JetBlue Airlines 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

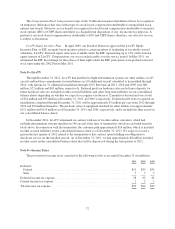

taxes, interest, depreciation and amortization, or EBITDA margin, as well as customary events of default.

Borrowings, which are to be paid monthly, are subject to a 6.9% annual interest rate but could be higher if

borrowing activity does not reach certain levels. This borrowing facility will terminate no later than

December 31, 2014. As of December 31, 2011, there was $88 million outstanding under this revolving credit

facility which is included in short-term borrowings on our consolidated balance sheet. During January 2012, we

made payments of $44 million against the facility.

Note 3—Operating Leases

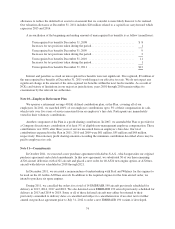

We lease aircraft, as well as airport terminal space, other airport facilities, office space and other equipment,

under leases which expire in various years through 2035. Total rental expense for all operating leases in 2011,

2010 and 2009 was $269 million, $245 million and $236 million, respectively. We have $33 million in assets that

serve as collateral for letters of credit related to certain of our leases, which are included in restricted cash.

During 2011, we extended the leases on four Airbus A320 aircraft; leases which were previously set to

expire in 2012. These extensions resulted in an additional $19 million of lease commitments through 2015. Also,

in 2011, we returned one EMBRAER E190 aircraft to its lessor, upon expiration of the lease term.

During 2010, we leased six used Airbus A320 aircraft from a third party, each with a separate six year

operating lease term.

At December 31, 2011, 60 of the 169 aircraft we operated were leased under operating leases, with lease

expiration dates ranging from 2013 to 2026. As of December 31, 2011, three of our Airbus A320 aircraft leases

were scheduled to expire within 18 months. Five of the 60 aircraft operating leases have variable rate rent

payments based on LIBOR. Leases for 53 of our aircraft can generally be renewed at rates based on fair market

value at the end of the lease term for one or two years. We have purchase options in 45 of our aircraft leases at

the end of the lease term at fair market value and a one-time option during the term at fixed amounts that were

expected to approximate fair market value at lease inception.

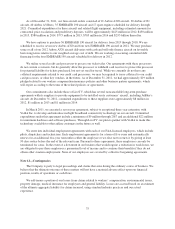

In 2010, we executed a supplement to our Terminal 5 lease with the Port Authority of New York and New

Jersey, or PANYNJ. Under this supplement, we will lease the 19.35 acre portion of JFK known as Terminal 6,

which is adjacent to our current facility at Terminal 5. We were responsible for the demolishing, and related

activities, of the Terminal 6 passenger terminal buildings, the costs of which will be reimbursed by the PANYNJ.

We intend to use this property primarily for maintaining, deicing, and parking aircraft during the five year term.

The lease supplement also contains an option to extend our current Terminal 5 structure onto this property.

In March 2010, we announced we will be combining our Darien, CT and Forest Hills, NY corporate offices

and relocating to a new corporate headquarters in Long Island City, NY. In September 2010, we executed a lease

for our new corporate headquarters in Long Island City for a 12 year term.

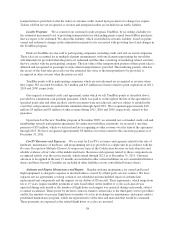

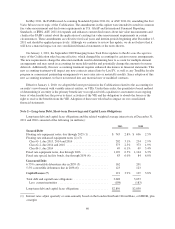

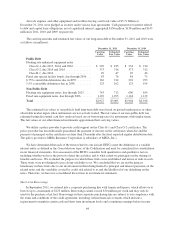

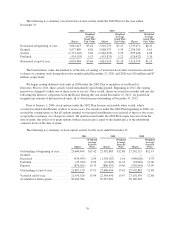

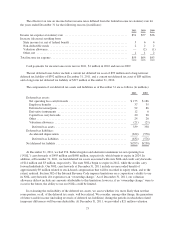

Future minimum lease payments under noncancelable operating leases, including those described above,

with initial or remaining terms in excess of one year at December 31, 2011, are as follows (in millions):

Aircraft Other Total

2012 ............................................... $ 147 $ 58 $ 205

2013 ............................................... 127 49 176

2014 ............................................... 132 39 171

2015 ............................................... 138 34 172

2016 ............................................... 77 30 107

Thereafter .......................................... 396 351 747

Total minimum operating lease payments ................. $1,017 $561 $1,578

65