shorter advance purchase requirements in most of the markets

we serve and match the sale fares offered by other airlines. Passenger revenue also includes revenue from our

Even More ancillary product offerings.

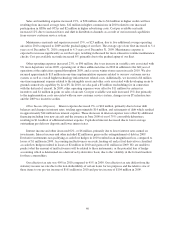

The highest levels of traffic and revenue on our routes to and from Florida are generally realized from

October through April and on our routes to and from the western United States in the summer. Our VFR markets

continue to complement our leisure-driven markets from both a seasonal and day of week perspective. Many of

our areas of operations in the Northeast experience bad weather conditions in the winter, causing increased costs

associated with de-icing aircraft, cancelled flights and accommodating displaced customers. Many of our Florida

and Caribbean routes experience bad weather conditions in the summer and fall due to thunderstorms and

hurricanes. As we enter new markets we could be subject to additional seasonal variations along with competitive

responses to our entry by other airlines. Given our high proportion of fixed costs, this seasonality may cause our

results of operations to vary from quarter to quarter. As such, we are currently focused on trying to reduce the

seasonal impact of our operations and increase demand and travel during the trough periods.

Other revenue consists primarily of fees charged to customers in accordance with our published policies

relating to reservation changes and baggage limitations, the marketing component of TrueBlue point sales,

concession revenues, revenues associated with transporting mail and cargo, rental income and revenues earned

by our subsidiary, LiveTV, LLC, for the sale of, and on-going services provided for, in-flight entertainment

systems on other airlines.

We operate in an evolving industry, which most recently includes American Airlines entering bankruptcy

protection as well as the acquisitions of Continental Airlines by United Airlines and of AirTran Airways by

33