JetBlue Airlines 2011 Annual Report Download - page 76

Download and view the complete annual report

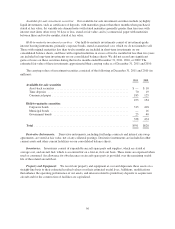

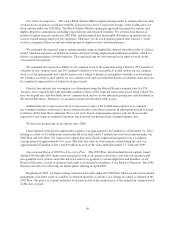

Please find page 76 of the 2011 JetBlue Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We have entered into sale-leaseback arrangements with a third party lender for 45 of our operating aircraft.

The sale-leasebacks occurred simultaneously with the delivery of the related aircraft to us from their

manufacturers. Each sale-leaseback transaction was structured with a separate trust set up by the third party

lender, the assets of which consist of the one aircraft initially transferred to it following the sale by us and the

subsequent lease arrangement with us. Because of their limited capitalization and the potential need for

additional financial support, these trusts are variable interest entities as defined in the Consolidations topic of the

Codification and must be considered for consolidation in our financial statements. Our assessment of each trust

considers both quantitative and qualitative factors, including whether we have the power to direct the activities

and to what extent we participate in the sharing of benefits and losses of the trusts. JetBlue does not retain any

equity interests in any of these trusts and our obligations to them are limited to the fixed rental payments we are

required to make to them, which were approximately $901 million as of December 31, 2011 and are reflected in

the future minimum lease payments in the table above. Our only interest in these entities are the purchase options

to acquire the aircraft as specified above. Since there are no other arrangements (either implicit or explicit)

between us and the individual trusts that would result in our absorbing additional variability from the trusts, we

concluded that we are not the primary beneficiary of these trusts. We account for these leases as operating leases,

following the appropriate lease guidance as required by the Leases topic in the Codification.

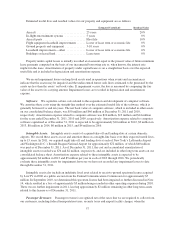

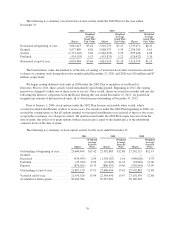

Operating Leases as Lessor: In 2008, we leased two of our owned EMBRAER 190 aircraft, each with a

lease term of 12 years. The net book value of these two aircraft was approximately $46 million and $48 million

as of December 31, 2011 and 2010, respectively, and is included in other assets on our consolidated balance

sheet. Under the terms of these leases, we recorded approximately $6 million, in rental income during each of

2011, 2010 and 2009. Future lease payments due to us under these leases are approximately $6 million per year

through 2020.

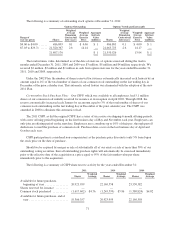

Note 4—JFK Terminal 5

In 2008, we began operating out of our new Terminal 5 at JFK, or Terminal 5. The construction and

operation of this facility is governed by various lease agreements with the PANYNJ. Under the terms of the

facility lease agreement, we were responsible for the construction of a 635,000 square foot 26-gate terminal, a

parking garage, roadways and an AirTrain Connector, all of which are owned by the PANYNJ and which are

collectively referred to as the Project. We are responsible for various payments under the lease, including ground

rents for the new terminal site which began on lease execution in 2005 and are reflected in the future minimum

lease payments table in Note 3, and facility rents which commenced in 2008 when we took beneficial occupancy

of Terminal 5, and are included below. The facility rents are based on the number of passengers enplaned out of

the terminal, subject to annual minimums. The lease terms end in 2038 and we have a one-time early termination

option in 2033.

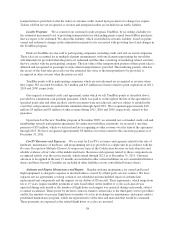

We were considered the owner of the Project for financial reporting purposes only and have been required to

reflect an asset and liability for the Project on our consolidated balance sheets since construction commenced in

2005. Since certain elements of the Project, including the parking garage and AirTrain Connector, are not subject

to the underlying ground lease, following their delivery to and acceptance by the PANYNJ in October 2008, we

removed them from our consolidated balance sheets. Our continuing involvement in the remainder of the Project

precludes us from sale and leaseback accounting; therefore the cost of these elements of the Project and the

related liability will remain on our consolidated balance sheets and be accounted for as a financing.

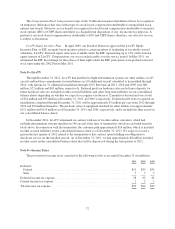

Through December 31, 2011, total costs incurred for the elements of the Project which are subject to the

underlying ground lease were $637 million, $561 million of which is reflected as Assets Constructed for Others

and $76 million of which are leasehold improvements included in ground property and equipment in our

consolidated balance sheets. These amounts reflect a non-cash $133 million reduction in 2008 for costs incurred

for the elements that were not subject to the underlying ground lease. Assets Constructed for Others are being

amortized over the shorter of the 25 year non-cancelable lease term or their economic life. We recorded $22

million in amortization expense in each of 2011 and 2010, and $21 million in 2009.

66