JetBlue Airlines 2011 Annual Report Download - page 85

Download and view the complete annual report

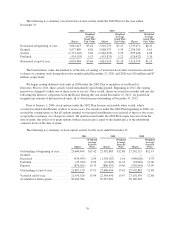

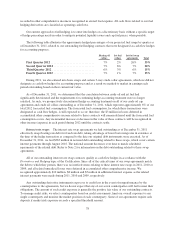

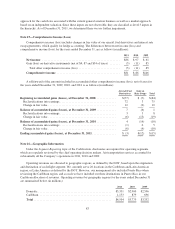

Please find page 85 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As of December 31, 2011, our firm aircraft orders consisted of 21 Airbus A320 aircraft, 30 Airbus A321

aircraft, 40 Airbus A320neo, 35 EMBRAER 190 aircraft and 17 spare engines scheduled for delivery through

2021. Committed expenditures for these aircraft and related flight equipment, including estimated amounts for

contractual price escalations and predelivery deposits, will be approximately $425 million in 2012, $450 million

in 2013, $580 million in 2014, $775 million in 2015, $785 million in 2016 and $2.95 billion thereafter.

We have options to purchase 56 EMBRAER 190 aircraft for delivery from 2013 through 2018. We are

scheduled to receive seven new Airbus A320 and four new EMBRAER 190 aircraft in 2012. We may purchase

some or all of our 2012 Airbus A320 aircraft deliveries with cash and will only finance aircraft on favorable

borrowing terms relative to our weighted average cost of debt. We are working on securing committed debt

financing for the four EMBRAER 190 aircraft scheduled for delivery in 2012.

We utilize several credit card processors to process our ticket sales. Our agreements with these processors

do not contain covenants, but do generally allow the processor to withhold cash reserves to protect the processor

for potential liability for tickets purchased, but not yet used for travel. While we currently do not have any

collateral requirements related to our credit card processors, we may be required to issue collateral to our credit

card processors, or other key vendors, in the future. As of December 31, 2011, we had approximately $19 million

pledged related to our workers compensation insurance policies and other business partner agreements, which

will expire according to the terms of the related policies or agreements.

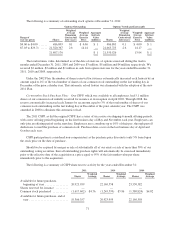

Our commitments also include those of LiveTV, which has several noncancelable long-term purchase

agreements with its suppliers to provide equipment to be installed on its customers’ aircraft, including JetBlue’s

aircraft. At December 31, 2011, committed expenditures to these suppliers were approximately $8 million in

2012, $1 million in 2013 and $1 million in 2014.

In March 2011, we executed a seven year agreement, subject to an optional three year extension, with

ViaSat Inc. to develop and introduce in-flight broadband connectivity technology on our aircraft. Committed

expenditures under this agreement include a minimum of $9 million through 2017 and an additional $22 million

for minimum hardware and software purchases. Through LiveTV, we plan to partner with ViaSat to make this

technology available to other airline customers in the future as well.

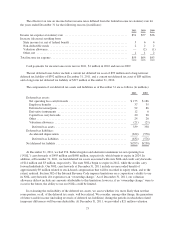

We enter into individual employment agreements with each of our FAA-licensed employees, which include

pilots, dispatchers and technicians. Each employment agreement is for a term of five years and automatically

renews for an additional five-year term unless either the employee or we elect not to renew it by giving at least

90 days notice before the end of the relevant term. Pursuant to these agreements, these employees can only be

terminated for cause. In the event of a downturn in our business that would require a reduction in work hours, we

are obligated to pay these employees a guaranteed level of income and to continue their benefits if they do not

obtain other aviation employment. None of our employees are covered by collective bargaining agreements.

Note 12—Contingencies

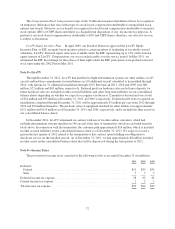

The Company is party to legal proceedings and claims that arise during the ordinary course of business. We

believe that the ultimate outcome of these matters will not have a material adverse effect upon our financial

position, results of operations or cash flows.

We self-insure a portion of our losses from claims related to workers’ compensation, environmental issues,

property damage, medical insurance for employees and general liability. Losses are accrued based on an estimate

of the ultimate aggregate liability for claims incurred, using standard industry practices and our actual

experience.

75